How to Use Plastiq to Pay Bills That Don’t Accept Cards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Did you know you can use your credit card to pay most of your bills, including your mortgage, rent, or car payment, even if they don’t accept credit cards?

Plastiq will send a check to the business you want to pay for a 2.5% fee. You can even pay an individual!

However, it’s not always worth it because of the fee. I’ll help you decide when it could make sense for you!

Should You Use Plastiq to Pay Bills?

Link: Plastiq

With Plastiq, you can pay nearly any bill, including small businesses or individuals, with a Visa, MasterCard or AMEX credit card for a flat 2.5% fee.

Plastiq sends an electronic or paper check on your behalf. So you can pay nearly any bill with a credit card. Even if the business doesn’t accept credit cards!

This service can be useful to meet minimum spending requirements to earn the sign-up bonus on a new credit card. Or to meet a spending threshold to earn elite status with an airline, including Delta, or with a hotel chain.

For example, if you make a $1,000 payment through Plastiq, you’ll pay a $25 fee, for a total of $1,025. If you’re close to earning a sign-up bonus, or earning elite status, it could be worth it to pay $25 for thousands of miles or points. Or elite status for another year!

But if you’ll earn 2% cash back, or 1 mile or point per $1 spent, it usually isn’t worth it to pay the 2.5% fee.

As always, run the numbers to make sure it’s a good deal for you!

My Plastiq Review

Back when Plastiq started, some folks complained of late payments or other issues with the service.

But I think they’ve come a long way! Million Mile Secrets team member Harlan reports timely payments with Plastiq for the past 6 months. With no issues at all!

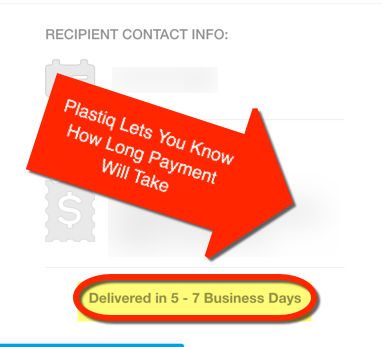

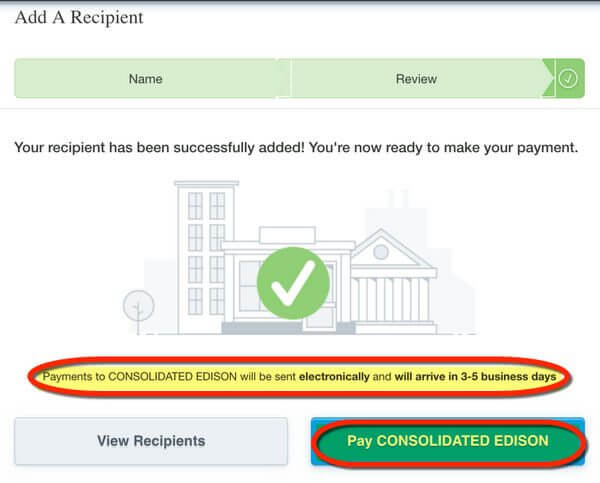

That said, it can take 3 to 6 business days for Plastiq to deliver an electronic payment to a popular payee. Most big companies, like utilities, student loan servicers, or mortgage lenders are set-up for electronic payments.

And it can take 5 to 7 business days for an individual or small business to receive payment. Because Plastiq will send them a paper check.

So always factor that in and send your payments at least 6 or 7 business days before they’re due. That way if there’s an issue, you’ll still have some time to correct it.

And if you’re charged a fee because of a late payment, you can take advantage of Plastiq’s Delivery Guarantee to get reimbursement.

But if you plan ahead, it can be a smooth experience. And help you earn miles, points, or elite status!

How to Pay Bills With Plastiq

Let’s look at how to make a payment.

Step 1. Create an Account or Log-In

Navigate to the Plastiq website. Add your name, email, phone number, and a password if you’re new. Then click “Get Started.”

