Easily Find Credit Card Currency Conversion Rates With Mercez App

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.I recently wrote about which card issuers give the best exchange rate for foreign transactions. And

But that might not be the case in every situation. Deciding which credit card to use when traveling abroad can be tricky, because the major banks use a different conversion tool for rates.

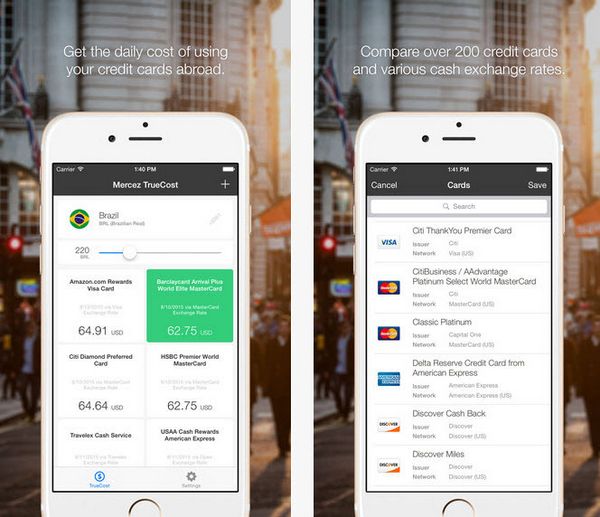

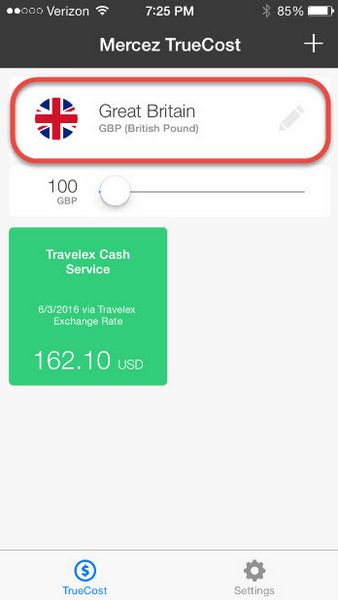

The Mercez app can check which card gives you the best exchange rate from the local currency into US dollars when making your purchase.

I’ve been playing with the app and the concept is great, but it’s not perfect. Here’s my full review.

There’s an App for That

Link: Mercez

Link: Download Mercez From the App Store

Mercez is currently only available for iPhones, iPods, and iPads running iOS 8.0 or better.And

it’s free to download.It’s very easy to use! But I spotted a few bugs and hiccups that made me wary about this app as a helpful travel tool.

How It Works

The Mercez app is simple to use. Once you download the app, you’re prompted to create an account. You’ll need to provide your email address and choose a username and password.

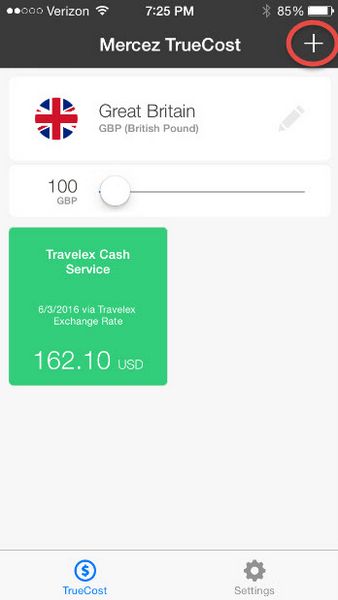

Then press the + sign in the top right to select the cards you want to compare.

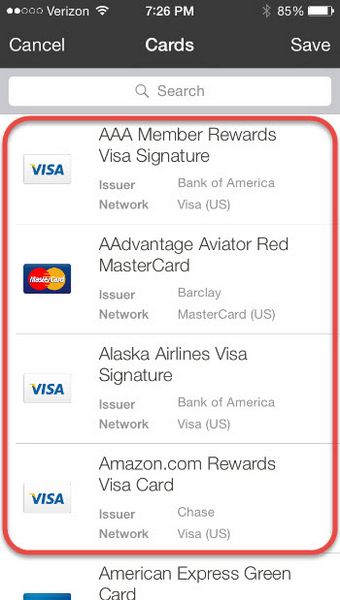

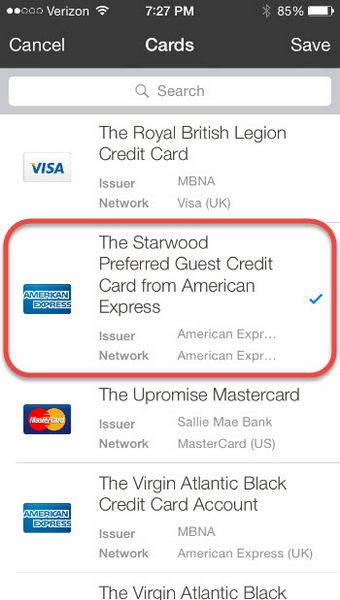

Then scroll through the list of credit cards and tap to select.

