How Do Barclaycard Arrival Miles Redemptions Work?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets Reader, mmt, commented:

Please comment on the redemption “gotchas” for the Barclaycard Arrival Plus. Must the credit be in exact $100 multiples? Can you combine line items on the card statement to reach the $100 minimum? Can you have multiple $100 items on the same statement credited?

There are a lot of questions surrounding the miles you earn with the Barclaycard Arrival Plus. That’s because the card is currently offering the highest bonus it’s ever had!

Let’s take a look at these miles, so you can decide whether the Barclaycard Arrival cards are right for you.

Everything You Need to Know About Barclaycard Arrival Miles

Link: Barclaycard Arrival Plus World Elite Mastercard

The Barclaycard Arrival Plus currently comes with a sign-up bonus of 50,000 Barclaycard Arrival miles after spending $3,000 on purchases in the first 90 days of opening your account. That’s worth $525 when you redeem them toward travel purchases!

You’ll also get:

- 2 Barclaycard Arrival miles per $1 you spend on all purchases

- No foreign transaction fees

- Chip-and-PIN capability (handy when traveling overseas)

The $89 annual fee is waived the first year.

Barclaycard Arrival “Miles” Aren’t Exactly Miles

The Barclaycard Arrival Plus and Barclaycard Arrival earn miles that are different from cards like the Chase Sapphire Preferred or Citi Prestige. You can NOT transfer your miles to other airline and hotel partners.

Barclaycard Arrival miles are also different than frequent flyer miles. They have a fixed value of 1 cent per mile when you redeem them for travel purchases.

Redeeming Barclaycard Arrival Miles

Folks like Barclaycard Arrival miles because they offer a lot of flexibility. You can redeem miles for travel costs, like Airbnb stays, taxi rides, and flights with NO blackout dates.

If you want to use your Barclaycard Arrival miles, book your travel as you would with any credit card, and then erase the purchase once it’s posted in your transaction history online. You must redeem the miles within 120 days of your travel purchase.

Note: You can redeem for other things, like gift cards, but your value per mile drops to .5 cents, which is NOT a good deal.Barclaycard Arrival Cards Have Different Redemption Minimums

In order to redeem your Barclaycard Arrival miles, you will need to:

- Have a certain amount of miles in your account

- Redeem for a travel purchase greater than or equal to the value of those miles

If you have the Barclaycard Arrival Plus, you will need to redeem at least 10,000 miles ($100) at a time. The redemptions don’t need to me in multiples of $100.

So you’ll be able to use your miles towards your $150 hotel stay, but not towards your $48 Uber ride.

You can use your miles for as many travel purchases on each statement as you want (provided you have enough miles, of course!).

As long as your travel purchase is over $100, you can use miles for the exact amount of the transaction. So if you spend $121 on a rental car, you can use 12,100 to cover the cost.

You can also use points for different travel transactions as long as they are over $100 each.

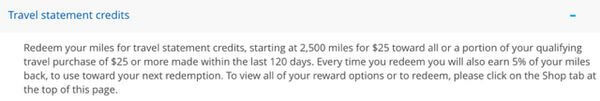

If you have the Barclaycard Arrival, you must have at least 2,500 in your account. This means the miles of the no-annual-fee Barclaycard Arrival are more flexible, because you can use them for smaller purchases!

Barclaycard Arrival Cards Earn Miles at Different Rates

The Barclaycard Arrival Plus and Barclaycard Arrival earn rewards at different rates.

The Barclaycard Arrival Plus earns an effective 2.1% back on all purchases, while the Barclaycard Arrival earns an effective 2.1% back on travel and dining only, and 1.05% back on everything else.

Keep Your Miles Without Paying an Annual Fee

Reader Shaan asked a question many folks might not think about! Will the miles expire as soon as you cancel the card, and can you keep them active with the no-annual-fee card?

Your miles will expire as soon as you cancel your card, but you can keep them active if you downgrade the card to the no-annual-fee Barclaycard Arrival instead of closing your account.

Downgrading your card will keep you from cancelling a credit card, which can temporarily have a negative effect on your credit score. And you can keep it forever to improve your score!

Note: Barclaycard now considers the Barclaycard Arrival Plus and Barclaycard Arrival to be the same credit card product. This means if you currently have the no-annual-fee Barclaycard Arrival, your application for the Barclaycard Arrival Plus will probably be denied.Bottom Line

The miles you earn with the Barclaycard Arrival Plus and Barclaycard Arrival are valuable because they offer great flexibility and are not subject to blackout dates! Just book your travel and use your miles online to save money.

But there are restrictions:

- You must redeem your Arrival Plus miles for a travel redemption of at least $100 or more

- You can not transfer your miles to hotels or airlines

- You must redeem them within 120 days of your travel purchase

If you’ve taken the benefits of the Barclaycard Arrival Plus for a test drive and don’t want to pay the annual fee, you can downgrade your card to the no-annual-fee Barclaycard Arrival. The no-annual-fee version earns rewards slower, but it’s a good way to preserve the miles you’ve earned, and help your credit score in the process!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!