Here’s How I Travel to Europe So Often: I Have the Chase Sapphire Preferred, Ink Cash, and Freedom

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

When I’m not gleefully burning through my Chase Ultimate Rewards points to travel to Europe, I’m earning more! But how?

I put as much of my everyday spending as I can on my Ink Business Cash℠ Credit Card, Chase Sapphire Preferred® Card, and Chase Freedom® credit cards. Then I use my points in 3 simple ways to enjoy Europe.

In recent years I’ve

- marveled at castles and architecture in Scotland

- lived like a local in Amsterdam taking trolleys and bicycles

- tasted delicious mussels in Brussels

- experienced Anthony Bourdain’s favorite seafood restaurant in Lisbon

- hiked fresh air forests in Finland

- feasted on pierogis and vodka with friends in Poland and seen mind-blowing historical sites

- drank and danced in youthful Tallinn, Estonia

to name a few!

With this simple strategy I can consistently:

- Get any flight I want at a 25% discount in the Chase travel portal. (If you know how to use Expedia you know how to use the Chase portal and the flight prices are the same.)

- Transfer my Chase Ultimate Rewards points to United Airlines to fly to and from Europe on quality partner airlines like Lufthansa, Air Canada, and more. This is how I flew Business Class round-trip in a bed with great food.

- If a Hyatt hotel has rooms for sale, I can book it by transferring my Chase Ultimate Rewards points to Hyatt’s program. It’s very easy.

I’ve had all 3 cards for many years. Only the Chase Sapphire Preferred has an annual fee but it’s totally worth it for all the free flights and hotels I’ve enjoyed. Also, Chase doesn’t charge you at all in your first year with the Chase Sapphire Preferred. So it’s a no-brainer to get the card and then decide if you want to keep your annual membership. Again, I’ve kept it for years.

Note: In order to get discounts in the Chase travel portal and be allowed to transfer your points to airline and hotel partners, you MUST have the Chase Sapphire Preferred, Ink Business Preferred℠ Credit Card, or Chase Sapphire Reserve®. For me, it’s Chase Sapphire Preferred because I’m comfortable with the reasonable annual fee and it fits in with my other travel credit cards.

Above: Paris, France! I loved my trip. It seems everywhere you look is another beautiful view.

How Do I Earn Chase Ultimate Rewards Points to Travel to Europe?

Well, I did greatly enjoy earning the awesome sign-up bonuses on these credit cards! But for me, that was a while back. I’ve kept these 3 credit cards open for YEARS and I keep earning more points.

Chase Sapphire Preferred: I use this credit card to earn 2X points at restaurants. Also, most bars and nightclubs code as restaurants in my experience. I put travel expenses on here too. And when I’m outside the US, I use the Chase Sapphire Preferred to avoid foreign transaction fees.

Example: This past summer I put European train travel, Airbnbs, and restaurants on my Chase Sapphire Preferred to earn 2X points on all of it.

Chase Ink Business Cash Credit Card: I use this card for nearly all my small business purchases in the US. For me, this is mainly 5X points, that’s right, FIVE points per dollar on my internet and cable bills and on purchases at office supply stores. And I use it for business meals to earn 2X points. Then I move all the points from my Ink Cash to my Chase Sapphire Preferred so I can transfer the points to airline and hotel loyalty programs.

Example: My decade-old office chair was literally tired of my ass. So I had to buy a new one. I went to Staples with my Ink Cash to earn 5X points AND to turn down their up-sell extended warranty. Because Ink Cash extends the warranty on many purchases like that just by using it!

Ink Cash Fine Print: Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year. Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year.

Chase Freedom: Every few months, Chase sticks an eye-popping 5X multiple on certain categories. All you have to do is click a link in your email when they remind you. And done, you’re registered. You now earn 5X points per $1 you spend in those categories up to a limit of earn 7,500 Chase points for the quarter.

7,500 points is worth $75 OR transfer those 7,500 points to your Chase Sapphire Preferred like I do. Flying from the US to Europe is only 30,000 United Airlines miles. And your 7,500 Chase points are worth 7,500 United Airlines miles. So you see how this quickly adds up to free flights!

With the Freedom card, you also earn 1 point on every other purchase, so it’s worth a spot in your wallet, or purse, or snazzy hip pack.

Example: Earlier this year, Freedom was rewarding gas station and supermarket purchases with 5X points. Those were good times.

Free Travel Is Easier Than You Think!

So what’s the catch? Pay all your bills in full and on time! Do NOT fall in the trap of paying interest. If you’re good with that, you’re ready to start!

Here are some screenshots so you can see this is really pretty simple:

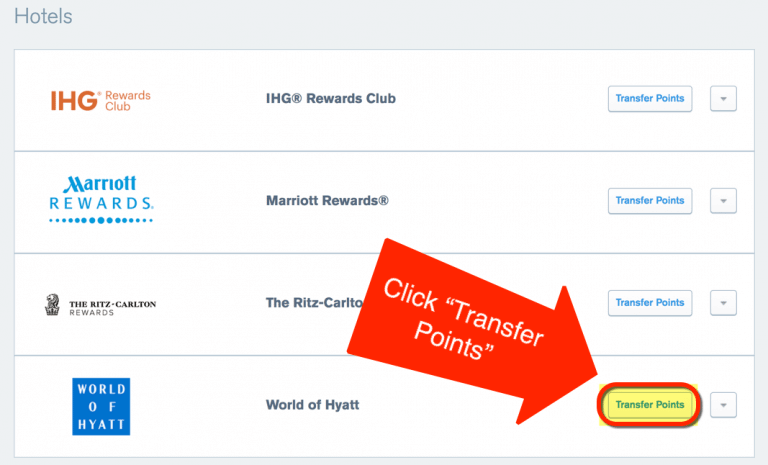

And here’s how quick it is to transfer Chase Ultimate Rewards points to airline and hotel programs:

Many of you have non-stop flights from an airport near you to major cities in Europe. But even if you’re in a smaller city, your connecting flight to a major US departure airport hub is included in the points price when you use United Airlines miles!

I’ve flown non-stop from New York – JFK to Europe. But I’ve also flown from South Florida connecting in Toronto and then flying onward to Europe. No difference in the points price.

United Airlines has lots of partners airlines you can fly to Europe. Personally, I’ve made European trips on partners Air Canada, Brussels Airlines, LOT Polish Airlines, Lufthansa, and TAP Portugal. It was affordable because of my stash of Chase Ultimate Rewards points!

It feels great to know that exploring medieval castles, indulging in delicious authentic food, and seeing the natural beauty of the “Old World” is all possible because of travel miles and points! At one time in my life I thought I’d never get to go back to Italy. I figured it was a once-in-a-lifetime experience. But I’m so grateful that I can use miles instead of money to go back again and again!

Bottom Line

Don’t miss out on Europe because of expensive flights and hotels! Use Chase Ultimate Rewards points to pay for them instead! I’ve had these 3 travel credit cards for years and years and I recommend them to my friends and family when they ask how to get to Europe:

Chase Sapphire Preferred: our #1 pick for beginners to using travel miles instead of money

Chase Ink Business Cash: if you have a small business, this is a great no annual fee card. You can apply with your social security number and list the business name as your name if you have no employees. That’s what I did.

Chase Freedom: The rotating 5X points categories are fun and profitable! It also has no annual fee so it’s a keeper.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!