5 Ways To Use the Annual $325 Travel Credit With the US Bank Altitude Reserve Card – One of the Best Travel Credit Card Perks!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

In my opinion, the U.S. Bank Altitude™ Reserve Visa Infinite® Card is an underdog in the conversation of the best travel credit cards.

Many people overlook this card because of the restriction of needing an exisiting relationship with US Bank (such as a credit card or checking account). But it’s not difficult to establish yourself with US Bank, and it’s well worth the opportunity to open this card.

It does come with a $400 annual fee. But it also comes with a humongous $325 annual travel credit. So just how easy is this travel credit to redeem, and what exactly can you use it for?

Here are 5 ways to use $325 in travel credits from the U.S. Bank Altitude Reserve Credit Card.

Ways to Use the US Bank Altitude Reserve $325 Travel Credit – One of the Best Travel Credit Cards

When you use your U.S. Bank Altitude Reserve Credit Card for an eligible travel purchase, you’ll automatically be reimbursed, up to a total of $325 per cardmember year.

In the terms and conditions, US Bank says the costs that will trigger the $325 annual travel credit are as follows:

- Airlines

- Hotels

- Car rentals

- Taxis

- Limousines

- Passenger Trains

- Cruises

However, there are other things you can use it on that aren’t explicitly listed in the above categories…

1. Uber/Lyft

While taxis are listed as a category, it is rare for someone to say “I prefer taxis over Uber and Lyft.” It is confirmed that you are able to use the $325 in credits on either platform.

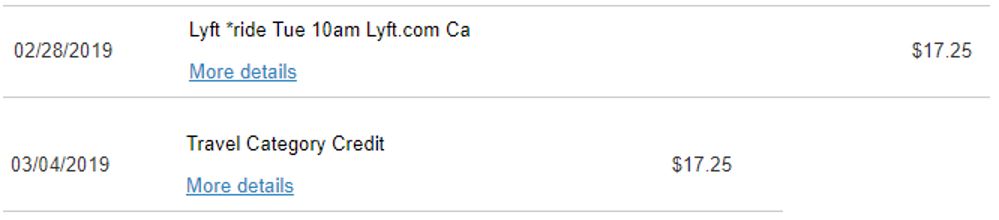

Here is what the credit will look like on your online statement.

2. Airbnb

Data points show that Airbnb triggers the $325 credit, and I am ecstatic about this! Sometimes, paying cash or points for a hotel just doesn’t make sense due to high prices. In addition, I find Airbnb a better option for long term travel, including business travel.

3. Turo

If you’re looking for alternatives to traditional car rentals, consider using car-sharing platforms like Turo. There have been reports online of this working to trigger the $325 travel credit.

I have yet to use Turo myself, but Keith had a great experience with renting from Turo. Joseph also used the service during his Thanksgiving travels and loved it.

If driving someone else’s car doesn’t appeal to you, remember the credit also activates for rental car agencies.

4. Public Transportation

Simply trying to save on your own public transportation in your home city? Looking to use your credit during your travels for a more local experience? Go on, then! I take the train to and from work every day in Salt Lake City and the credit has reimbursed me for my train pass.

5. In-Flight Purchases

Whether it be an on-board meal, snack, or a top-shelf cocktail, in-flight purchases will trigger the $325 credit.

Bottom Line

The $325 US Bank Altitude Reserve travel credit is largely overlooked because of the $400 annual fee and the required relationship with US Bank. However, it is one of the best deals in the credit card space today, and I’m incredibly excited to continue using this card!

Let me know if you have any tips for using the US Bank Altitude Reserve welcome bonus. And subscribe to our newsletter for more travel tips!

[gravityform id=”3″ title=”false” description=”false”]Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!