How to Use ReceiptMatch With AMEX Small Business Cards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

I’ve written about a tool that can help AMEX small business cardholders organize receipts and track expenses. LINK TO POST

Using ReceiptMatch is a great way to save time! And you won’t have to worry about losing receipts because you’ll have electronic copies right in your AMEX account!

I’ll show you how to use ReceiptMatch!

How to Use ReceiptMatch

Link: American Express ReceiptMatch

The benefit of using ReceiptMatch is you can link business expense receipts directly to credit card purchases. This means you won’t have to keep physical copies of receipts. And the electronic copies will be saved and organized in your AMEX account.

To use ReceiptMatch, you’ll first need to download the mobile app on an eligible Apple or Android device.

After you have the app, you can follow these 4 steps.

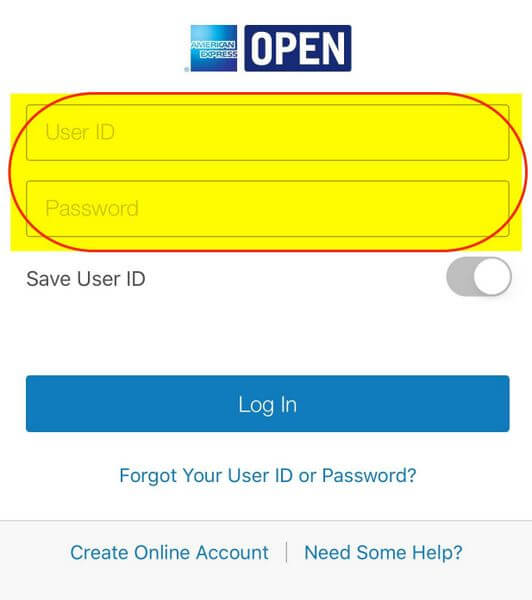

First, you’ll want to log-in to your AMEX account. You’ll use the same user ID and password for ReceiptMatch that gets you into your online AMEX account.

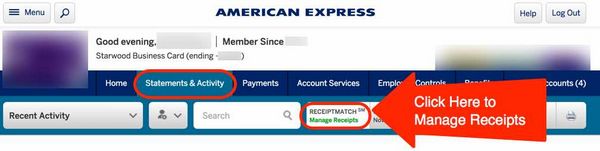

Folks without the app can also use the ReceiptMatch program through their online AMEX account.

You’ll still need to save a photo or scan a copy of your receipt to your computer in order to upload to ReceiptMatch.

I’d recommend using the mobile app to upload receipts because it’s much quicker!

Step 2 – Three Ways to Upload Receipts

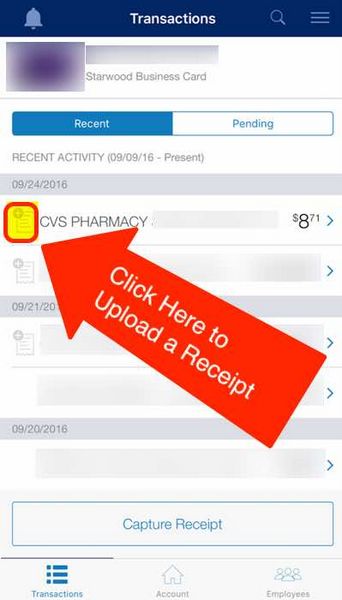

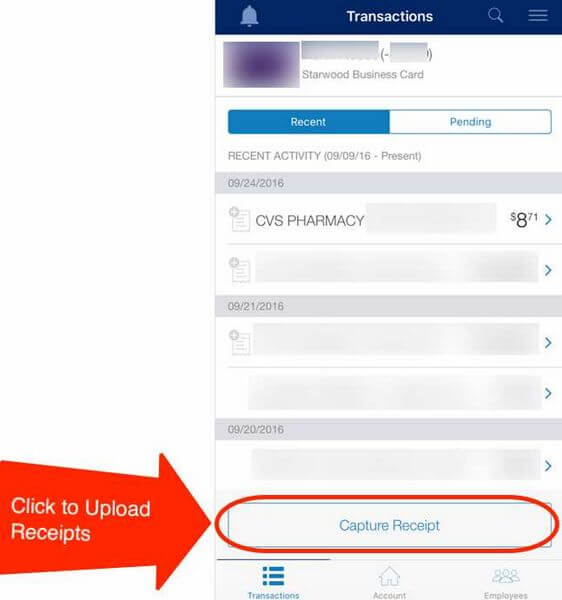

There are multiple ways to upload receipts for your purchases through the app. One way is to click the receipt icon next to the transaction description on the recent transactions page.

