Best bank account bonus I’ve ever seen: Easy $600+ by following these steps

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

This bank bonus has been around for a couple months, but I’ve now seen a sufficient number of wildly successful data points that I’m willing to write about it. By taking advantage of this deal, you’re effectively manufacturing another stimulus check! Here’s why it’s worth your time:

- You can make an easy $600 (or much more — I’ll explain)

- It’s very simple

- It has nothing to do with credits or loans or anything like that

- It doesn’t pull your credit score

- It’s better than most credit card welcome bonuses

This deal is through HSBC. If you’re interested, I’ll give you a step-by-step guide to opening an account. You don’t even have to keep it open for long.

Possibly the easiest $600 you’ll make in 2021

Before you continue, answer the below two questions:

- Do you have an HSBC consumer deposit or investment account, or have you had one in the past three years?

- Do you have an HSBC business account, or have you had one in the past three years?

If you answered yes to either, you aren’t eligible for this deal.

Below are five steps to getting your $600 bonus. Read all the steps first before you cannonball into the deal. It may not be for everyone, but it’s very accessible for lots of readers. Here’s how to open an account.

Step 1. Call HSBC

Call 866-788-5583 to talk to the “Premier Relationship Team” (that’s the number that’s worked best for me). This office is open between 9am and 4pm ET, Monday-Friday. You can also visit an HSBC branch if you’ve got one nearby.

Note: Some data points suggest 716-841-6408 works, as well. If the above number isn’t working for some reason, try this one.

Step 2. Tell the bank rep that you’re calling about the “Share the Experience” promotion

This limited-time offer is called “Share the Experience.” It expires on January 31, 2021. If you don’t mention this phrase, you might not get the right offer.

Step 3. Explain that you want to open an HSBC Premier account

Make sure you’re opening an HSBC Premier account with a welcome offer of $600. When I called, the rep began signing me up for a lower offer. I had to restate that I wanted a Premier account through Share the Experience.

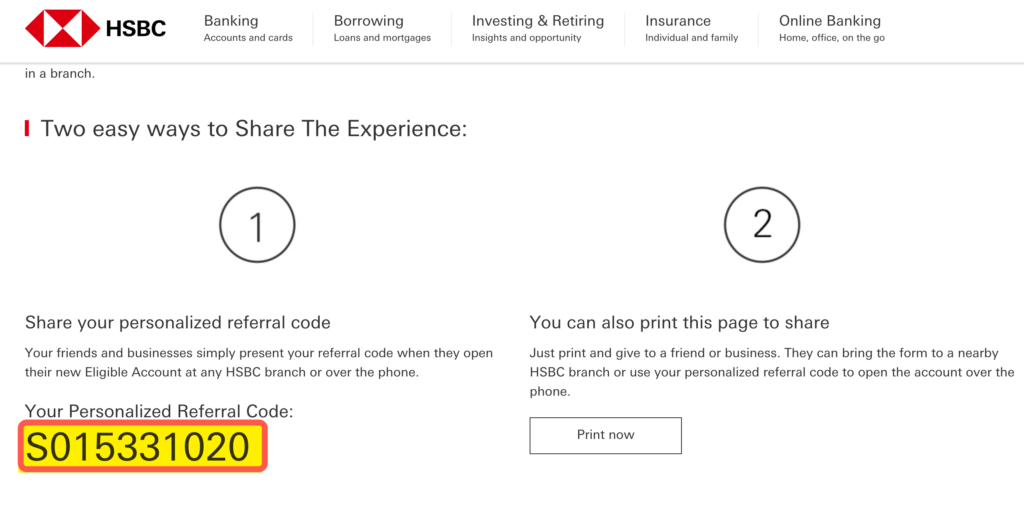

Step 4. Provide a referral code

To get in on this deal, you’ll need a referral code from someone who already has an HSBC Premier account. You can use a friend or family member’s code or you can find a referral code on the internet. You’ll need to give the HSBC customer service rep the name of the referer their referral code to get the bonus attached to your account.

