How I Booked Over $3,800 Worth of European Travel for Free Using Miles And Points!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Miles and points earned from the best travel credit cards are the easiest way to travel the world without breaking the bank. I wanted to share how I was able to book a summer vacation for myself and my wife for a fraction of the cost – in fact, we got ~$3,800 in travel for next to nothing!

I was able to book my flights to and from Europe for just the cost of taxes and fees using points I earned with my Chase Sapphire Reserve® and Chase Freedom® cards, and got a free 2-night stay at an incredible Marriott in Nice thanks to my wife’s Marriott Rewards® Premier Plus Credit Card. And we got $300 worth of Airbnb stays for free using my Chase Sapphire Reserve® card.

Want to do something similar? I’ll show you how!

Here’s how I planned the itinerary and figured out which credit cards would strategically get me the points I needed for our big trip!

How I Earned the Miles and Points I Needed for a Trip to Europe

So I knew going into our vacation that I wanted to travel around Europe for 2 weeks. As we discussed the trip, my wife and I started gravitating towards traveling around the Mediterranean, especially once we found we could fly direct to Barcelona from our home airport on United Airlines for only 30,000 United Airlines miles one-way.

Barcelona would be our gateway to Europe, followed by the French Riviera for a few days in Nice, then finally making our way over to Croatia where we would travel up the Dalmatian Coast for a week! Once we knew where we wanted to go, I sought out cards that would help me get there!

Chase Sapphire Reserve

Apply Here: Chase Sapphire Reserve®

Read our review of the Chase Sapphire Reserve

The main staple in my wallet is my Chase Sapphire Reserve card. This is my go-to credit card and one of the best ways to earn points towards travel.

The Chase Sapphire Reserve earns 3X Chase Ultimate Rewards points per $1 spent on restaurants and travel. It also currently comes with a sign-up bonus of 50,000 Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months from account opening.

The card does have a $450 annual fee, however, that fee is almost wiped away with all the benefits you get, including a $300 annual travel credit, free lounge access with Priority Pass, $100 statement credit for Global Entry or TSA PreCheck, and much more! Read our review of the Chase Sapphire Reserve to learn about all the great benefits this card has to offer!

Chase Freedom

Apply Here: Chase Freedom®

Read our review of the Chase Freedom

I pair my Reserve with the Chase Freedom card, which earns 5X Chase Ultimate Rewards points on up to $1,500 worth of spending in bonus categories which rotate every quarter when you activate the bonus.

I always make the most of these rotating categories, which earns me 7,500 Chase Ultimate Rewards points per quarter or 30,000 points per year. The Chase Freedom comes with a sign-up bonus of $150 cash back (15,000 Chase Ultimate Rewards points) after you spend $500 on purchases in the first 3 months from account opening.

Also, this card has no annual fee! After opening the Chase Sapphire Reserve and Chase Freedom, earning the welcome bonuses, and doing the majority of my spending on these 2 cards for about a year, I was able to accumulate ~130,000 Chase Ultimate Rewards points!

Marriott Rewards Premier Plus Credit Card

Apply Here: Marriott Rewards® Premier Plus Credit Card

Read our review of the Marriott Rewards Premier Plus Credit Card

While I put our every day spending on my Chase cards, my wife opened the Marriott Rewards® Premier Plus Credit Card to use for a big purchase we had coming up. This card has a welcome offer of 75,000 Marriott points after you spend $3,000 on purchases within the first 3 months from account opening.

It also earns 6X Marriott points per $1 spent Marriott (which now includes Starwood) hotels and 2X points for every $1 spent on all other purchases. The best part of this card is it gives you 1 free night (valued up to 35,000 points) every year after your account anniversary date, which helps offset the $95 annual fee. 35,000 Marriott points can easily get you a night at hotels that can cost $300+!