Or select “Sign In” if you already have an account.

Step 2 – Add a Payee

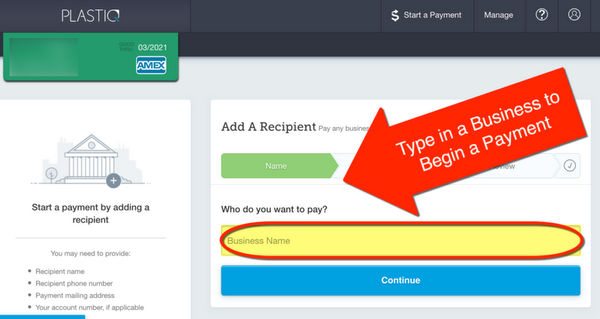

After you make an account, you’ll see this screen:

So you can make a payment right away. Type who you want to pay and click “Continue.”

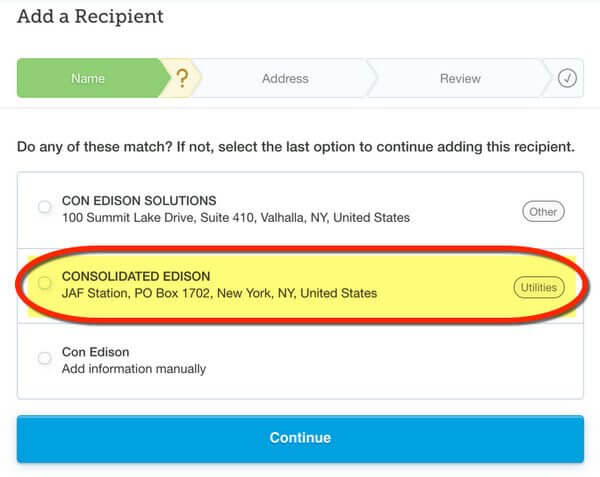

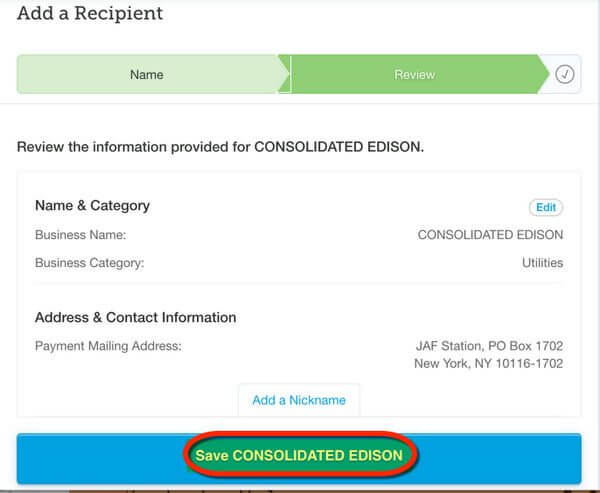

I searched for utility company Con Edison, which was already in Plastiq’s database. If your business isn’t listed, you can always add them manually.

After you choose an option, click “Continue.”

If the address and other information match your usual bill, click “Save” to add the payee.

You’ll see how your payment will be sent (electronically or through the mail) and how long it will take for it to arrive.

Choose “Pay” if you’re ready to send a payment.

