“Miles and Points Offer Freedom to Travel Uninhibited and Unrestrained”

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Welcome to the next installment of our interview series where folks share their thoughts about Big Travel with Small Money!Miles & Points Interview: NomadsNation

Aaron is the co-founder of NomadsNation. He’d like to help travelers make their life awesome, because life is short! You can check him out on Facebook, Instagram, and Twitter.

How and when did you start collecting miles and points?

I began my travel-hacking-journey in November of 2012.

I was 23 years old, had an awful credit score (low 600’s – more on this later), and had never traveled internationally as an adult.

Having traveled extensively in the States (living in Florida, Colorado, and California), I began developing an interest in international travel, and with a bit of research, discovered the world of points and miles. It changed my life forever.

Fast forward to now, I have 13 active credit cards, circled the globe more than half-a-dozen times, and redeemed over 600,000 points and miles in the process. I estimate that Travel Hacking has saved me in excess of $10,000 on flights and accommodation (and it’s just the beginning!).

Why did you start your blog? What’s special about it?

We believe the experience of travel strengthens our understanding of the world. We started NomadsNation to spread this message.

As a travel community, our goal is to inspire Nomads (travelers) to help each other explore the world. Hence our motto – Inspiration through Exploration.

Our site is made for travelers, made by travelers. No BS. Just travel goodness.

If you explore the site, you’ll currently find three active categories:

1. ) Back Hacks – multi-post series’ covering a central topic or theme (typically related to travel hacking)

2. ) Power Rankings – entertaining ways for NomadsNation Authors to make their highest traveling recommendations

3. ) THE BLOG – a place for Nomads to publish detailed chronicles of their travel adventures and/or ideas

In addition, we are also developing a Travel Consultation Service, a Tour Operations Company, and a networking platform for our site. We’ve got big plans 😉

What’s the one single thing people can do to get more miles?

“Give me six hours to chop down a tree, and I will spend the first four sharpening my axe” – Abraham Lincoln

To my knowledge Abraham Lincoln was not a credit card Travel Hacker, but his quote highlights the importance of preparation.

So let’s take a moment to discuss something exciting – Personal Finance! (The crowd roars.)

I know. It’s boring. It’s super lame. But truth be told, if you are interested in starting Travel Hacking and getting more miles, keeping track of your personal finances needs to be priority numero uno.

Why?

Rewind back to November of 2012 when I was first introduced to Travel Hacking. My credit score was bad – hovering somewhere in the low 600’s. I desperately wanted to begin accumulating miles, but I knew the chances of being approved for any cards were low.

So what’d I do?

I sharpened my axe, and got my finances together.

Over the next 4 months I began cleaning up my credit score. It wasn’t easy (it was actually pretty tedious), but with resources like IWillTeachYouToBeRich and WiseBread, I got my financial-act together.

As I equipped myself with the knowledge of responsible credit card use, I watched my credit score begin to improve. Knowledge is power.

When I was approved for my first card (the Chase Sapphire Preferred® Card) I waited an entire year before applying for another credit card!

Some in the travel-hacking sphere might frown upon this, but I stand strong behind it. Comfort with my personal finances was my main focus. I needed to be sure I possessed the knowledge and discipline necessary to responsibly use my new card.

After getting acquainted with my shiny new card, I spent every penny I could on it, I made payments in full, and I watched my credit score rise.

… Speaking of which …

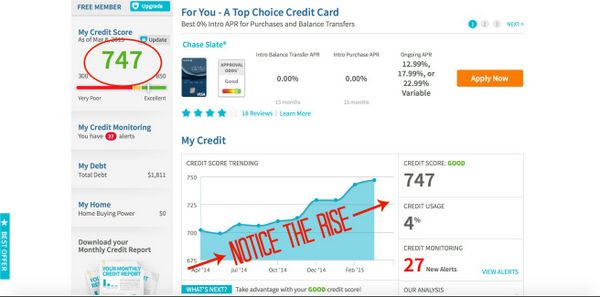

Above was my credit score in March of 2015. Notice the rise.