How We Redeemed Our Points for Maximum Value

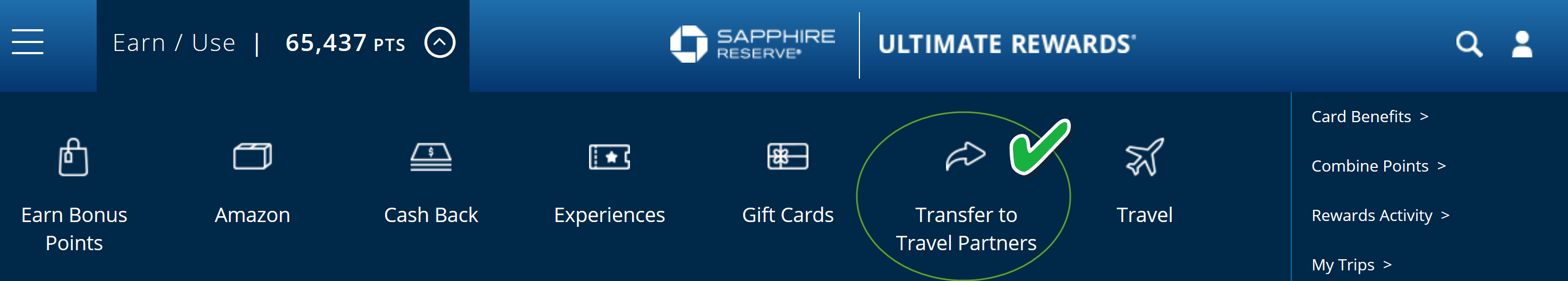

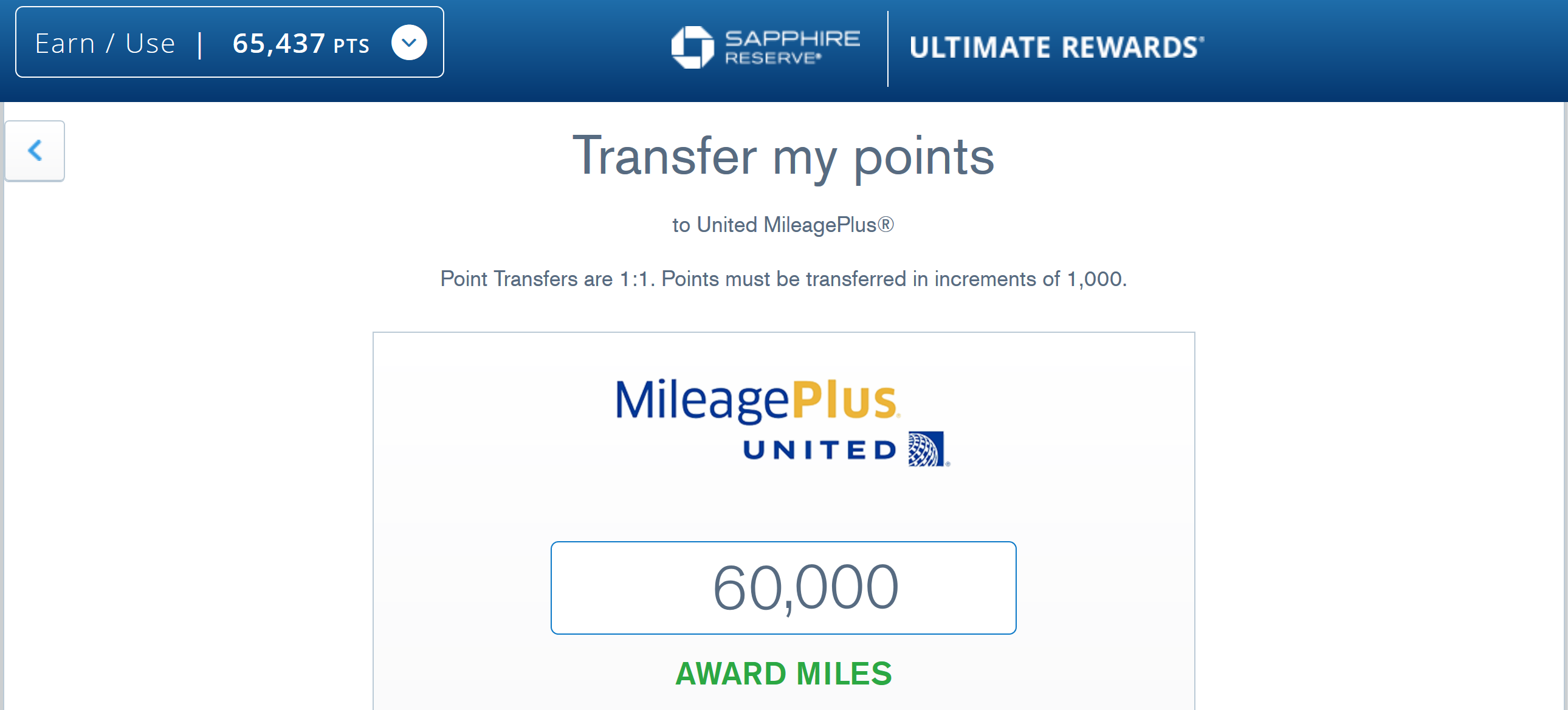

Now that we had a nice pool of Chase Ultimate Rewards points to work with, it was time to actually start booking our dream European vacation. As I mentioned earlier, flying from the US to Europe on United Airlines costs 30,000 miles one-way in coach. We were able to find a direct flight to Barcelona that worked for us, so I went ahead and transferred 60,000 Chase Ultimate Rewards points to my United Airlines account.

Transferring points from Chase to their travel partners is really easy. All you have to do is sign into your Chase account, chose the partner you’d like to transfer points to, enter your frequent flyer number, and Chase sends your points instantly.

Within minutes my 60,000 points were transferred from Chase to United Airlines and I booked our flights to Barcelona!

We then knew the end goal was flying home from Croatia so we searched for flights home leaving from various cities in Croatia. We finally settled on a flight home from Split, which would also cost 30,000 United Airlines miles. Because we had the Chase Ultimate Rewards points readily available, we again transferred points to United Airlines and booked our flight home.

