Horrendous Exchange Rates and Miserable Transaction Fees Can Kill Your Travel Budget! Here’s the Trick to Skipping Both

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

I remember when I experienced taxes for the first time. I came home with a check for 2 weeks of washing dishes. I expected to have a fat $170 in my pocket (40 hours X $4.25 minimum wage) and was more than disappointed to see I had much less than that.

Welcome to the real world!

It’s one thing to pay for for something when you know what the price is, but it’s a different emotional experience to unexpectedly have your money taken away. And I felt this sting on my first overseas trip when I realized the best currency exchange rate I found online, wasn’t the exchange rate I would have access to.

But there is a simple solution to avoiding extra fees and getting a better exchange rate at the same time when you’re traveling out of the country!

When you’re traveling overseas the first thing to consider is if your card charges a foreign transaction fee. These fees can easily be 3%, and erase the value of any rewards you earn.

Thankfully, there are lots of great cards that don’t have foreign transaction fees and will earn you travel rewards at the same time, like the Chase Sapphire Reserve®, Capital One® Venture® Rewards Credit Card, Citi Premier Card, and Premier Rewards Gold Card from American Express.

But foreign transaction fees aren’t the only hidden cost that can increase the price of your vacation. Criminally terrible exchange rates and extra ATM fees can quickly add up, making everything you purchase more expensive!

How I Save When I Need Cash Overseas

For over a decade now I’ve been using my Capital One 360 debit card to get cash from international ATMs. This card doesn’t charge foreign ATM withdrawal or exchange fees! Being able to get cash out of an ATM saves a lot compared to a currency exchange or bank. ATMs won’t charge an extra commission, and you’ll almost always get a much better exchange rate.

There is one catch to getting cash out of a foreign ATM. You’re often given the option of completing your transaction in your home bank’s currency (US dollars) or in the local currency (euros, yen, etc.) – always complete the transaction in the local currency!

When you choose to withdrawal in the local currency (or “without conversion”) your bank will make the currency exchange and you’ll get a better rate. If you choose to make the ATM transaction in your home bank’s currency (US dollars), the foreign bank or ATM will usually make the exchange using something called “Dynamic Currency Conversion (DCC).” DCC is a fancy way of saying “we’re going to charge you a bunch extra (up to 10%+) and you probably won’t even notice.” Hey, they gotta pay for that 2nd yacht somehow.

If you’re more a visual learner, this video does a good job of explaining why it’s better to make ATM withdrawals in the local currency.

I like my Capital One 360 debit card because I’m not hit with extra foreign ATM fees. And when you factor in the better exchange rate I get with an ATM withdrawal, the savings really add up!

Note: I’ve been successfully using my Capital One 360 to avoid extra fees for a while. But I’ve heard this deal only works if your account is completely online (no physical Capital One locations in your state). It seems that if you bank through a Capital One brick-and-mortar branch, you might be charged foreign withdrawal fees. I don’t have any experience with this, so if you do, please let me know.

Update: Reader RevNelson has a account at a brick and mortar Capital One bank and has never been charged additional ATM fees overseas with the Capital One 360 debit card!

The one place where my go-to debit card falls short is when the ATM charges a fee. If I’m using an out-of-network ATM, there is typically an extra fee of $3 to $5+, and Capital One does NOT reimburse you for these fees. However, there is a bank that does!

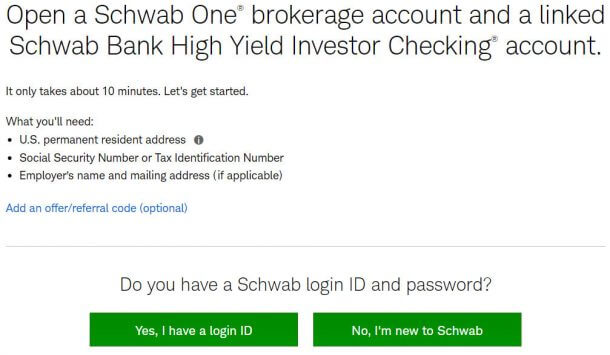

If you have a Charles Schwab High Yield Investor Checking account, you won’t be charged extra currency conversion fees for using an international ATM. And you’ll get reimbursed for all ATM fees at the end of every month. Even extra charges you incur at foreign out-of-network ATMs!

The biggest downside to opening this account is it will result in a hard credit inquiry. And you need to have a Charles Schwab brokerage account ($1,000 minimum opening deposit or $100 automatic monthly deposits required) to set up the checking account. But even with the extra hassle, a Charles Schwab account is probably going to save you the most.

I love having a bank account I only use for travel because I can transfer just the money I need for the trip into the account. This provides an extra layer of protection if I lose my debit card or if my information is stolen because they won’t have access to my main bank accounts. And it makes it easier to budget for the trip.

What’s your go-to debit card when you’re traveling abroad? Let me know why it’s your favorite and I’ll add it to the post!

Use a Card to Get the Best Exchange Rates on Purchases

When you use a credit or debit card to make purchases, you’ll also get a favorable exchange rate (compared to exchanging cash or traveler’s checks). But again, you’ll want to watch out for “Dynamic Currency Conversion.” Always be sure that the vendor is charging you in the local currency.

Also, depending on the country, you might be more likely to run into a situation where the local merchant charges you more if you’re paying with a credit card. So make sure you aren’t paying extra fees for those purchases.

It’s also important to be aware that different payment networks (Visa, Mastercard, etc.) will have different exchange rates. For big purchases or long trips, this can really add up.

Most folks agree that Mastercard will get you the best rates, in most cases. And that was the experience we had with test purchases we made in Canada. If you want to check the exchange rate you’ll get when using your card, Visa and Mastercard have currency conversion tools you can use.

I typically use a Mastercard or Visa when I’m traveling, because they seem to be much more widely accepted than AMEX or Discover.

Know the Country’s “Card Culture” Before You Go

While using a card overseas can save you cash in lots of ways, there is one big catch. You have to actually be able to use the card where you’re going!

I’ll be visiting Japan soon, and most folks report that US debit cards don’t work at all Japanese ATMs (although the ATMs at 7-11s and the post office seem to be the exception). So I might have to bite the bullet and bring a bit of cash to exchange the old fashioned way until I can find a suitable ATM.

What countries have you found to be particularly card friendly or unfriendly (other than North Korea)?

Bottom Line

When you’re traveling internationally, foreign transaction fees aren’t the only hidden cost you’ll want to watch out for. You’ll be able to save even more if you can ensure you’re getting the best exchange rate possible.

You’ll often get a much better exchange rate if you make your purchases with a credit or debit card. But for when you need cash, I suggest using a debit card that doesn’t charge extra fees to make withdrawals from foreign ATMs.

I use a Capital One 360 debit card. But you’ll probably be able to save even more if you can set up a checking account with Charles Schwab. Because Schwab will refund all ATM fees at the end of each month. Even those charged by out-of-network foreign ATMs!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!