Can the New Ink App Help You Manage Business Finances?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

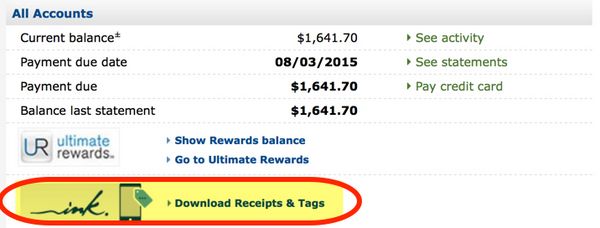

Did you know the Chase Ink cards have their own app?

With the new Ink app for iPhone and Android you can organize receipts and track employee purchases right from your cell phone. And it’s free!

Let’s take a look at how it might help you keep your business finances in check!

What’s the Ink App?

Link: Chase Ink App for iPhone

Link: Chase Ink App for Android

You can use the new Ink app with the Chase Ink Bold (no longer available), Ink Business Cash Credit Card, and Ink Plus cards.

With the app you can:

1. Save Receipts

After you make a purchase, you can take a photo of the receipt with your smartphone and add it to the transaction listed on the app.

Select an image of your receipt saved to your phone or take a photo.

This will help you track receipts for employee reimbursement, taxes, and more.

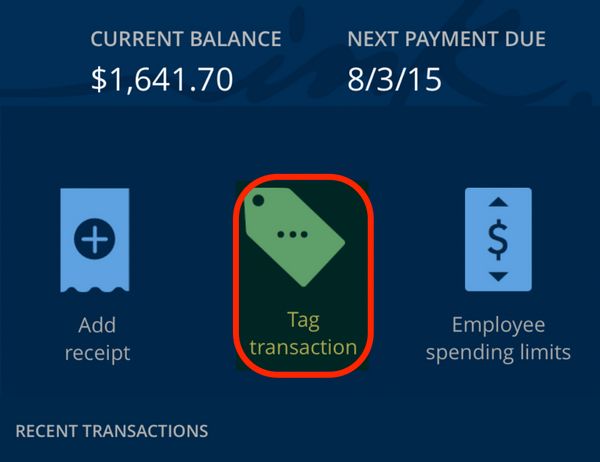

2. Tag Purchases

You can also organize expenses by categories you choose, so you can quickly find them later.

You can set a single tag for each transaction or divide it with several tags.

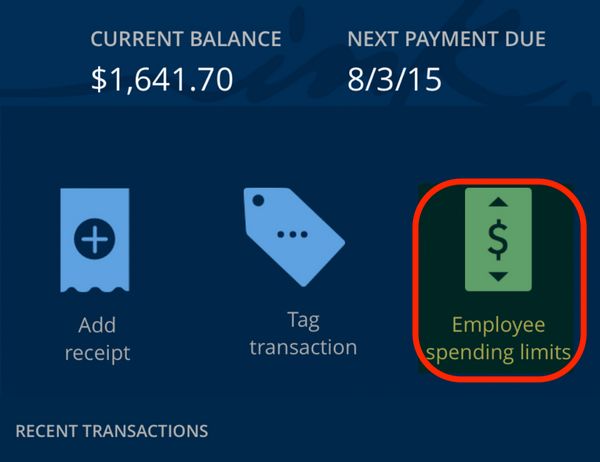

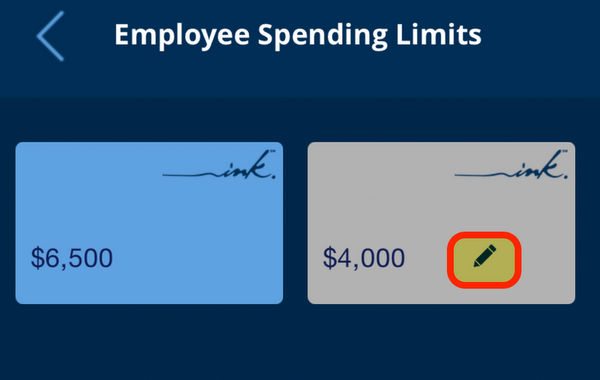

3. Limit Employee Spending

Worried about your employees getting carried away with the company card? You can adjust their spending limit right from your mobile device.

Click “Employee spending limits.” Then select the pencil and enter the new limit.

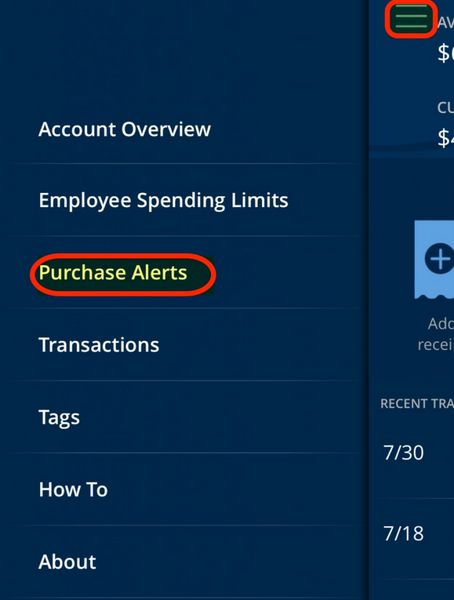

4. Receive Purchase Alerts

You can also set the Ink app to send you alerts when there’s a new purchase on the cards in your account. To activate the alerts, click the menu at the top of the main page.

Move the sliders to the right to turn on purchase alerts.

Sounds Great, Right!? But…

While the Ink app has some great features, there are still glitches and functions I think it’s missing.

When I was testing it I received messages saying the app couldn’t connect to Chase. And it crashed several times. Also, I was looking forward to trying the purchase alerts, but I was never able to get it to work.

Also, the Ink app only holds transactions for the last 60 days. So this app won’t work for folks looking to organize their yearly or even quarterly expenses at once.

And it would be nice if the app automatically synced to my online account.

More importantly, I’m still hoping Chase gives us the ability to easily track bonus category purchases with the Ink Cards the way we can with the Chase Sapphire Preferred.

The 5X Chase Ultimate Rewards points you earn in certain categories with the Chase Ink cards have a spending limit ($25,000 per card year for the Chase Ink Cash and $50,000 per card year for the Chase Ink Bold and Chase Ink Plus).

So it would be great to quickly check which purchases earned 5X points and how close you are to the spending limit.

As it stands, you’ll have to assign tags and do the math!

Should You Use the Ink App?

The Ink app is free for iPhone and Android, so it doesn’t hurt to upload it to your smartphone and check it out for yourself.

This app may work for folks who want to quickly save receipts and set spending limits on employee cards from their phone.

But otherwise, you may want to wait to see if Chase can remove the glitches and add other important features.

Bottom Line

The Ink app for the Chase Ink Bold (no longer available), Chase Ink Cash, and Chase Ink Plus is available for free on iPhone and Android.

The app tracks your business expenses by helping you save your receipts, set tags to organize transactions, limit employee spending, and send alerts when purchases are made using a card on your account.

But the app still has glitches. Some features, like the purchase alerts, didn’t work at all for me. And there are functions I think it’s missing, such as the ability to easily track your 5X Chase Ultimate Rewards points bonus category spending.

That said, the app is free, so it might be worth seeing if it’s useful for your business.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!