Here’s a detailed post about how to use Chase Ultimate Rewards points for flights to Europe on Star Alliance airlines.

Once we had both legs of the trip planned, we knew we wanted to move around Europe and had always wanted to visit the south of France. We decided on Nice, which had cheap flights from Barcelona for about $70 (including baggage!) per person on Vueling.

I found the cheapest flights I could throughout Europe using Google Flights and because the flights were so inexpensive, it made more sense to just go ahead and book using my Chase Sapphire Reserve. I earn 3X Chase points for every $1 spent on travel, and pay no foreign transaction fees, so I was able to book my trips in Euros without having to worry about extra charges (while earning Chase Ultimate Rewards points).

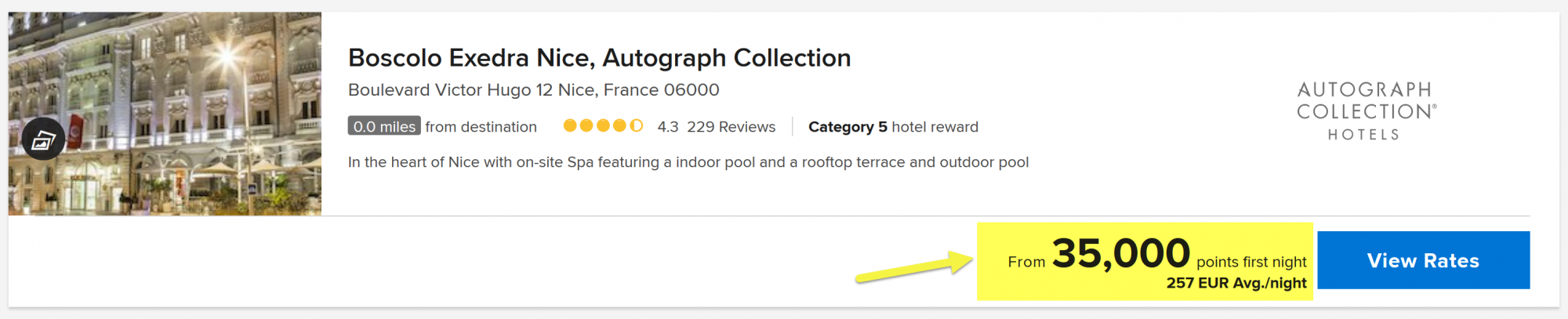

Knowing that Nice was probably going to be a bit on the pricey side, we wanted to see if we could use either Chase Ultimate Rewards points or Marriott points to book a hotel for 2 nights. We searched Marriott hotels in Nice and settled on the Boscolo Exedra Nice, part of Marriott’s Autograph Collection.

