Confession: I Use Citi ThankYou Points for Cheap Flights – And Why I Don’t Get Caught on “Value”

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Citi is an MMS advertising partner

You’ll notice here at MMS we don’t have “points valuations.” A useful metric to aim for with transferable points, including Chase Ultimate Rewards, Citi ThankYou, and AMEX Membership Rewards, is 2 cents each.

That’s to say, if you get a value of 2 cents per point, you’re doing well for yourself. It’s easy to get caught up on redeeming points for First Class flights to faraway destinations. And while I’ve taken my share of luxurious trips, lately I’ve been using my Citi ThankYou points to pay for cheap flights at a rate of 1.25 cents each!

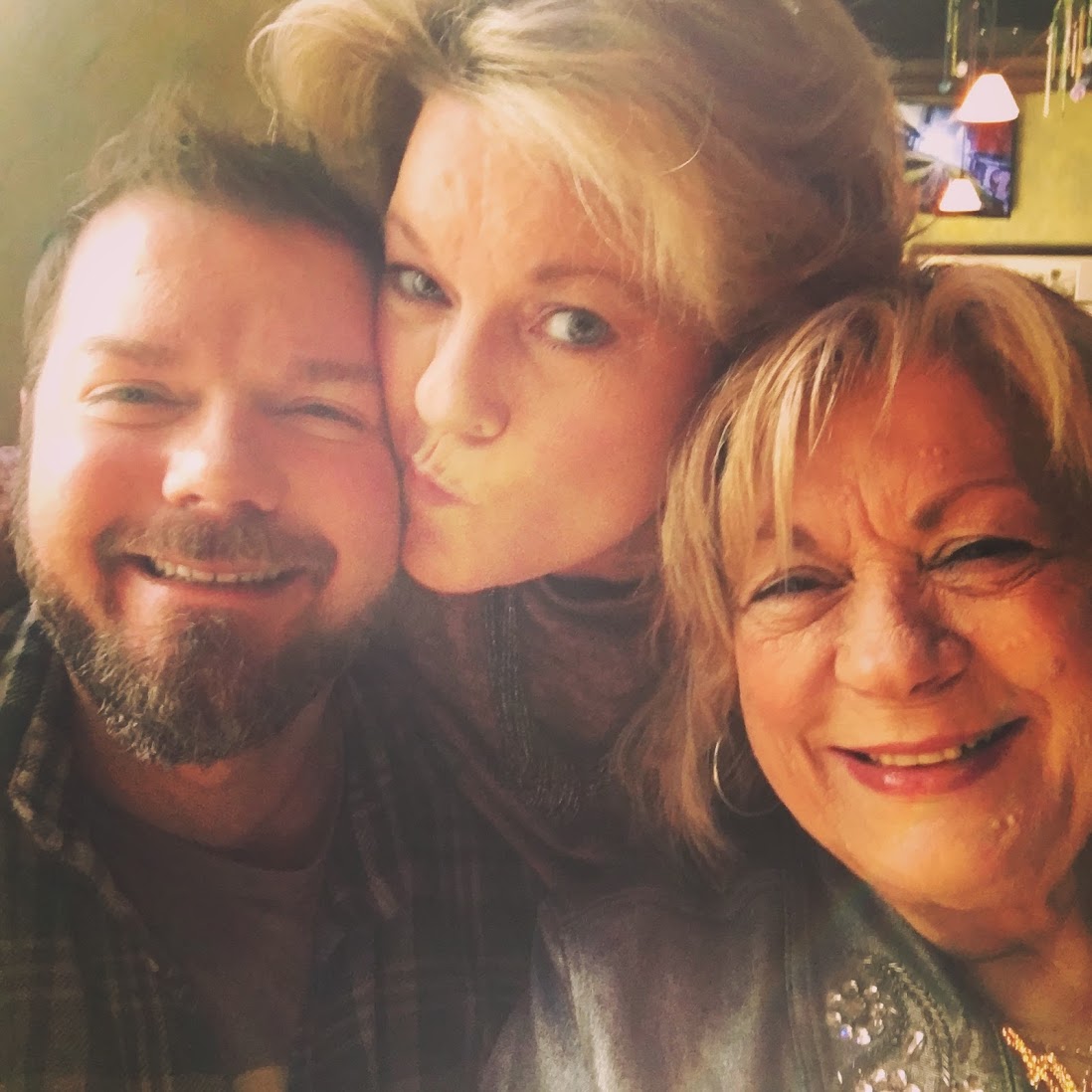

Last week, I flew home for Thanksgiving and my mom’s birthday on United Airlines and used 21,888 Citi ThankYou points. And loved every second of it!