Whenever someone uses your referral code, the referrer gets $100 (capped at $2,000 per calendar year). So once you’re signed up, you could refer your partner and find yourselves with an easy $1,300.

Meeting the HSBC Premier “requirements”

Here’s the thing — the terms aren’t exactly clear as to what you must do to get this bonus. There are a few conflicting reports floating around the internet. What we know for certain is that if you receive $5,000 in direct deposits each month, you will get the bonus. But you may not have to do anything at all.

See, to have an HSBC Premier account, you must do only one of the following:

- Maintain a balance of $75,000 in combined U.S. consumer and qualifying commercial U.S. Dollar deposit and investment accounts

- Have monthly direct deposits that total at least $5,000 from a third party to an HSBC Premier checking account

- Have an HSBC U.S. residential mortgage loan with an original loan amount of at least $500,000, not an aggregate of multiple mortgages

If you don’t accomplish at least one of those, you will incur a $50 monthly maintenance fee. This fee is waived for the first six months you have the account.

Per the offer terms, the only requirement seems to be that you keep your HSBC Premier account in good standing. And paying the $50 fee each month will do that. So in theory, you can just open the account and do nothing, and the $600 bonus will appear in your account in a couple of months.

However, when calling the HSBC Premier number, the customer service representatives are adamant that you will need to fulfill at least one of the above three requirements. Admittedly, I haven’t seen any data points from those who have opted to open the account and leave it alone. All the successful data points I’ve seen from people earning this bonus went ahead with the $5,000 in direct deposits each month. So we at least know that qualifies you.

Frequent Miler (the site that originally notified me of this deal) has data points showing that HSBC considers ACH transfers specifically from Capital One checking accounts as direct deposit. So you could put money in a Capital One account and transfer it to your HSBC account to help you meet the monthly $5,000 requirement. If this works, you could just keep cycling the same money for a few months to meet the requirement.

FAQ

How do I maximize this deal?

If you have a partner or roommate or travel buddy, you can make out like a bandit with this deal. As stated above, once you open your account, you can then refer your partner, receive $100 for the referral, and they’ll get a $600 bonus like you. That’s a quick and easy $1,300.

This deal is really good, so you can feel guiltless (even…altruistic??) telling your friends to sign-up, too. Remember, you’re capped at earning $2,000 per calendar year in referrals.

