2 Reasons You Should Open a Credit Card for Priority Pass — Even If the Card Annual Fee Is Higher Than a Priority Pass Membership

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

INSIDER SECRET: Several credit cards offer Priority Pass airport lounge access for free. This membership is NOT part of the card’s welcome bonus. You can simply open the card, activate the Priority Pass membership, and start traveling like a rich person.I had a conversation with a frequent traveler a couple weeks ago that I’ve never had before. She was knowledgeable of hotel points and airline miles, but floored me when she casually stated that she had purchased a Prestige Priority Pass membership (the most expensive one).

She stated that she purchased the membership during a promotion, so she didn’t pay full price. She also said she was aware that some credit cards offer lounge membership for free, but she didn’t want to pay astronomical credit card annual fees.

Are there any more of you out there that have done this?These are common misconceptions. Let me provide two simple reasons why acquiring a Priority Pass membership from a credit card with a high annual fee is better than buying it.

Why Priority Pass Airport Lounge Access Through Credit Cards Is Superior

Priority Pass membership gets you access to 1,200+ airport lounges worldwide.

Even if your sole intention is to get Priority Pass for a discount, you should open a credit card that offers membership instead of buying it — even if the card’s annual fee is higher!

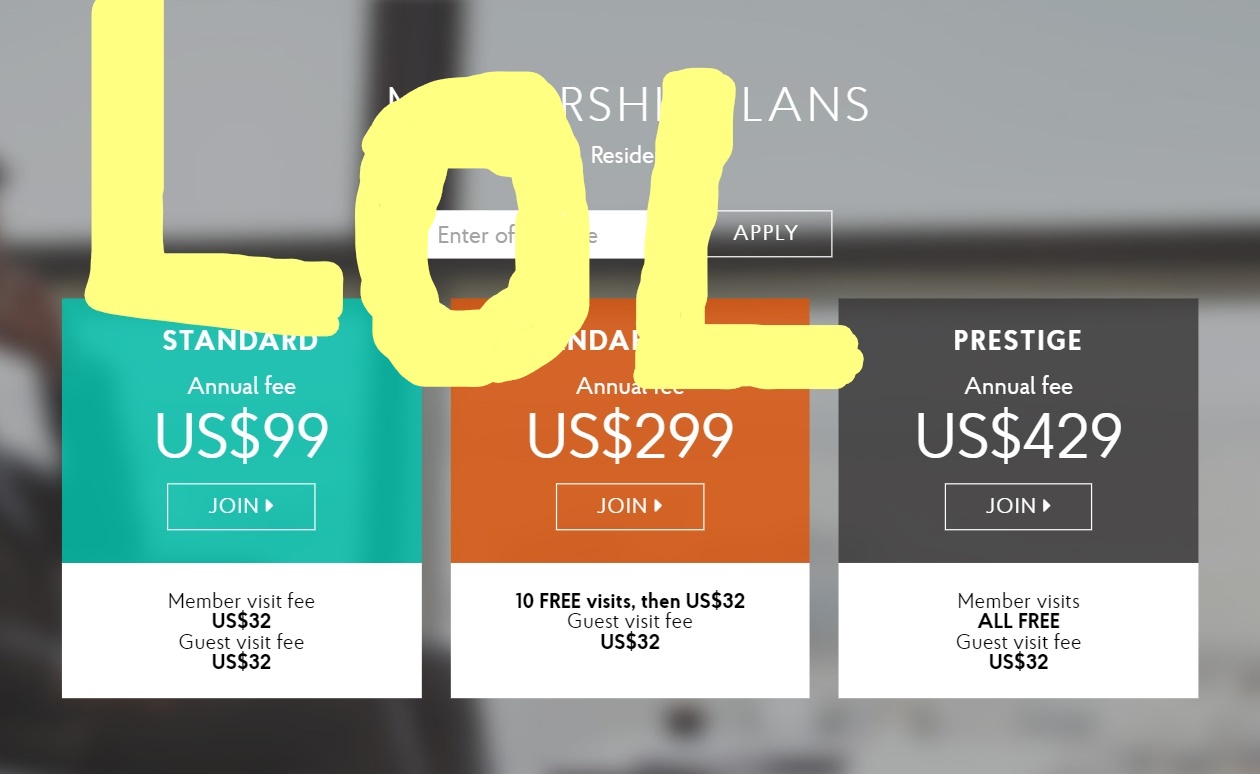

First, let’s quickly cover what you’ll get when you purchase a Priority Pass membership:

- Standard – $99 annual fee: You can enter Priority Pass lounges for a discounted rate of $32 per visit

- Standard Plus – $299 annual fee: You receive 10 free Priority Pass visits per year, then you’ll pay the discounted rate of $32 per visit

- Prestige – $429 annual fee: You can enter Priority Pass lounges as often as you want for free

With all three above plans, you’ll pay $32 per guest. So if you often travel with friends or family, none of the above plans are worthwhile to you.

Several cards offer Priority Pass, but let’s look at the biggest no-brainer:

- Chase Sapphire Reserve® – $550 annual fee: You can enter Priority Pass lounges as often as you want. And you can always bring two guests for free!

Huh. At first glance, it looks like purchasing a Priority Pass membership really is cheaper. A “Prestige” membership costs $429, and the Chase Sapphire Reserve annual fee is $550. But here’s why the Chase Sapphire Reserve is an infinitely better deal

1. Free Guests!

The Chase Sapphire Reserve comes with a membership that’s even better than the most expensive Priority Pass membership available for purchase. You can bring up to two guests for free, every time you enter a Priority Pass lounge. That could save you up to $64 per visit if you’re traveling with friends or family!

If you’re always traveling alone, this won’t make a difference to you. But for the rest of us, this makes an enormous difference. When we travel internationally, we usually stop at multiple Priority Pass lounges. I’d estimate that I save $200+ per year on guest fees

2. Chase Sapphire Reserve Annual Travel Credit

Link: Chase Sapphire Reserve $300 Travel CreditIt’s true, cards that come with a Priority Pass membership have high annual fees. But they also come with useful statement credits that will help offset the annual fee.

With the Chase Sapphire Reserve, you’ll receive a $300 statement credit every cardmember anniversary. This credit will automatically activate when you use your card for travel related things, such as:

- Airfare

- Hotels

- Car rentals

- Airbnb

- Uber

And lots more! If you spend $300 on travel per year, this $300 travel credit effectively brings the card’s $550 annual fee down to $250. So you’re basically receiving a superior Priority Pass membership for $250 per year! That’s $279 cheaper than the “Prestige” membership, which doesn’t even have guest privileges.

Even if you don’t care about any other Chase Sapphire Reserve benefits and perks (and yes, they are amazing), it’s worth opening the card SOLELY FOR PRIORITY PASS ACCESS.

It’s also important to note that this membership isn’t part of the welcome bonus. You don’t have to meet any minimum spending requirements to use it. Just open the Chase Sapphire Reserve, activate the membership, and Bob’s your uncle.

Don’t dismiss credit card annual fees until you’ve examined the card benefits to see if you’ll save lots more money than you’re spending on the annual fee. Check out our post on the best credit cards with lounge access here.

You can also subscribe to our newsletter, and we’ll outline card benefits like this to ensure you’re spending the least amount of money while traveling in style.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!