Can You Transfer Chase Ultimate Rewards Points to a Spouse?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader, Soosie, commented:

Can you please tell me if it is possible to transfer Chase Ultimate Rewards points directly (not to airline/hotel program) from spouse to spouse? Thanks!

Great question, Soosie!

It is possible to directly transfer Chase Ultimate Rewards points to your spouse. This is great news for folks who want to combine points to book award travel.But Chase has different rules for transfers depending if you have a personal or small business card.

I’ll explain the rules for transferring Chase Ultimate Rewards points to someone else!

Transfer Chase Ultimate Rewards Points to Spouse

Link: New Rules for Transferring Chase Ultimate Rewards Points

Chase allows folks to transfer Chase Ultimate Rewards points directly to someone else. But the rules are different if you have a personal or small business card.

For personal cards, like the Freedom, Freedom Unlimited, Chase Sapphire Preferred Card, and Sapphire Reserve, Chase says:

You can move your points, but only to another Chase card with Ultimate Rewards belonging to you, or one member of your household.

The rules are slightly different for small business cards like the Ink Business Preferred Credit Card, Ink Cash, and Ink Plus (no longer available). Chase says:

You can move your points, but only to another Chase card with Ultimate Rewards belonging to you, one member of your household, or your joint business owner, as applicable.

So the main difference with small business cards is you have an added option to transfer Chase Ultimate Rewards points directly to joint business owners who do NOT reside in your household.

And Chase has different rules for folks who’d like to transfer Chase Ultimate Rewards points to someone else’s airline or hotel loyalty account. This person has to live in your household AND be an authorized user on your account.

Keep in mind, Chase has strict language for folks who try to workaround their rules. If they suspect you’re moving points against their policies, the bank can prohibit you from earning points or using points you’ve already earned. They can even close ALL of your credit card accounts and take your points away.

So it’s NOT worth trying to get creative to move points just to risk losing them all!

If you’re eligible, here are the steps to transfer Chase Ultimate Rewards points directly to someone else.

Step 1. Log-In to Chase Ultimate Rewards Account

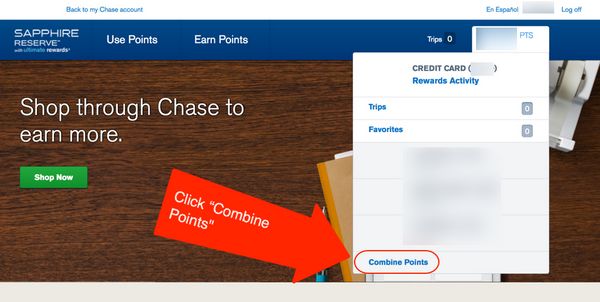

First, log-in to your Chase Ultimate Rewards account. Then, click on your points total in the top right corner of the screen and you’ll see a drop down menu. Click “Combine Points“.

Step 2. Add Household Member

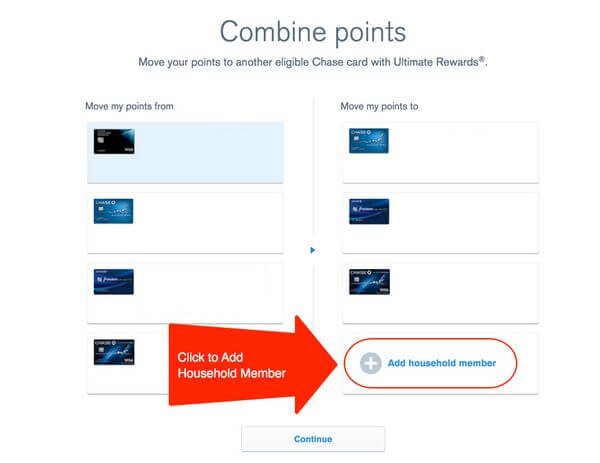

Next, instead of combining Chase Ultimate Rewards points with one of your existing cards, you’ll see an option to “Add Household Member“.

You can only have 1 household member (or joint business owner on small business cards) added at a time. So you can’t link multiple family members or roommates’ accounts.

Note: If you have a small business card, at this step you’ll see the option to add a joint business owner who does not reside in your household.Step 3. Add Account Information

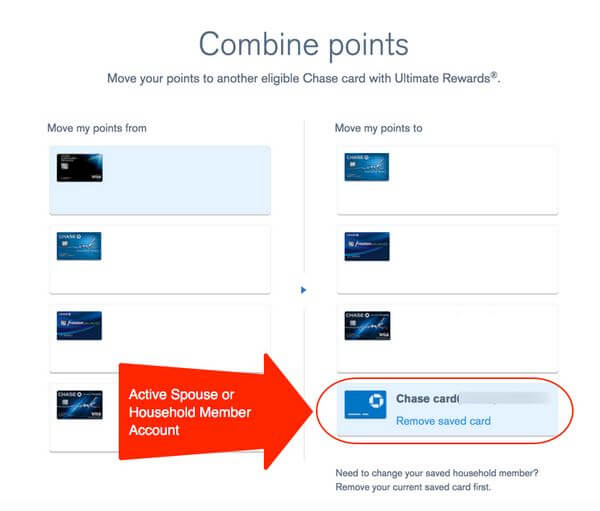

Now, you can enter the card number and last name of the person you’d like to add.

Remember, if it’s a personal card this person must live in the same household to be eligible to transfer points.

If it’s a small business card, you can add an authorized user who doesn’t live with you.

Step 4. Link Accounts

You’ll see your other household member’s account on the combine points screen when you’re logged in to your Chase Ultimate Rewards account.

This means you’re now able to transfer points directly!

Step 5. Transfer Points!

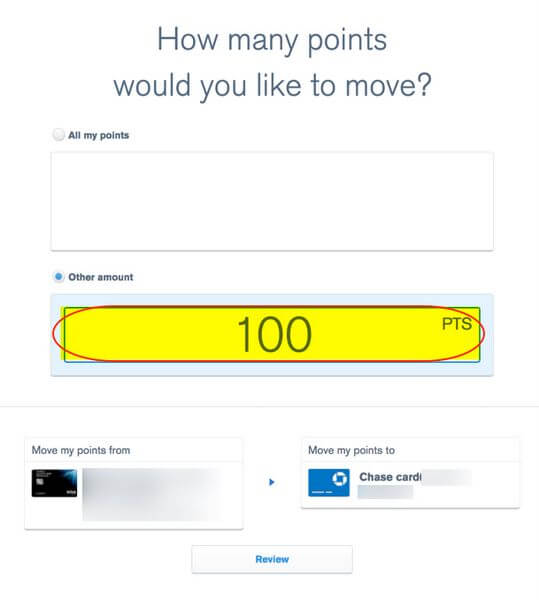

To transfer points directly to your spouse, enter the number of points you’d like to transfer.

Then, review and submit your transfer.

The points will instantly appear in your spouse’s account!

Bottom Line

You can directly transfer Chase Ultimate Rewards points to someone else.

But the person must live in your same household AND have a Chase Ultimate Rewards credit card if you’re transferring points from a personal card like the Sapphire Reserve. Or they can be a joint business owner who does not live in your household if you’re transferring points from a small business card like the Ink Business Preferred.

Remember, Chase has strict rules to prevent folks from transferring points to other people who do not meet the criteria. So changing an address on an account as a workaround is NOT worth the risk of losing all your points!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!