Why Capital One miles are better than Chase Points for (nearly) all hotel stays

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Absurd as it may sound if you’ve been in the points game for a while, Capital One miles can make a lot more sense than Chase Ultimate Rewards points.

A perfect example is paid hotel stays — for multiple reasons. Yes, Capital One miles are even better than booking via the Chase Travel Portal, despite being worth less. We estimate Chase points value to be 2 cents each, on average. That’s double the average Capital One miles value.

The current best option for earning Capital One miles in a hurry is the Capital One Venture Rewards Credit Card. I have the card, and I’ve used the bonus for fun stays in a tree house Airbnb, as well as a castle near Galway.

Use Capital One miles instead of Chase points for paid hotel stays

Here’s a simple summary: When you book with Capital One miles, you get all the benefits of booking directly with the hotel. When you book through the Chase Travel Portal with points you earn from cards like the Chase Sapphire Preferred® Card, you don’t. That’s because the Chase Travel Portal is powered by Expedia, so you’re essentially using your points to book through Expedia.

When you book directly with the hotel, you’ll get the following benefits:

You’ll probably get a better room

Hotels like when you book directly with them. They can see who booked through a third party and who booked direct, and they prioritize folks who come straight to them. This is not a rule, but it does happen.

For example, if a hotel is filling up, travelers who book direct will get all the preferred rooms before anyone who booked third party. I’ve experienced this a few times before. While in Ireland, I booked a night at Clontarf Castle through Expedia. Upon arriving, the room was far more cramped than the pictures I’d seen. I looked at the floor plan on the back of my door, and I literally had the smallest room in the hotel. Laying on the bed felt like getting a CT scan.

In fairness, I can’t prove the reason I was given that room, but I strongly suspect they save it for third party bookings.

You earn hotel points

When you book with an online travel agency like Orbitz or Expedia, you won’t earn any hotel rewards. So if you’re staying at a chain hotel like Marriott, Hilton, or Hyatt, you won’t earn points that you can redeem later for free nights! Only travelers that book directly with the hotel will earn points.

You earn elite night credits

Booking third party will not earn you elite night credits. If you desire hotel elite status, booking through a third party is the worst thing you can do.

You receive elite status benefits

If you already have elite status, you won’t receive any of your status benefits unless you book directly with the hotel. For example, if you have Gold elite Hilton status, you’ll receive the following benefits just for booking direct:

- 80% bonus points

- Potential upgrade to Executive room type

- Complimentary breakfast at all hotels

If you book through Expedia, you’ll get none of that.

Reservation changes are much easier

Need to change or cancel your reservation? You’ll have a much easier time if you book direct with the hotel. You (usually) can’t call the hotel to make any changes to your reservation if you reserved your room third party. You’ll have to contact the website from which you made your purchase, and they’ll liaise with the hotel. It can be a nightmare.

If you simply book with the hotel, you can contact them for an immediate solution to your problem.

Capital One miles are usually a better deal than transferring Chase Ultimate Rewards points to hotels

There is a way to use Chase Ultimate Rewards points to book directly with certain hotels: Transfer your points.

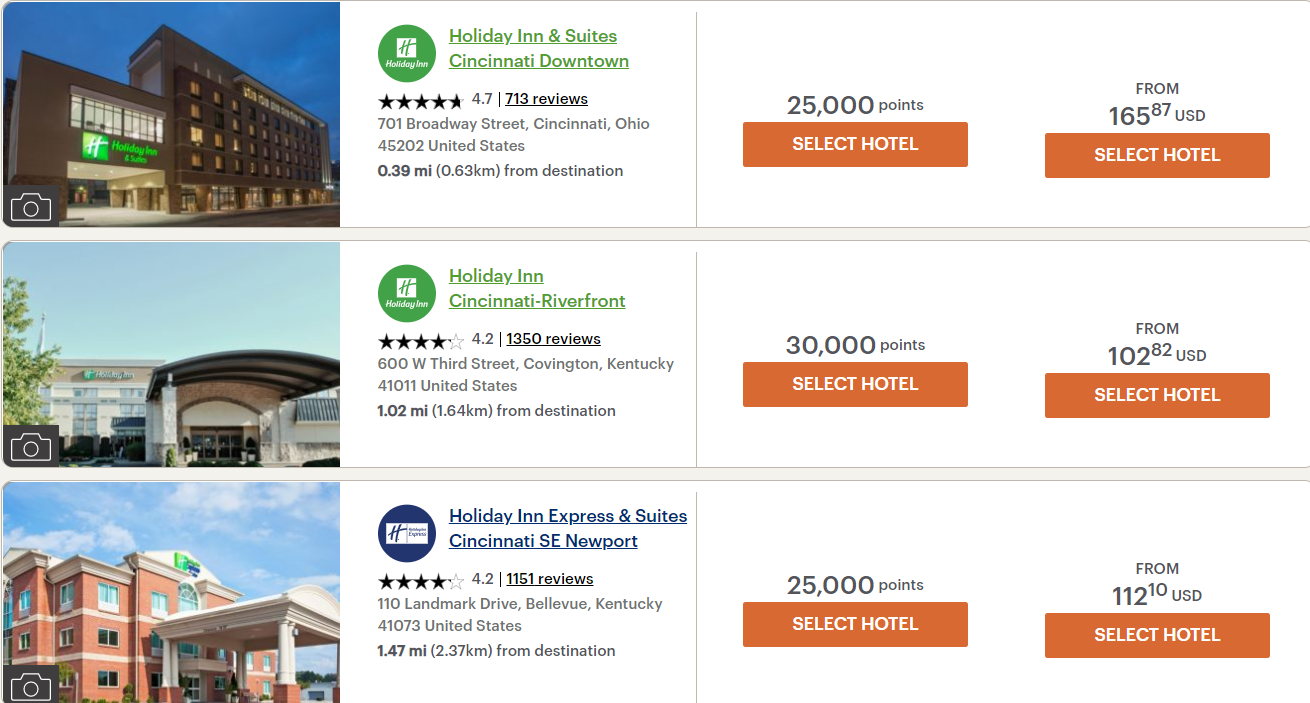

It’s important to understand that, with the exception of Hyatt, it’s usually a bad idea to transfer Chase points to hotel partners, namely Marriott and IHG. You’ll often receive a value below 1 cent per point with these currencies. For example, here are both the cash and the points prices for IHG hotels in my area.

As you can see, you’ll spend significantly more Chase Ultimate Rewards points than you would Capital One miles for all these hotels. In the middle example, you’ll pay ~10,300 Capital One miles for the room, or 30,000 Chase points (transferred to IHG) for the same room.

Chase Ultimate Rewards points are great for TONS of things. But in the hotel department, I’d only recommend you use them exclusively for Hyatt stays. Better to redeem Capital One miles for everything else.

You can read our post on the best ways to use Capital One miles — and let me know your favorite card to receive free hotel nights.

Also subscribe to our newsletter for more miles and points analysis delivered to your inbox once per day.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!