Why You Might Consider Paying Your Credit Card Balances Early

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Million Mile Secrets reader, George, commented:

Do banks care when you pay off your credit card balance? Should I wait for the statement to close or pay the outstanding balance every week?

Great question!

The banks do NOT have a preference for when you pay your bill. But depending on your spending habits, it could be a good idea to pay off your balances more frequently as reader George suggests.

Because each bank reports your outstanding balances to the credit bureaus at different times. And the amount you owe impacts your credit score, even if you plan to pay the balance in full by the due date.

Regardless of when you pay, I always recommend paying the total credit card balance in full each month by the due date. Because carrying a balance or paying late means you’ll be hit with fees and interest. And these charges offset the value of any miles & points you earn!

I’ll explain why the date you pay your credit card balance makes a difference.

Pay Early to Avoid High Credit Utilization

Link: How to Easily Improve Your Credit Score With an Early Payment

Most banks report your credit card balances after the statement close date. Although Chase lets the credit bureaus know your balance a few days after you make a purchase or payment.

The longer you wait to pay your credit card bill, the more time your outstanding balance will appear on your credit report. And this has the potential to have a negative impact on credit score.

Because 30% of your credit score is based on balances owed, or your utilization.

Folks with high utilization (when your balance is close to your credit limit) can be seen as risky. Banks tend to look more favorably on applications for new credit cards or mortgages if your credit utilization is low. That said, there are lots of factors banks look at when reviewing your application.

But even if you pay your balance in full each month, your utilization can be high because your credit report reflects just a snapshot in time.

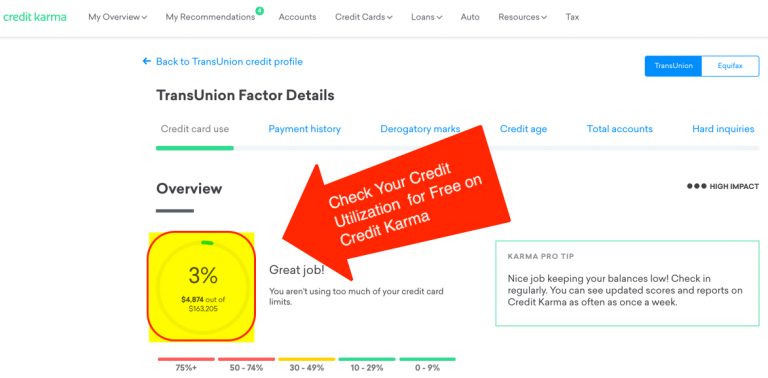

You can check your credit utilization for free by logging into Credit Karma.

To avoid having a high credit utilization, you can pay your credit card bills more than once per month or before the statement close date. For example, Million Mile Secrets team member Harlan pays his Chase cards off every week. And his credit report always shows a $0 balance for these cards.

Paying before the due date is also a good strategy if you make a large purchase during the month. You can pay it off right away to avoid having a large outstanding balance appear on your credit report. So making early payments can be an easy way to boost your credit score!

Bottom Line

Paying off your credit card balances before the statement close date can be a good idea for folks looking to maintain an excellent credit score.Because the outstanding balance shown on your credit report is what determines your credit utilization ratio. And this is a big factor in calculating your credit score.

Keep in mind, most banks report your card balances a few days after your statement is issued. But Chase lets the credit bureaus know within a few days of any changes.

You can monitor your credit utilization for free using Credit Karma.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!