You can earn Citi ThankYou points with Citi Prestige and the Citi Premier℠ Card. And here are the best travel rewards cards for your future travels.

Here’s my reasoning.

Only YOU Can Assign Value to Your Points

What are points worth? The truth is they’re worth whatever you want them to be.

There’s no right or wrong way to earn or redeem your points. The only thing that matters is that you’re happy with where they take you. That’s it.

For all the talk about value, and endless examples of trips you “could” use your points for, I find most folks redeem their points for seemingly mundane trips to places like Cleveland, Memphis, or Tucson (ya know, regular ol’ places).

They’re visiting friends, attending weddings, meeting newborn family, or participating in conferences – and want to save cash on their flights.

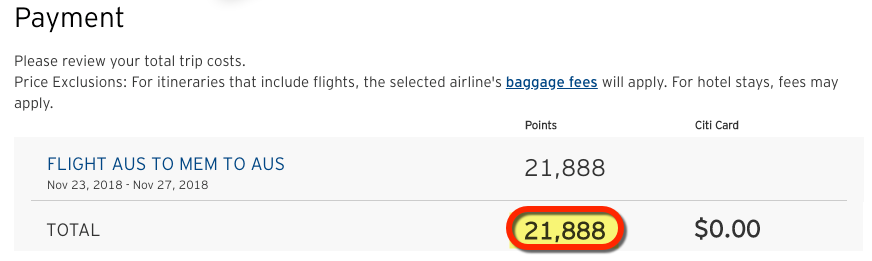

A few weeks ago, my mom asked if I was coming home for Thanksgiving. And spur of the moment, I checked flights, which were ~$274 for the most reasonable times.

Not bad, but I didn’t want to pay cash. Because I have a big collection of Citi ThankYou points, I found the same flights on Citi’s travel portal and saw I could use 21,888 Citi ThankYou points instead.

Because I’d still have well over 100,000 Citi ThankYou points after redeeming, I decided to go for it.

Not only would I be there for my family’s Thanksgiving dinner, but as an added bonus, I’d get to celebrate my mom’s birthday – something I haven’t been able to do in years.

And just like that, the concept of “value” went right out the window. Those experiences would be worth it. And instead of spending a cent, points got me a seat on those flights home.

It’s Hard to Place a Value on Points Anyway

When you redeem Citi ThankYou points and have a Citi Prestige (open to new applicants again in January 2019) or Citi Premier℠ Card, each point is worth 1.25 cents toward flights.

Note: As of September 2019, ThankYou points linked to the Citi Prestige will only be worth 1 cent each toward flights.

That’s fine and all, but I earn most of my points from bonus categories. With Citi Prestige, for example, you’ll earn 5X Citi ThankYou points on airfare and dining starting January 2019.

And through September 2019, you can redeem points for 1.25 cents each. So for each $1 you spend, that’s like getting 6.25% back for flights (5 X 1.25), which is awesome!

In that light, using Citi ThankYou points for flights is actually a terrific deal. But if you only earn 1 Citi ThankYou point per $1 spent, that drops to a 1.25% return.

Is that bad? Not necessarily. Ultimately, it’s about what makes you happy.

That’s why I don’t get overly obsessed with squeezing the highest value from each point any more. Sure, I could wait until perfect flights open up on the perfect route to the perfect destination, but realistically, I take what I can get.

I look for award flights around dates that work, keep an eye on it, and strike when the iron is hot. I’ve gotten lucky many times.

I recently flew home in Japan Airlines Business Class. Team member Keith is currently visiting Hong Kong via Cathay Pacific’s amazing First Class seat. And Jasmin just got back from a mother-daughter trip to Ireland on Aer Lingus.

So the opportunities are still out there. But when you can be home for Thanksgiving and catch your mom’s birthday at the same time? Well, I’d say that’s an awesome points redemption.

And that’s why I’m not as caught up on “value” as I used to be when I started collecting points. If it makes you happy, go for it!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!