Chase Ultimate Rewards Points: How to Tell If You’re Using Them The Wrong Way

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

We always tell you to spend your points in the way that makes you happiest. Don’t obsess over the value you’re receiving per point.

For example, you can redeem Chase Ultimate Rewards points for 1 cent each. If you open the Ink Business Preferred℠ Credit Card and want to redeem that 80,000-point sign-up bonus (after you $5,000 on purchases in the first three months) for $800 in cash, do it.

There are, however, some ridiculous and borderline offensive ways to redeem Chase Ultimate Rewards points.

If you’re new to collecting Chase points, we want you to make good decisions with them. As long as you stay away from these four redemptions, you’ll be alright.

Worst Ways to Use Chase Ultimate Rewards Points

Before we jump in, here’s a golden rule to follow: The lowest value you should redeem your Chase Ultimate Rewards points for is 1.25 cents each.

MMS values Chase points at 2 cents each, because we can consistently squeeze that value from our points by transferring to various Chase transfer partners, like United Airlines, Hyatt and Iberia.

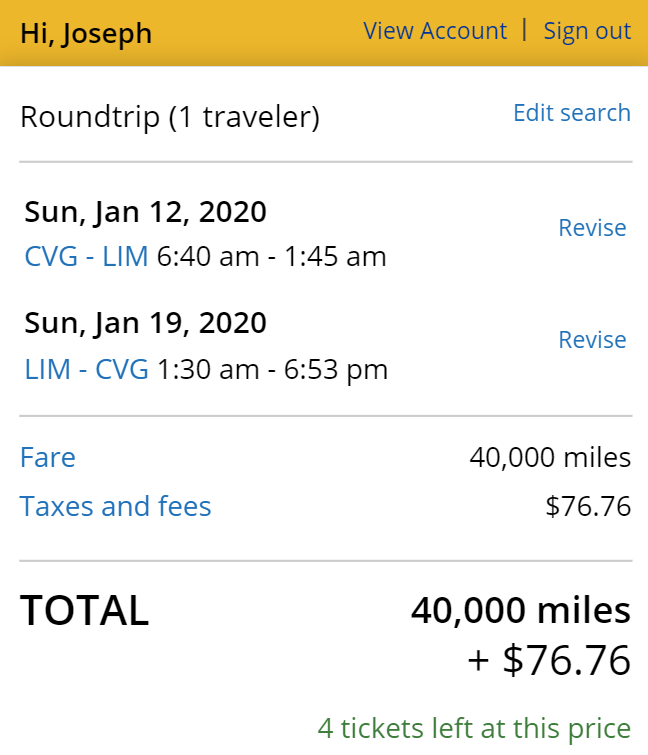

Quick example: A round-trip flight from my home airport to Peru costs 40,000 United Airlines miles and ~$77 in taxes. That same flight costs ~$900 cash, which means transferring 40,000 Chase points to United Airlines will save me $823 (a value of 2+ cents per point).

Further Reading: Chase Points Value

Using your points in this way is a bit more complicated than just redeeming them for cash, but it’s worth it. On the other hand, if your average redemption value is lower than 1.25 cents each, you may want to consider collecting a different kind of points or just switch to a cash-back card.

For instance, the Discover it® Miles comes with 1.5 miles per dollar (which you can redeem for 1.5% cash back). What’s more, Discover will match the miles you’ve earned at the end of your first cardmembership year. That means you’ll effectively receive 3 miles per dollar (3% cash back ) during your first 12 billing cycles.

Below are the absolute worst ways to use your Chase points. NEVER do them.

The information for the Discover it Miles card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Amazon

Amazon allows you to redeem points toward your purchases at checkout. As tempting as this may be, restrain yourself.

When you redeem Chase Ultimate Rewards points through Amazon, you’ll only receive a value of 0.8 cents per point. You’re better off just paying for your Amazon purchase with your Chase card and cashing out your points at 1 cent each to offset that charge.

IHG and Marriott

These are, hands down, the two worst Chase transfer partners.

True, it’s possible to receive 2+ cents per point from both of these programs — but it’s rare. You’re smarter to simply buy a whole hotel through the Chase portal instead of transfering Chase Ultimate Rewards points to IHG or Marriott.

