My Experience Using Western Union with Credit Cards, Debit Cards & Pre-Paid Debit Cards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Don’t forget to follow me on Facebook or Twitter!

A few weeks ago, Gary Leff from View from the Wing, sent me a link to an offer by Western Union which waived the money transfer fee for transfers direct to a bank account.

Unfortunately, the waived fees for deposits direct to a bank account is now over, though the landing page still gives the impression that fees will be waived. Next time, perhaps I shouldn’t wait for the results of the experiment to come in before posting!

Hopefully this will be helpful for the next time Western Union waives fees for transfers to a bank account.

I experimented with Western Union with credit cards, debit cards, and with pre-paid debit cards.

I was charged cash advance fees and interest for using a credit card, earned no miles for using the Alaska Air and Delta debit cards. The only success was being able to use Western Union to transfer money from pre-paid debit cards (Wells Fargo etc.) to Emily’s bank account!

The Western Union website was annoyingly slow and quirky (don’t press the “back” button on your browser). My transactions were sometimes declined on-line, and at other times I had to call Western Union and have a rep call me back to verify my identity before the transaction processed.

Sometimes the telephone representative couldn’t process the transaction even after calling back to verify my identity, but the transaction was processed when I resubmitted it the next day!

Western Union & Credit Cards – Fail

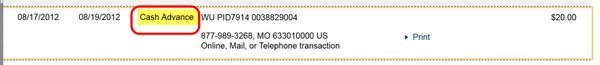

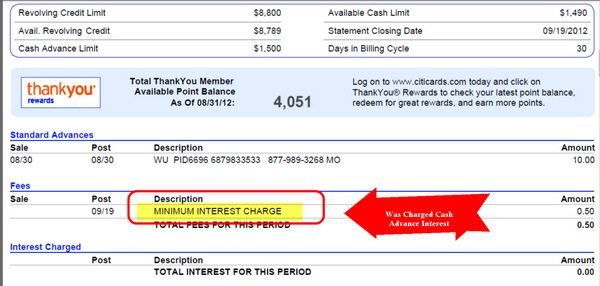

I was fairly sure that I would be charged a cash advance fee for using Western Union to transfer money to Emily’s bank account using a credit card. Cash Advances also earn no miles or points.

A cash advance is when you use your credit card to get cash. Cash advances are charged a higher level of interest than regular purchases and there is no grace period to avoid the interest. The interest starts accumulating the day you make the cash advance and usually compounds at a daily rate.

To be clear – cash advances are NEVER worth paying for – and certainly NOT worth paying for miles and points.

1. Chase Sapphire Preferred. I transferred $20 using my Chase Sapphire Preferred to Emily’s bank account. Unfortunately, the transaction was coded as a cash advance so I paid interest and earned no points.

Western Union & Debit Cards – fail

I actually expected this to work, but I didn’t earn any miles for using a miles-earning debit card to transfer money via Western Union to Emily’s account.

1. Alaska Air & Delta Debit Card. I transferred $10 using my Alaska Air and Delta debit card to Emily’s bank account.Unfortunately, I didn’t earn any Delta or Alaska Air miles for using their debit card with Alaska Air. These transactions posted to my account just a few days before my statement closed, so they *may* show up in next month’s statement.

But I suspect that Western Union is well known as a way to send money, so the banks could have systems in place to not award miles or points for Western Union transactions.

Western Union & Pre-Paid Debit Cards – success

Success! Finally!

1. Wells Fargo Prepaid Debit Card. I was able to transfer $10 to Emily’s bank account using my Wells Fargo Prepaid Debit Card.This is good news, because it is another way – after ATM withdrawals, cash back when shopping, and buying money orders – to remove cash from a pre-paid debit card.

I’ll write more on pre-paid debit cards soon, but some folks buy pre-paid debit cards with a miles earning credit card (to either meet the minimum spending or to earn miles and points) and then remove money from the debit card using ATMs, cash-back or with money orders.

I’m not a big fan of using pre-paid debit cards regularly just to earn miles and points, unless you have a legitimate reason to load a pre-paid debit card and the remove cash from it.

But I would use pre-paid cards as a way to meet minimum spending requirements on credit cards. But weigh the risk for yourself – in the worst case you could be banned from doing business with certain banks if you abused this method.

If you do buy a pre-paid debit card with a credit card, be sure that you’re not charged cash advance fees for this. Citi usually charges cash advance fees.

Western Union Transaction Limits

Western Union has certain transaction limits, which vary based on your profile and usage. But I didn’t test to see whether it was possible to go over the limit.

For the “Three Days” service which I used, I had a limit of $2,500 per transaction.

Bottom Line

You shouldn’t use Western Union to transfer money with a credit card because you will pay the astronomical cash advance interest rate and will earn no points.

You don’t earn any miles when you use a regular debit card with Western Union.

But it could be worth it to use Western Union to transfer money from a pre-paid debit card, the next time Western Union waives fees for transfers to bank accounts.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!