Reader Harry’s Best Tips to Get Approved for More Business Cards!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Welcome to the next installment of our Small Business Card Reader Success Series, where Million Mile Secrets Readers share how they opened a small business credit card to get Big Travel with Small Money!Small Business Card Interview: Harry Campbell

Please introduce yourself and tell us a bit about your small business.

My name is Harry Campbell and I’m the founder of The Rideshare Guy blog and podcast, a site that helps Uber and Lyft drivers with everything from getting signed-up and started to keeping them updated on what’s going on in the industry.

I started driving for Uber and Lyft part-time in 2014 and quickly realized there was a lot more to it than it looks. So I started blogging about my experience, sharing detailed spreadsheets of how much I was earning, and fortunately, the blog took off, in large part due to the huge popularity of rideshare services.

Why did you decide on the card(s) you chose?

I decided on the Chase Ink Plus (no longer available) for my primary business card because it was offering a 50,000-point bonus and I absolutely love the transfer partners associated with the Chase Ultimate Rewards portal.

I live in Los Angeles and fly to San Francisco often, so it’s great to be able to transfer points to my Southwest account whenever I need them. I book multiple flights in and out depending on my schedule. Then I’m free to cancel the flights I don’t need, and the points deposit back to my account!

Describe the application. ex. Did you apply as a sole proprietor with your social security number or some other way?

I already had a couple Chase Ink cards so I decided to apply using my EIN (Employer Identification Number). One of the nice things about having an official business with an EIN is you can start applying for business cards with your EIN and often get multiple business cards that way.

Approximately how much annual small business income did you list on your application? (Or if you’re not comfortable sharing that, which factors do you think lead to your applications being approved?)

I was generating around $100,000 of income at the time so I listed that and since I anticipated higher expenses, I also listed between $20,000 and $30,000 of expenses.

What would you tell someone who’s never applied for a small business card?

Most business cards don’t show up on your personal credit report since they’re part of your business. So they can be a great way to get additional miles and points.I’d also pick a card that you are going to be happy to keep since if your business starts to grow, you’ll likely need to set up a lot of auto-payments and it can be a hassle to switch cards.

Now the fun part! How do you plan to use your miles or points to get Big Travel with Small Money? 🙂

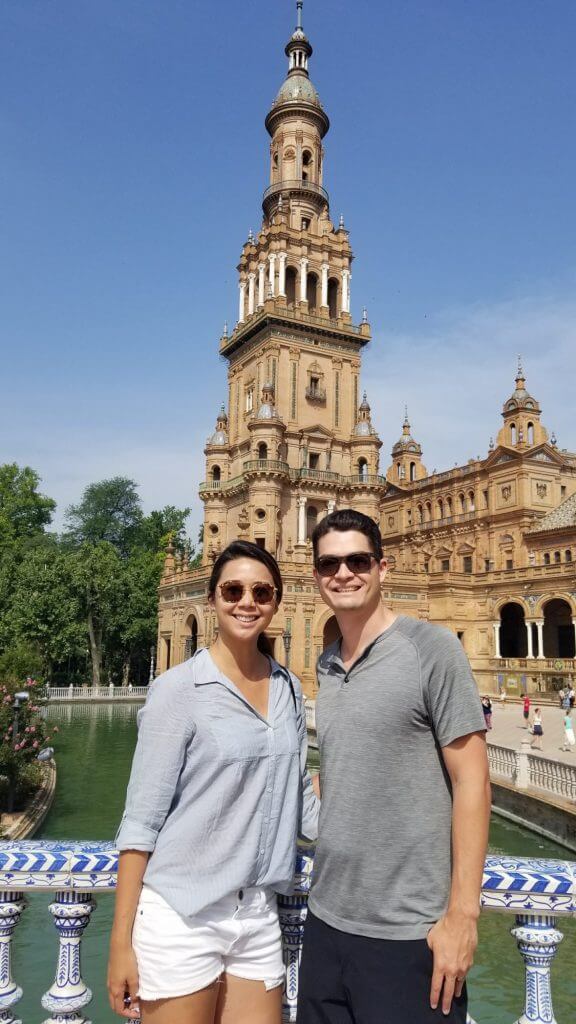

I’m addicted to Park Hyatt hotels lately, and since I’m way too cheap to pay cash for them, I’ve been saving all my points for future stays. Our last trip took us to the brand new Park Hyatt Mallorca and it was an amazing experience!

Thanks for sharing your small business card experience, Harry!

Want to Share Your Story?

If you’d like to share your small business card success, please send me a note! Emily and I would love to hear about how it went for you!Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!