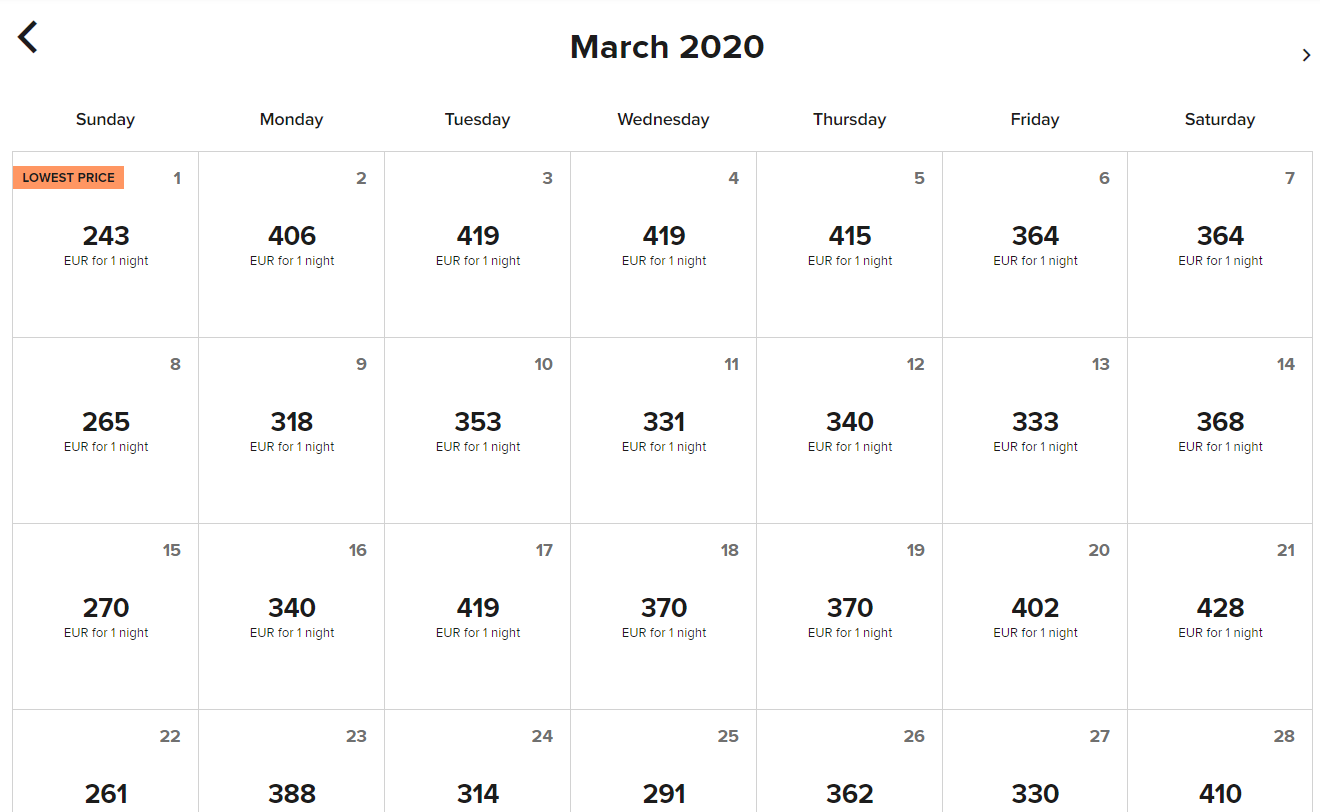

Example: The W Amsterdam costs 60,000 Marriott points per night. But you can reserve a room with cash for $460 (and often much less).

Here are your options for reserving a room:

- Transfer 60,000 Chase Ultimate Rewards points to Marriott

- Redeem 46,000 Chase Ultimate Rewards points for cash

- Chase Sapphire Preferred Card or Ink Business Preferred cardholders can book this room through the Chase portal for 36,800 points (points are worth 1.25 cents each through the portal)

- Chase Sapphire Reserve cardholders can book this room through the Chase portal for 30,666 points (points are worth 1.5 cents each through the portal)

Clearly the worst option is transferring points to Marriott.

Gift Cards

You can also redeem Chase points for gift cards at a value of 1 cent each. This is a bad idea because you won’t earn points on your spending.

If you buy a gift card to a restaurant, you’ll swipe the gift card to pay for your meal. Meanwhile, if you’ve got a card like the Chase Sapphire Preferred, Ink Business Preferred, or Chase Sapphire Reserve, you’d earn BONUS points on dining.

You’re better off swiping your card to earn points and redeeming your points for cash.

Note: Chase will occasionally sell gift cards at a discount (usually 10%), which can make this a slightly better deal. Still not recommended.

Apple Products

As with Amazon, Apple allows you to redeem your Chase Ultimate Rewards points through their store for 0.8 cents each. However, there’s a seemingly endless promotion that gives you a 25% bonus (equaling 1 cent per point).

Again, you won’t earn points when you redeem with this method, so you should just use your card for the purchase and redeem your points for cash later.

Boost Your Chase Points — But Remember These Rules!

There are tons of credit cards that can skyrocket your Chase points balance (particularly small-business cards). But remember three Chase rules when building your Chase-points-earning wallet arsenal:

- Chase 5/24 Rule – If you’ve opened five or more cards from ANY bank in the past 24 months (not counting certain small-business cards), you are ineligible for any Ultimate Rewards-earning credit card.

- Chase Sapphire Rule – You cannot hold more than one Sapphire card at a time. If you’ve got a Chase Sapphire Preferred, you aren’t eligible for a Chase Sapphire Reserve, and vice versa.

- If you’ve already received a bonus on a Chase Sapphire card, you can’t earn one again for 48 months.

Everyone on the MMS team has at least three cards that earn Chase Ultimate Rewards points. Let me know your thoughts. And subscribe to our newsletter for more miles and points do’s and don’ts like this.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!