Chase Fraud Protection to the Rescue: I Got a Text Alert That Tipped Me Off to a Naughty Authorized User

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

One of the things I love about Chase credit cards (and other top travel credit cards) is how proactive they are about alerting you when they notice unusual activity on your account. It’s a great protection from hackers. Most credit cards nowadays won’t hold you liable for fraudulent activity on your card, so it’s safer to use a credit card for purchases than using a debit card and having some creep drain your entire checking account balance!

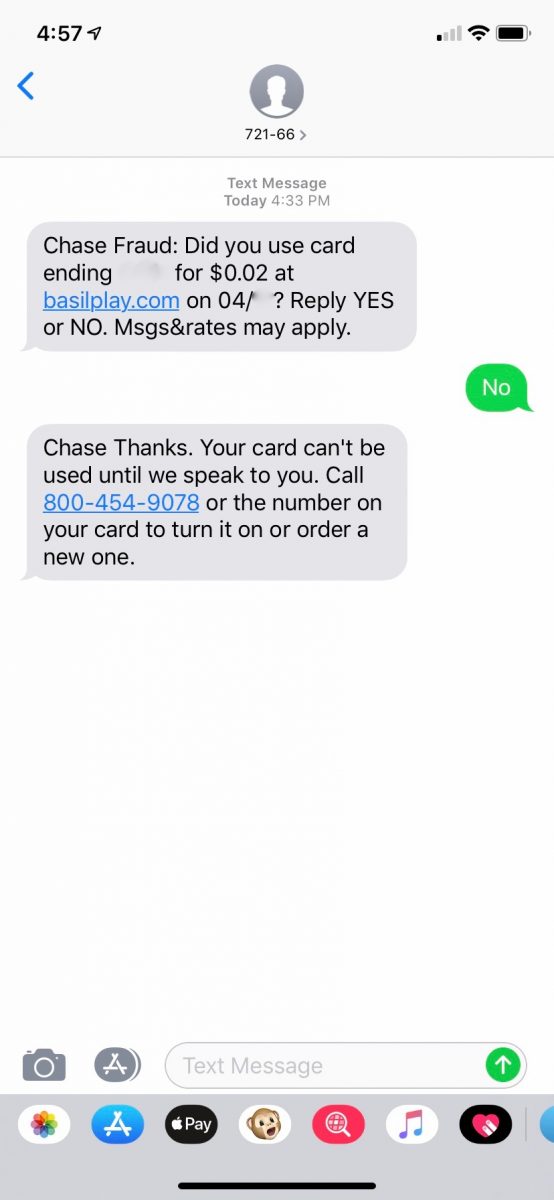

I’ve gotten text messages now and again from banks when they’ve seen suspicious purchases on my card. Most of the time, it’s been me buying something from a website or location that doesn’t match my usual spending habits. But this week, I got a Chase fraud protection text alert that I didn’t recognize.

I immediately went into defensive mode. But come to find out, one of my authorized users made a poor judgement call with their card … and thankfully, Chase had my back.

Here’s how Chase fraud protection text alerts saved the day.

A Chase Fraud Protection Text Alert Saved Me From Even More Charges

Parents, you might know this scenario: It was late afternoon and I was simultaneously making dinner, pestering my son to get into his gear for lacrosse practice, preparing my teenage daughter for a band concert, and wrapping up my editing and writing for the day. And then the fraud alert text message from Chase came to ask me about an unusual charge. Perfect timing, right?