Step 3 – Make a Payment

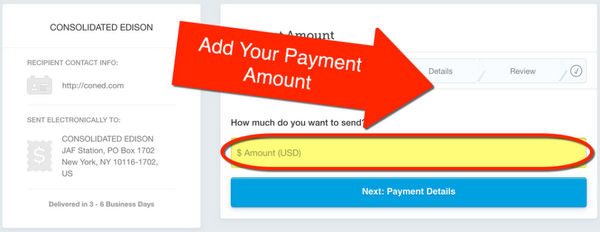

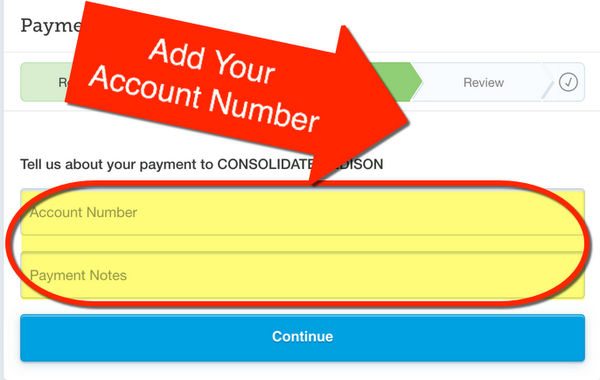

You’ll need to enter payment details, including how much you want to send and your account number.

Click “Next” to move through the steps.

Add your account number so it’s credited to the right place.

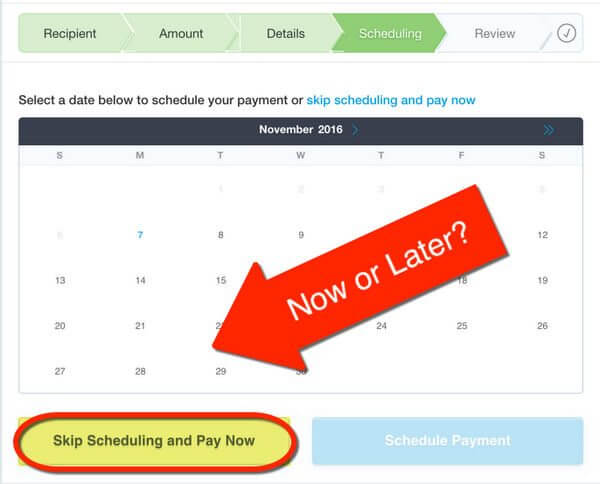

Next, you can select to pay now or add a delivery date. I really like this feature to plan payments in advance!

Then, you can send your payment. And on this page, you can add your credit card if you haven’t already.

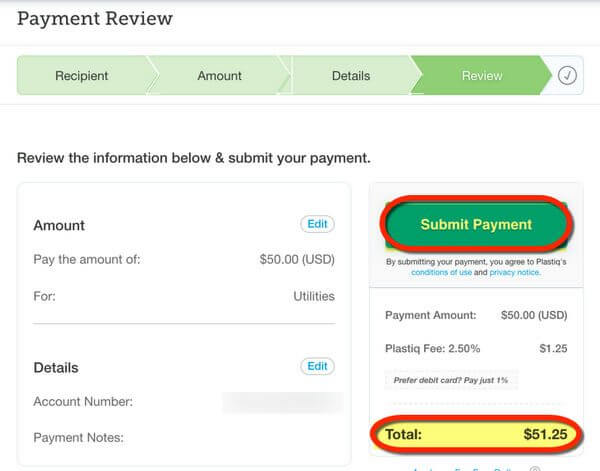

Review the information to make sure it’s accurate. Note the total amount includes Plastiq’s 2.5% fee.

If everything is correct, click “Submit Payment” to charge your card and send the payment.

And that’s it!

Watch Your Account for Credit

After you’ve sent a payment, it’s a good idea to keep an eye on your account to be sure it posts. Team member Harlan say he hasn’t had any issues using Plastiq service. But it’s a good idea to make sure the payment clears.

You may also want to pay a couple of days early. So just in case there’s a problem, you have time to fix it before you’re charged a late fee!

Bottom Line

Using Plastiq to pay bills with a credit card can be an easy way to meet minimum spending requirements or earn elite status with your favorite airline or hotel chain.Keep in mind you’ll pay a flat 2.5% fee. And you can use a Visa, MasterCard, or AMEX card for payments.

I wouldn’t recommend Plastiq for everyday payments because of the fee. But if it’s the difference between earning a big sign-up bonus or not, it can be worth it on occasion.

Let me know your experience with Plastiq!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!