Getting Ready for Travel – How Quickly Will You Receive Your New Card?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

This page includes information about the Discover it® Miles that is not currently available on Million Mile Secrets and may be out of date.

Getting approved for a new credit card is exciting! And if you’re like me, you probably can’t wait to receive the card and start making purchases.

Because the sooner you meet minimum spending requirements on new cards, the quicker you can unlock lucrative welcome bonuses! And that’s the easiest way to get Big Travel with Small Money!

Most credit cards arrive within 7 to 10 business days after approval. But some banks can get you the card a lot faster!

I’ll let you know which banks will expedite your new card!

How Long Does It Take to Get a Credit Card?

Perhaps you’re planning to make a large purchase that can knock out a big chunk of a card’s minimum spending requirements. Remember, the minimum spending clock starts on your approval date, NOT your activation date.

Getting rush shipping might also help if you’re traveling overseas and want a card that has no foreign transaction fees!

Here’s a guide to helping you know which cards you can get quickly after approval.

1. American Express

AMEX automatically overnights some of their premium credit cards, like the AMEX Platinum cards, including:

- The Business Platinum® Card from American Express

- The Platinum Card® from American Express

Team member Meghan’s mother was recently approved for the AMEX Business Platinum card and it was automatically overnighted to her!

It’s possible you might get expedited shipping with other AMEX cards, but you’ll probably have to request it.

Once you’re approved for a new AMEX card, I’d suggest calling AMEX to request expedited shipping. But there is no guarantee you’ll get it.

Meghan was recently approved for The Hilton Honors American Express Business Card. And even though the application page stated the card would be delivered within 2 to 3 business days, it took 7 business days for her to receive it. Even after calling (and online chatting!) with AMEX to ask for rush delivery!

2. Bank of America

You’ll normally have to wait 7 to 10 business days to get your Bank of America card in the mail. But the Bank of America representative I talked to said that expedited shipping was available on any new credit card for no extra fee!

3. Barclays

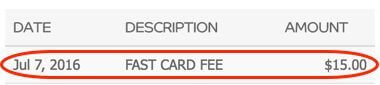

You can get rush delivery on your Barclays credit card, but you’ll have to pay a $15 fee. And you can select the option for expedited shipping during the application process.

The Barclays representative I talked to said that the fee is charged to your account by FedEx, so they won’t waive it except in the case of fraud.

4. Capital One

You can expect your new Capital One card within 7 to 10 business days following approval. You can make a request for expedited shipping, but there’s no guarantee it will be granted.

The Capital One phone representative told me that if the request for expedited shipping is approved, there would be no additional fee. This applies to cards like:

- Capital One® Spark® Miles for Business

- Capital One® Venture® Rewards Credit Card

- Capital One® Quicksilver® Cash Rewards Credit Card

Read our full review of the Capital One Venture card. These miles are easy to earn and redeem. Because you can offset travel purchases without worrying about blackout dates!

5. Chase

If you call Chase after approval, they will expedite most of their cards for free! That includes cards that earn Chase Ultimate Rewards points, like:

- Chase Freedom

- Chase Freedom Unlimited

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Ink Business Cash Credit Card

- Ink Business Preferred Credit Card

- Ink Business Unlimited Credit Card

If you don’t feel like calling, you can send a secure message and ask for rush shipping.

That said, some folks have reported having a more difficult time getting co-branded cards expedited. Team member Meghan was approved for the United℠ Business Card ~11 months ago, and when she called to get it rushed, the Chase representative said it couldn’t be expedited because it was a co-branded card. So, it’s possible certain cards might not have an option to be expedited.

6. Citi

You’ll typically get your new Citi card within 7 to 10 business days. The Citi representative I talked to said that they do NOT expedite shipping on new cards.

However, if you need a replacement card, you can request rush shipping.

7. Discover

Discover credit cards are always sent with priority shipping. You don’t have to ask!

This includes terrific no-annual-fee cards like the Discover it® Miles! Remember if you’re a new cardmember, Discover will match the cash back or miles you’ve earned after the 12th billing cycle.

8. US Bank

You’ll automatically get rush shipping when you’re approved for the U.S. Bank Altitude™ Reserve Visa Infinite® Card. This is a great card with a good intro bonus and up to $325 in annual travel credits!

For other US Bank cards, it’s possible to get expedited shipping. But you’ll have to pay an additional fee of $15 to $25.

Bottom Line

After approval, some banks automatically rush your new card so you can start meeting minimum spending requirements right away. This is great if you’re trying to unlock valuable welcome bonuses on top travel cards!

Keep in mind, you might have to call to request expedited shipping. This is the case for cards like the Chase Sapphire Preferred and Chase Sapphire Reserve. And some banks charge a fee to get a new card faster than the standard shipping time.

Have you had success getting your card quickly? Tell me about your experiences in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!