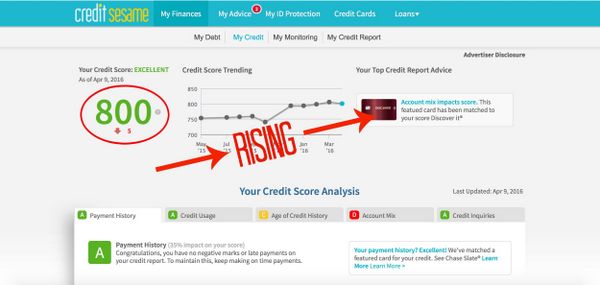

And this is my credit score a few months ago. Still rising 🙂

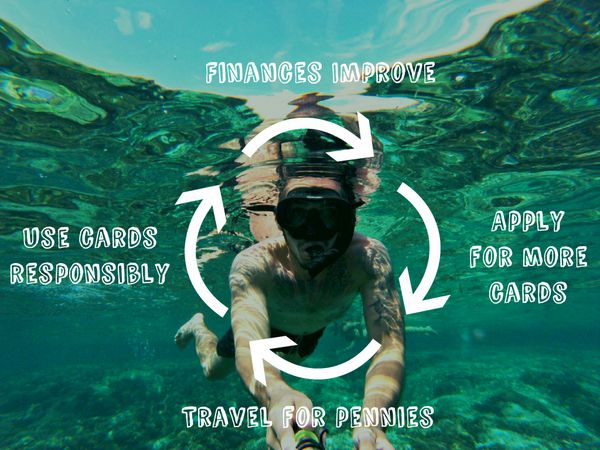

My rising credit score is attributed to what I refer to as “The Circle of Points.”

It’s a sweet cycle right?!? The Circle of Points is what enabled me to accumulate 600,000 points over the years.

I started with getting my finances in order. I then applied for cards. I then traveled with my points (while using my cards responsibly), which allowed my finances to improve and enabled me to apply for new cards.

Rinse. Wash. Repeat.

As I mentioned in the beginning, If you want more miles, the one thing you need to do is manage you finances well.

What’s your most memorable travel experience?

It was May 2015. I was in Hong Kong after 4 weeks backpacking through Europe. I was traveling solo without a plan. I had some savings and was going with the flow.

But, I then felt the urge to do something…crazy.

I had stacks of miles saved and no real reason to go back home yet. So I did it. I fired up the Macbook, logged in to my United Airlines account and redeemed myself a one-way ticket from Tokyo, Japan to Lima, Peru. It was insane!

My friends and family were expecting me back home and I didn’t even know how I was getting to Tokyo! BUT, I chose to make it happen.

Later that afternoon I redeemed another batch of miles for a one-way ticket to Tokyo (somewhere else I’d always wanted to go!).

At that point it was settled, 3 days days left in Hong Kong before departing for 5 days in Tokyo and who knows how long in Lima.

Total cost, you ask?

67,500 United Airlines Miles and $150.30.

Japan and Peru were amazing, but it wasn’t necessarily the destinations that made it my most memorable traveling experience – it was a spur-of-the-moment decision to travel.

Without my miles there was NO WAY I would have been able to afford that spontaneous trip across the globe. My miles empowered me to go where I wanted to go, when I wanted to go.

What do your family and friends think of your miles & points hobby?

They react the same as most non-collectors – they think I’m a nutcase. No joke. When I inform people I have 13 active credit cards, they tend to look back with a certain sense of…caution.

I’ve stopped trying to explain and now I let the travel talk for me.

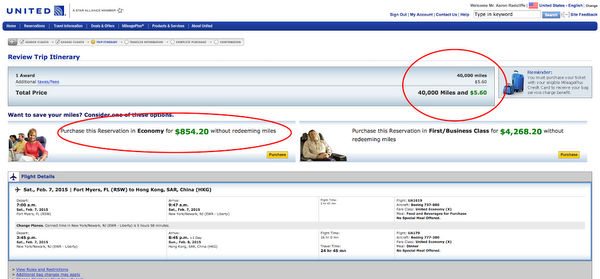

Plus, showing off screenshots like this never hurts.

