$2,000+ off my next trip: Here’s how I’ll meet the Marriott Bonvoy Brilliant minimum spend to unlock the bonus

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: The Marriott Bonvoy Brilliant™ American Express® Card gives you access to 1,200+ airport lounges around the world. If you were to buy a similar lounge membership, it would cost $400+ per year.

If you spend $300 or more on hotels every year, the Marriott Bonvoy Brilliant™ American Express® Card should, without question, live in your wallet.

Here’s why: The card comes with a $450 annual fee (see Rates & Fees). But it also comes with a $300 annual credit at Marriott hotels (i.e., the first $300 you spend with Marriott each year will be reimbursed). That effectively brings the annual fee down to $150 per year — an absurd price for this card’s benefits, like a free night at Marriott hotels costing 50,000 points or less every year you renew your card. You can use this credit to stay at amazing hotels like the W New York – Downtown, which costs up to $600 per night.

Further reading: Marriott Bonvoy Brilliant review

On top of that, the card comes with 75,000 Marriott points after spending $3,000 on purchases in the first three months of account opening. My wife and I needed those points for our upcoming stay at the St. Regis Maldives. We’ll get $2,000+ in value from those points.

First, we need to meet the minimum spending requirement. I’ll show you how we plan to do it.

Easily meet the Marriott Bonvoy Brilliant spending requirement

You can read our full guide on how to meet credit card minimum spending requirements. Here are four surefire ways I choose to meet minimum spending:

1. Pay rent

Many landlords allow you to pay rent with a credit card. This is normally a horrible idea because you’re charged a service fee (usually 2.5%+) for using a card.

Under only one circumstance should you even consider paying rent with a credit card — to meet a minimum spending requirement. Even then, if you can do it without incurring a 3% fee, do that instead.

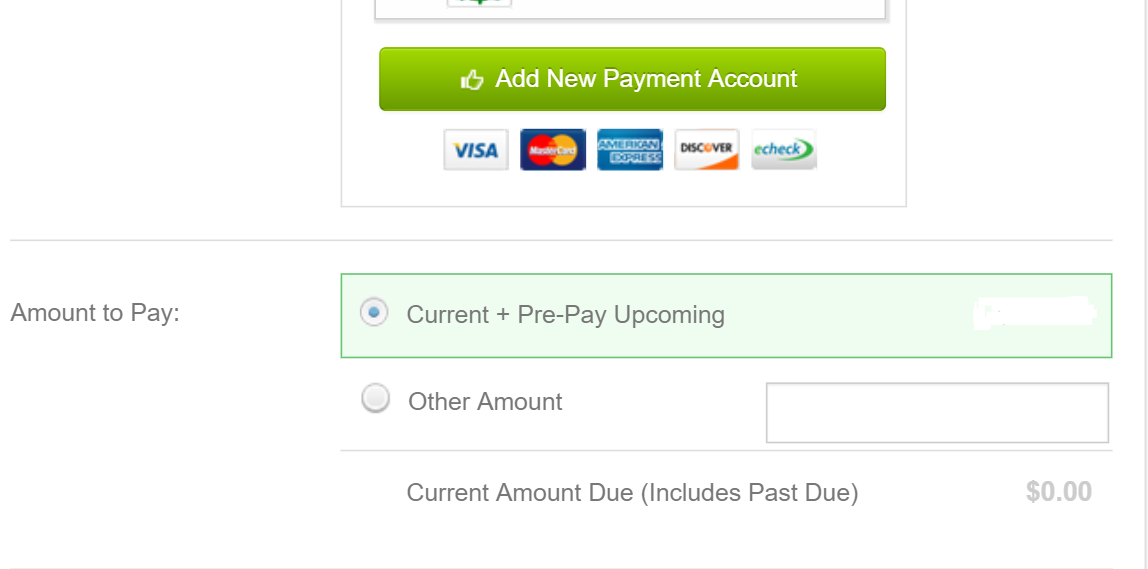

If you’re unable to pay rent or mortgage with a credit card as shown above, you can use a service called Plastiq to pay bills that you can’t normally pay with a card.

Plastiq allows you to pay any bill (business or individual) with a credit card and will charge a flat 2.5% fee. On occasion, the company will publish a promotion with lower rates.

Further reading: Plastiq review

2. Spending on travel

It’s not often that I’ll pay cash for travel expenses like airfare and hotel, but I have a few opportunities in the near future.

My family is flying to South Africa next month, and I was able to book cheap flights with the Marriott Bonvoy Brilliant. The card doesn’t come with impressive travel coverage like the Chase Sapphire Preferred® Card, so I’m rolling the dice in hopes that there’ll be no crises such as delayed baggage or canceled flights.

My wife and I also have a trip to Chicago coming up. However, we’re flying super cheap with Southwest, and we have the Southwest Companion Pass which cuts our flight expense in half.

Further reading: Southwest Companion Pass

We’re staying in a Marriott hotel in Chicago for free because the Marriott Bonvoy Brilliant comes with an annual $300 credit at Marriott hotels. This trip won’t make much of a dent in our wallets. Every penny counts, though.

Note: The Marriott Bonvoy Brilliant earns three points per dollar on flights booked directly with the airline, so it’s still a decent card to use for airfare — just not the best.

3. Everyday Spending

To meet a minimum spending requirement, it’s sometimes necessary to throw all of your daily spending on that card.

Example: I put most of my spending on:

- Chase Sapphire Preferred® Card – I use this card for travel and dining expenses, because I earn 2 points per dollar in those categories. Again, the travel insurance I receive from the card is fantastic.

- Chase Freedom Unlimited® – This card earns me a flat 1.5% cash back (1.5 points per dollar). I use it for all my spending that doesn’t fall into a bonus category, like dry cleaning, car insurance or groceries.

However, if I need to meet a new card’s minimum spending, that strategy goes out the window. All spending goes on the Marriott Bonvoy Brilliant for:

- Monthly payments (such as phone, internet, auto insurance, Netflix)

- Restaurants

- Gas stations

- Groceries

With expenses like insurance, I can even pay months in advance to help me meet the spending requirement now.

4. Venmo

Venmo is a last resort (it charges a 3% fee when you use a credit card), but I always keep it in my back pocket, just in case. Venmo is a way to transfer money from person to person with a credit card using your smartphone. It’s great for reimbursements to friends for meals or groceries or other items.

For example, if your roommate calls to tell you that the $1,800 glassblowing furnace you’ve been eyeing has gone on sale, you can tell him/her to buy it and then reimburse your roommate through Venmo. When you send money through the app, it counts toward minimum spending.

Note: Venmo will close accounts that frequently transfer money back and forth. Even if you and a friend legitimately transfer money to each other all the time, Venmo may not like it. It might be a better idea for you to transfer money through Venmo, and your friend to write you a check when he wants to give you money.

Let me know if you’ve got the Marriott Bonvoy Brilliant. Check out our full review of the card to see all of its valuable benefits, and subscribe to our newsletter for more miles and points strategies.

For rates and fees of the Amex Marriott Bonvoy Brilliant, please click here

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!