Parents! Check the Merchant Category Code for Your Kids’ Summer Expenses (You Might Get a Nice Surprise)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Jasmin: So, this is odd.

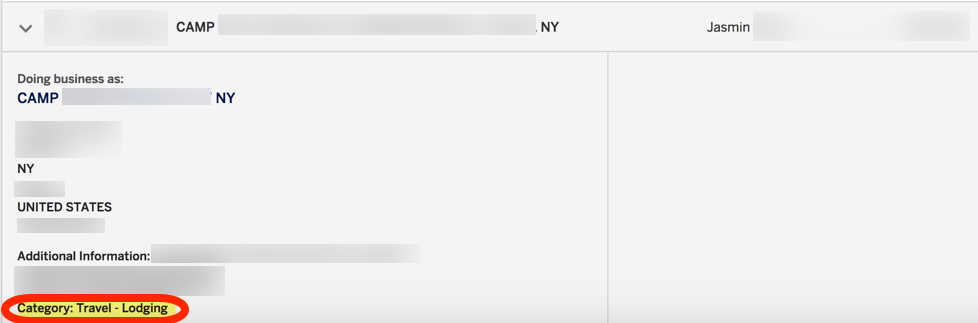

I was going through my American Express statements and discovered an unexpected merchant category code on the payment I made for the kids’ summer camp this year. I’d considered it “unbonused spend” and had paid with an AMEX card I was meeting the minimum spending requirement on.

It’s possible your children’s camps are coded this way too. Here’s what to look for.

Your Summer Camp Might Code as Travel!

Link: Don’t Miss Out on Rewards! How to Know If Your Purchase Will Earn a Category Bonus

Banks use merchant category codes to determine whether or not a purchase is eligible for bonus category points, like travel, airfare, gas stations, supermarkets, and the like.

Surprisingly, AMEX coded the kids’ summer camp as “Travel – Lodging.“

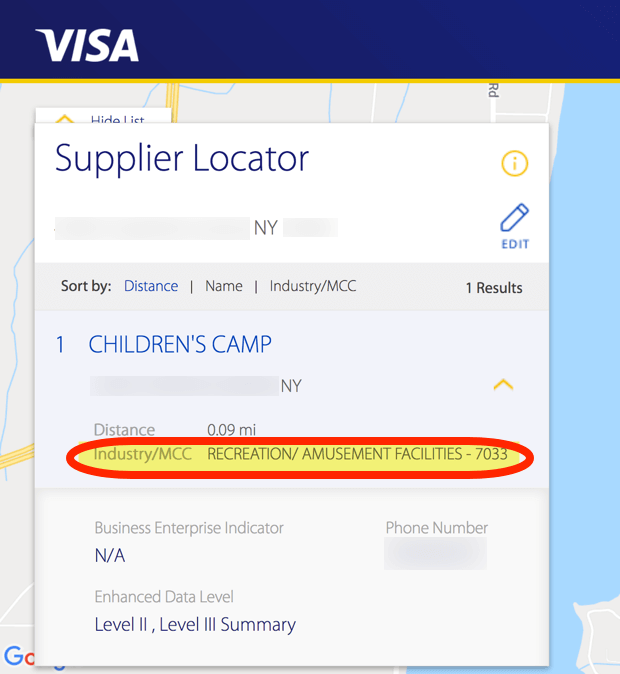

Keep in mind, different issuers (like Visa, Mastercard, or American Express) may code purchases in different ways. Visa has an online “Supplier Locator” tool that allows you to search for a merchant’s category code. But if you’re using a card from a different issuer, you’ll have to ask the company or make a small test purchase.

I plugged the kids’ camp into the Visa Supplier Locator and found it does NOT code as travel with Visa. Instead, it’s under the “Recreation – Amusement Facilities” category.

I’m not sure about Mastercard in this situation, but if it also coded as “Recreation – Amusement Facilities,” it’s possible it could qualify for bonus points using Mastercards like the Citi Prestige or Citi Premier Card. That include “amusement parks” as part of their 2X entertainment category.

That might be an experiment for next year. 🙂

Keep in mind, some camps also provide services like before and after school care during the school year, or run overnight events or recreation activities in the off-season. Those ongoing expenses definitely add up.

In any case, if you’ll be spending the money anyway, it’s worth checking to see what the camp codes as with your credit card issuer. You might get a pleasant surprise, particularly if it codes as travel with Visa. That way, you could earn bonus points with cards like the Chase Sapphire Preferred Card (2X Chase Ultimate Rewards points per $1 on travel) or Chase Sapphire Reserve (3X Chase Ultimate Rewards points per $1 on travel; excluding $300 travel credit).

Or use a Visa card like the Capital One Venture Rewards Credit Card to earn 2X miles on every purchase, then “erase” your travel purchase with Venture miles!

Bottom Line

I was surprised to see my kids’ summer camp coded as travel with AMEX. But with Visa, it codes as recreation / amusement facilities.

Because certain cards offer bonus points for purchases in these categories, it’s worth checking to see what the merchant category code is for your children’s camp with different card issuers. That way you don’t miss out on extra miles or points.

Parents, have you had a similar experience? Please share in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!