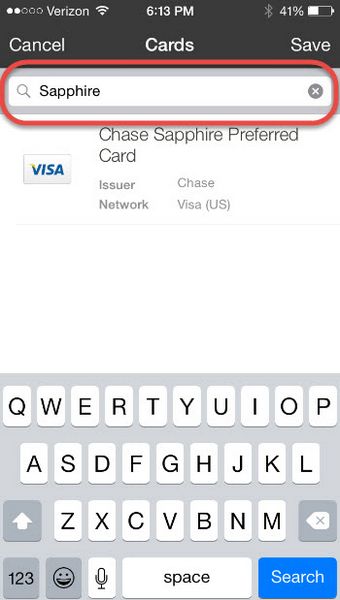

Alternately, you can use the search bar to select your cards.

Then select the default country and currency you’re converting from.

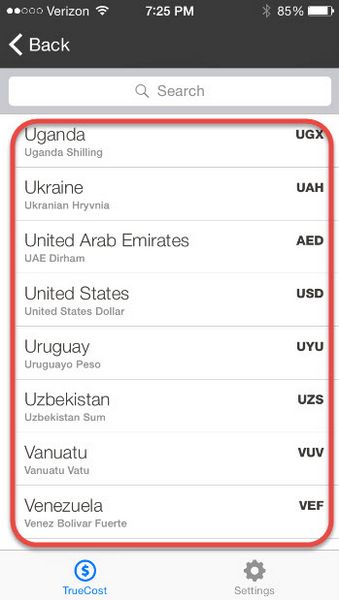

You can choose the country by scrolling.

Or you can use the search function:

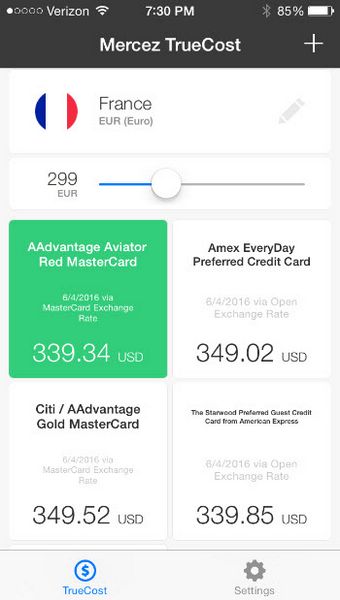

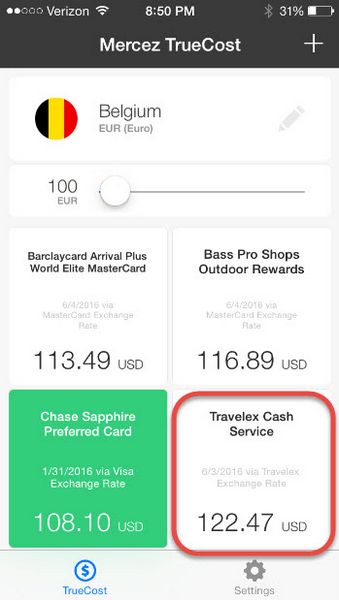

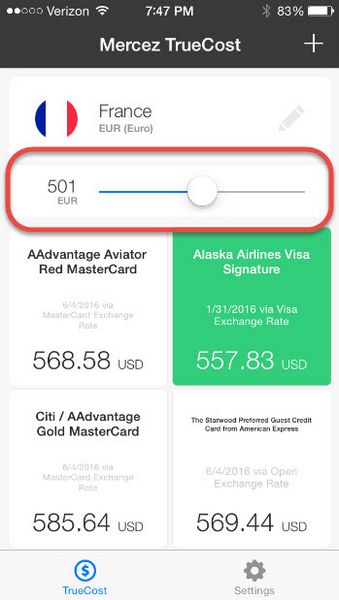

Once you’re set up, the app shows you the best card to use for your purchase based on the current exchange rates with each bank, and includes foreign transaction fees, if your cards have them.