Usually after I show them, I can’t stop the barrage of questions they have wondering how to do it, too!

It’s really cool to see them get started. It brings back a certain…nostalgia.

Is there any tool or trick which you’ve found especially useful in this hobby?

Tool

The best tools are ones which help you stay organized and minimize errors. Some crucial things to keep track of are:

- How many miles you have

- When miles expire

- When annual fees kick in

I keep all my Travel Hacking information neatly organized and refer to it frequently to make sure I’m up to date.

Now, I understand making spreadsheets is tedious, so as a bonus I’ve attached a downloadable version of my personal Travel Hacking Information Tracker.

Feel free to study it, or even better, fill it in with your own information!

Trick

As I highlighted with my Peru story – my favorite trick for miles is booking last minute flights!

Assuming there are available award seats, miles and points offer freedom to travel uninhibited and unrestrained. Basically…I’m James Bond now.

Hong Kong → Tokyo Tokyo → Lima Lima → Bogota Bogota → Miami Chicago → Fort Myers

Each of these flights I redeemed with last-minute points and miles bookings. Having this flexibility really gives some breathing room if you need to make a last minute change of plans. Or better yet, if you feel like doing something spontaneous and exciting!

I don’t always book with last minute miles, but when I do, it’s a darn good time!

What was the least expected way you’ve earned miles or points?

I must have missed this somewhere in my research, but I was offered a bonus for downgrading a card! Twice!

On separate occasions, I called my Club Carlson Premier Rewards Visa Signature® Card and Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard® in attempts to waive an upcoming annual fee. If denied, my backup plan was to downgrade to a no-fee version of the same card. The information for the Citi AAdvantage Platinum Select card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

On both occasions, I was informed the annual fee would not be waived, but if I downgraded to a different card and met a minimum spending, I would be given extra bonus points! It caught me off guard, but how could I say no?

Bonus tip: If you try this at home, be sure whoever you speak with makes note of the promotion! Unfortunately, my 30,000 Club Carlson points never processed (hence my advice), but the 15,000 American Airlines miles went through!What do you now know about collecting miles and points which you wish you knew when you started out?

Okay, this is a big topic for me.

When I first started out researching how to redeem points, everything I read indicated I should redeem flights for First Class or Business Class.

It makes sense. In terms of value, it’s where you get the biggest bang-for-your-buck.

But for me, a Nomad, while maximizing value was a huge priority, prolonging my travels seemed to matter more.

As a newbie, I didn’t know what to do! Do I listen to the pros or do I follow my gut?

Eventually, I bit the bullet and redeemed my first flight…in Economy!!!

Now, I always redeem my points and miles for flights in Economy. Always. It’s not because I don’t value my miles or care about bang-for-my-buck or want to fly Economy. It’s because it best suits my style of travel.If I have 110,00 United miles and can choose between:

a one-way First Class flight from Chicago to Tokyo

Or

a 5-leg trip from Chicago to Tokyo to New Delhi to Istanbul to Reykjavik.

You best believe I’m going for the long-term travel!

When I first started collecting miles and points, I had no idea this style was best for me. Only through my time spent traveling did I learn.

Who knows? Maybe one day I’ll have enough miles to fly back in time and tip-off my past self!

What would your readers be surprised to know about you?

Although I love collecting points and miles – I don’t obsess over them anymore!

I actually prefer to accumulate points slower these days. For a time, I felt a feverish need to apply for every card available.

But, truth be told, having to always find ways to meet the minimum spending can stress me out.

Now, I go a bit slower. I like to apply for a few cards a year and ensure my finances are easily manageable. I may lose out on some miles, but this strategy affords me more than enough miles to meet my travel needs.

Any parting words?

A smart traveler is the one who knows the cards in their hand (pun intended).

Travel on, Nomads.

Aaron – Thanks for sharing your thoughts on having Big Travel with Small Money!If you’d like to be considered for our interview series, please send me a note!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!