This hotel typically runs about $350+ per night in the summer, or you can book it for 35,000 Marriott points per night instead, which we did. If we didn’t have a pool of Marriott points, I would have tried to search the Chase Travel Portal, where I could redeem my Chase Ultimate Rewards points from the Chase Sapphire Reserve at a rate of 1.5 cents per point.

In the below example, I would have been able to book this stay in June 2019 for 19,600 Chase Ultimate Rewards points per night! That makes a lot more sense than transferring Chase Ultimate Rewards points to book an award room.

My wife used the points earned from her Marriott Rewards Premier Plus Credit Card to book our stay. We typically try to travel on a budget, but the Boscolo Exedra Nice was incredible, with it’s amazing marble lobby and rooftop pool – now that’s the kind of travel we can get used to!

Also, because of my wife’s silver elite status with Marriott, they offered to upgrade our room at no charge! We wound up with a balcony and a view of the city, and the best part was that our entire stay was free!

Finally, during our search for where to stay in Croatia, we realized most of the cities along the Dalmatian coast don’t really have any of the large hotel chains and the hotels were on the pricier side. So we turned to Airbnb, which was the best decision we made the entire trip.

We were able to stay in apartments that had full kitchens, plenty of room, washing machines so we could pack lighter, and balconies in Dubrovnik and Hvar that overlooked the Adriatic! The Airbnbs we stayed in never cost more than $120 per night, sometimes even cheaper than that! And the hosts were super friendly, offering to pick us up from the ferries and gave us great advice on what to see and where to eat!

The best part about booking with Airbnb is using one of my favorite perks of the Chase Sapphire Reserve – the $300 annual travel credit. Every cardmember year, Chase wipes away the first $300 worth of travel you purchase using your Reserve card. Stays with Airbnb count as travel, so I was able to book our Airbnb stays, of which $300 was erased as soon as the purchases posted to my card!

How Much Value Did I Get From My Points?

At the time, I didn’t realize just how much I was saving by booking my travels with miles and points. However, once we were able to book round-trip flights, 2 nights at a 4-star hotel, and $300 worth of Airbnb stays, all for nearly free, I wanted to see just how much we saved over paying for our travels with cash.

Here’s a summary of all the points we used and the value of those purchases if we had paid with cash instead of points. We saved over $3,800 on our trip thanks to top travel credit card rewards!

[table “487nbspresponsivescroll” not found /]Bottom Line

With just a little bit of planning ahead, I was able to generate a large stash of Chase Ultimate Rewards points which allowed us to book our dream European vacation.

Because Chase Ultimate Rewards points are so flexible, you can mix and match flights and hotels that suit your travel dates and style.

I love my Chase Sapphire Reserve®, which not only earned me 50,000 Ultimate Rewards points after I spent $4,000 on purchases in the first 3 months from account opening, but also allows me to earn 3X points per $1 on travel purchases. I was also able to erase $300 worth of Airbnb purchases as soon as they posted to my account thanks to the annual $300 travel credit.

The Chase Freedom® gave me a nice boost of 15,000 Chase Ultimate Rewards points after spending $500 on purchases in the first 3 months from account opening. I was also able to make the most of rotating spending categories throughout the year, earning me an additional 30,000 Chase Ultimate Rewards points!

My wife was able to use the Marriott Rewards® Premier Plus Credit Card for a big purchase we had coming up. This card has a welcome offer of 75,000 Marriott points after you spend $3,000 in purchases within the first 3 months from account opening, which we used to book a 2-night stay at a beautiful hotel in Nice, France for free!

Have you used miles and points to travel to Europe? We’d love to hear the best deals you’ve gotten and what cards you used to travel for free!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!