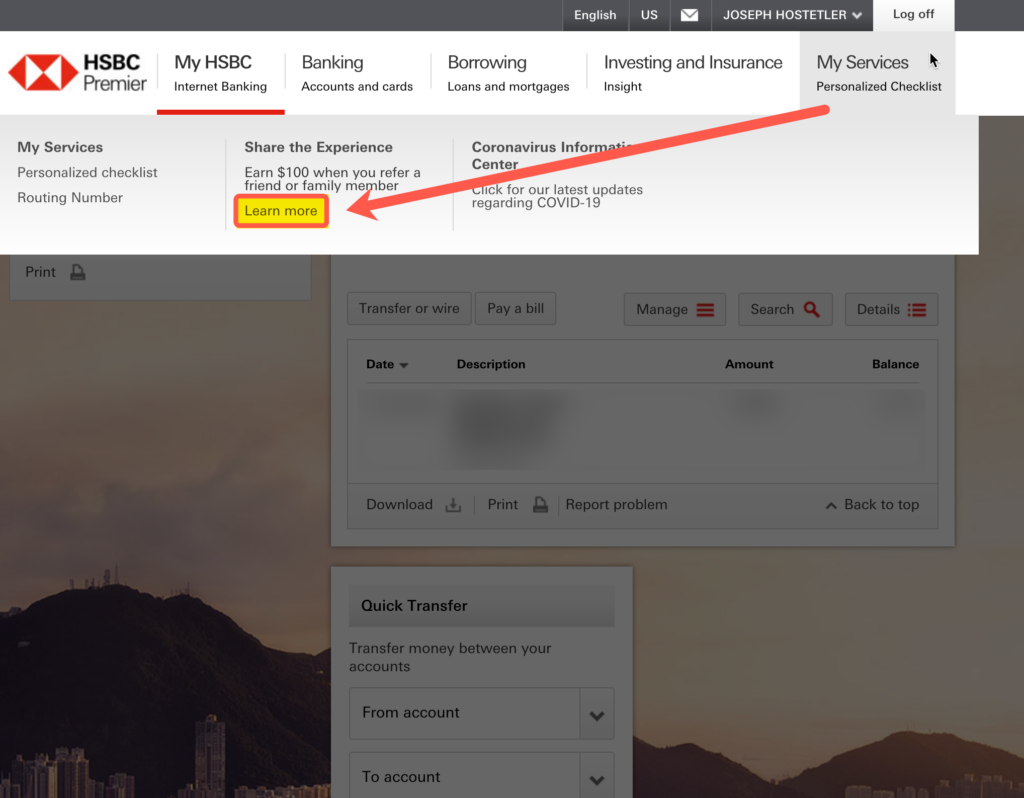

I signed-up, and I want to refer a friend. Where is my referral code??

HSBC says you’ll need to wait two days after you open an account before you refer, as that’s how long it takes your personal code to activate. My referral code posted the morning of the third business day. You’ll find it here.

Scroll down on the next page until you find your unique referral code in a gigantic font.

How long do I need to keep the account open for?

Those who have already received their bonus claim it was deposited in their account between one and two months after their call. Most accounts say two months.

You don’t have to keep it for any length of time after you’ve received the bonus. This means you may have to pay $100 in maintenance fees if you decide not to bother with the monthly $5,000 direct deposit (though again, all successful firsthand reports have participated in this direct deposit requirement — so be warned).

How long will the setup process take?

HSBC isn’t touted for their irreproachable IT department or their blazing fast phone representatives. Expect the entire setup process to take between 45 minutes and an hour. That sounds pretty ludicrous, I know, but making $600 an hour isn’t a bad wage. I was on my call for an hour and three minutes. It would have been about 45 minutes if the representative didn’t encounter any issues emailing me a document I was meant to electronically sign.

Do I have to leave the $5,000 in direct deposit in the account?

Nope, once it deposits into your HSBC account, you can turn right around and deposit it back into your normal bank account. Basically, your money just has a layover with HSBC before it reaches its regular destination.

What kinds of questions does the customer service rep ask?

The customer service rep won’t be asking hard questions like, “what features of this account appeal to you?” Instead, you’ll endure a pretty comprehensive list of boring bank questions, like:

- Address of employer

- Drivers license number and expiration

- Mother’s maiden name

- Previous address and date of move

- Your credit file indicates that you sold a robin’s egg Buick LeSabre in which of the following years?

Will I get a 1099 for earning this money?

Yep, bank account bonuses always count as income. You’ll have to report it on your taxes. It takes all of 20 seconds, so don’t let that deter you.

Bottom line

This is quite possibly the best bank account bonus I’ve personally seen. Earning $1,300 between you and a partner for each spending an hour on the phone is hard to beat — especially when there is no credit pull involved.

There’s really nothing to lose by opening an account, as all the fees are waived for the first six months. It’s like earning a couple of credit card welcome bonuses without opening any cards. You can use this money on your next trip to cover costs that otherwise wouldn’t be covered by points or miles — or for anything really!

While I don’t see that the terms expressly state you must receive at least $5,000 in direct deposits into your account to earn this bonus, all reports from those who have earned the bonus so far have done this, because it keeps you from incurring a $50 monthly “maintenance fee.” Whether you decide to do this or not, you should receive your bonus within a month or two — so you won’t have to keep depositing this money for very long (or paying a $50 fee, if you choose to not worry about direct deposit).

Let me know if you decide to go for this bank bonus! And subscribe to our newsletter for more low-hanging fruit delivered to your inbox once per day.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!