I did a quick Google search for the merchant and discovered it was some sort of online gaming website. Immediately I confronted my 9-year-old son, knowing I’d used the same credit card to purchase extras for his Fortnite game on the XBOX. He was the likely culprit, or so I thought. I feel a little bad because I was quite hard on him – he said, almost through tears, “Mom! I’d never do something like that!“

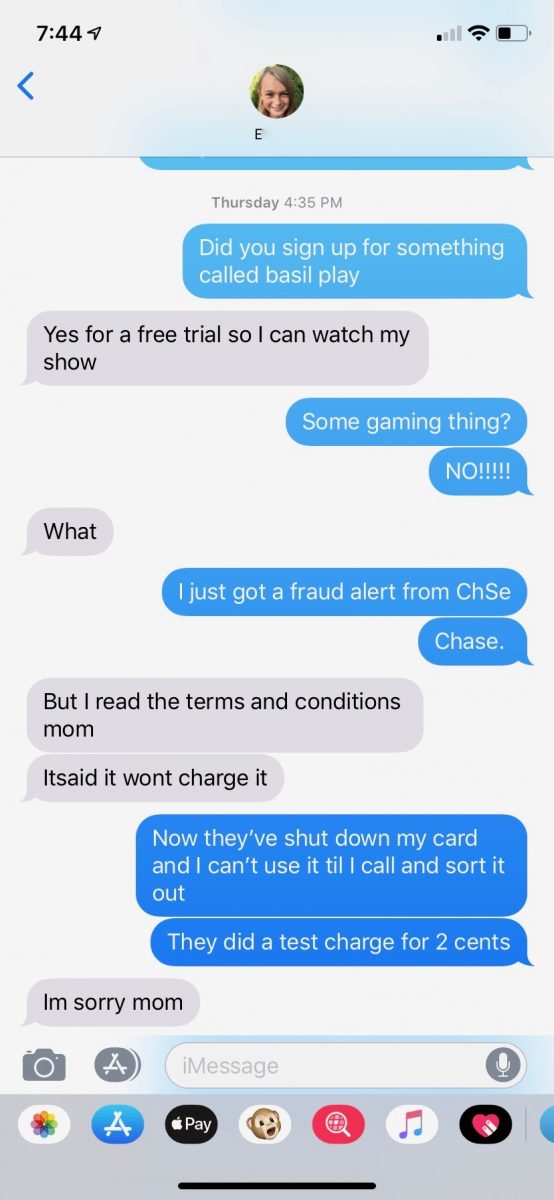

So then I texted my 12-year-old daughter (yes, sometimes I text instead of hollering up the stairs), and here’s how that went down:

Ugh! I’d added both my daughters as authorized users to my Chase Sapphire Preferred Card several years ago (which I’ve since downgraded to a Chase Freedom). It’s helping build their credit history, and it’s convenient for the times they go to the mall with pals or run down to the ice cream shop for a scoop. They’ve always been very responsible and careful with their cards, and have respected the spending limits I’ve given them.

So I was a little angry to discover my daughter had signed-up for some “free” website trial without asking me first. I had a very stern conversation with her (she was absolutely horrified and apologetic), and we immediately canceled her membership. Later, I sat all 3 kids down and reminded them that they never, EVER enter credit card information online without my permission / supervision, and to always ask before they use the card for real-life purchases, however small.

Meanwhile, Chase fraud protection called me before I could call them to reactivate the card. The representative was very understanding and immediately turned my account back on – no harm done.

But here’s the thing – if you add an authorized user to your credit card, YOU are responsible for any charges they make. You can’t turn around and say it was fraudulent – if they bought it, you bought it. If Chase hadn’t sent me a fraud protection text message, I likely wouldn’t have found out about my daughter’s foolish mistake until the free trial lapsed and they’d charged my card for a membership. THAT would have stunk.

So, thank you, Chase, for the catch! I’m grateful for Chase fraud protection (and how they know my spending habits well enough to pick up a charge like this) – not just for preventing an unwanted expense, but also giving me and the kids a teachable moment about credit card safety.

What about you? Have Chase fraud protection text alerts saved you from charges you didn’t make? Share your stories in the comments!

We want to hear from you! Thank you for being an MMS Reader. Please take this 1 minute survey so we can improve Million Mile Secrets and provide more valuable content for our readers.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!