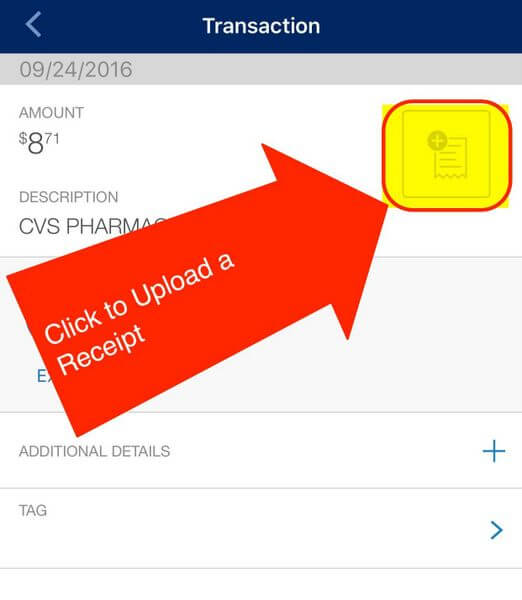

Or you can click on a specific transaction. Then, click on the receipt icon to upload your receipt.

You can also upload a receipt without linking it to a specific transaction.

Then, AMEX will automatically match the receipt with your recent purchase.

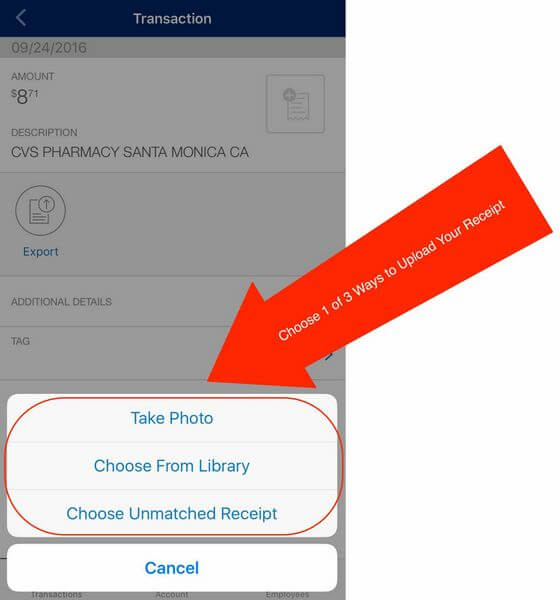

Step 3 – Upload Receipts

Now, it’s time to upload your receipt. You can either:

- Take a photo of a receipt

- Choose a photo receipt from your library

- Pick a receipt already uploaded

Alternatively, you can email a photo of your receipt (from the email registered to your AMEX account) to [email protected]. AMEX will automatically assign the receipt to the corresponding purchase. And you can email multiple receipts at one time.

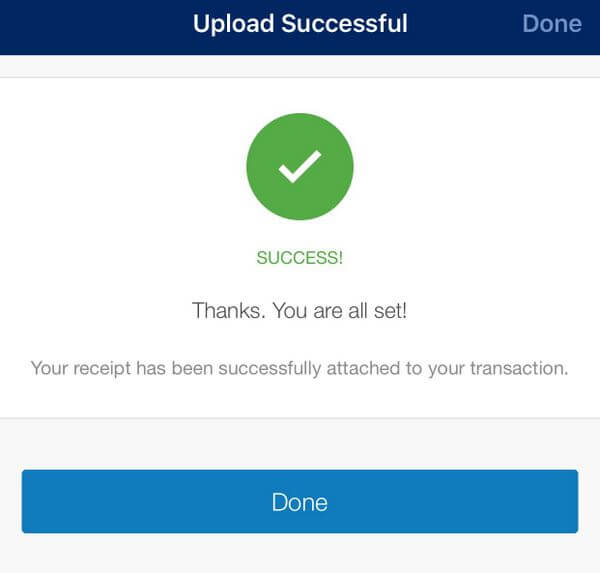

Step 4 – Back to Business

After you upload a receipt, you’re all set! You’ll now have access to view the receipt through the mobile app or on your desktop.

Bottom Line

With the ReceiptMatch mobile app, you can quickly upload and link receipts to your AMEX small business credit card purchases.

If you don’t have the mobile app, you can also email a photo of your receipt (from the email registered to your AMEX account) to [email protected]. AMEX will then automatically link the receipt to your purchase.

Have you used ReceiptMatch? I’d love to hear about your experience!

* If you liked this post, why don’t you join the 25,000+ readers who have signed-up to receive free blog posts via email (only 1 email per day!) or in an RSS reader …because then you’ll never miss another update!Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!