The app can also compare the conversion rate for cash from Travelex, which is a handy feature.

Drawbacks

When you’re first setting up the app, you choose from a long list of credit cards. Most popular cards are included, but I couldn’t find, for example, the US Bank FlexPerks Travel Rewards Card.

Also, the list seems ordered in a bit of an odd way. They’re listed alphabetically, but I had to dig around to find the Starwood Preferred Guest® Credit Card from American Express. I first looked in “A” for “American Express” and it wasn’t there.

Likewise, it isn’t listed under “S” for Starwood. You have to move down to “T” to find it listed under “The Starwood Preferred Guest…”.

You can also type “Starwood” into the search bar to find it, but I wish it was slightly more intuitive. After all, who would think to look under “T” for Starwood? 😉

Once you’ve selected the cards you want to compare, you select the country and currency you’d like to convert from and the amount you want to spend. This is where I came across my second – and third – hiccups. First, the bar is too sensitive, meaning it’s hard to make it land exactly where you want it.

I spent a few solid minutes trying to check the conversion on 500 even (of any currency), but the closest I could get was a few dollars more or less than that number.

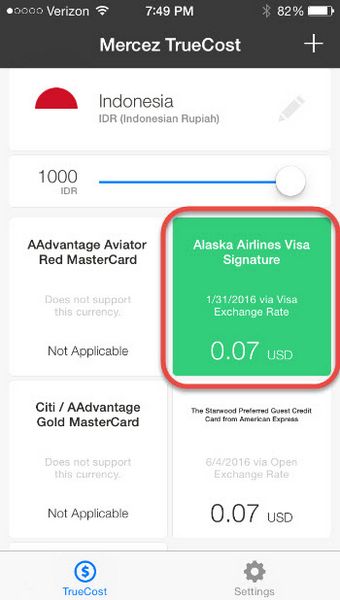

More concerning, though, is that you can only check up to 1,000 units of the local currency. That’s fine for euros, for example, which are roughly equivalent to the US dollar, but it doesn’t work as well for, say, the Indonesian rupiah.

Given that 1,000 rupiah is equivalent to about 7 cents US, it’s just too small a number for the app to derive any meaningful conversion.

A Structural Problem & Bugs

While the app can generally give you a real-time conversion when you’re swiping your card, the only rate that counts is the one at the time the transaction is processed by the bank. Which won’t necessarily be the same day you made your purchase!

So it’s possible the information could be outdated by the time the transaction posts.

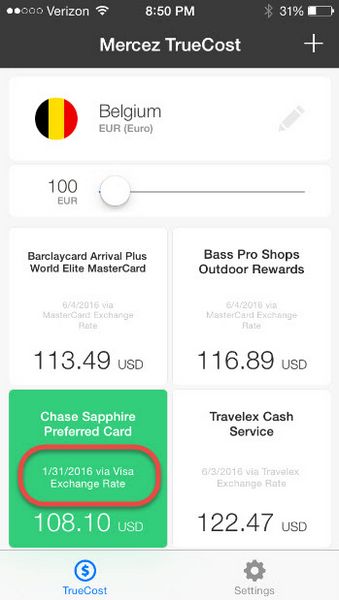

Strangely, sometimes the dates shown for conversion were months in the past, so it’s hard to know if you’re even getting the most up to date rate possible. I hope they work out this glitch!

Finally, I seemed to run into the same bug over and over again. When I’m in the app, and I click on the “+”, remove a card I no longer want to compare, and then try to save, the app shuts down for me every time.

Ultimately, I can go back and re-open, but I should be able to move cards in and out of view without it crashing.

A Good Tool Overall

I actually like the app as an easy and comprehensive conversion tool.

And

it’s helpful to show the different conversion rates for each card, even if the delay in posting may make the conversion itself inexact.I can imagine checking this app (though not necessarily relying on it) the next time I’m abroad.

When deciding which card to use, remember to take spending category bonuses into account. For example, I’d use my Chase Sapphire Preferred card for dining even if the conversion rate was slightly worse, because it earns 2X Chase Ultimate Rewards points – even overseas.

And

don’t forget to make your purchase in the local currency to avoid additional bank fees!Don’t Forget to Use Cards Without Foreign Transaction Fees!

If you’re using your credit card abroad, remember to choose a card with no foreign transaction fees (which may be as high as 3% of your purchase).

Favorite Cards with No Foreign Transaction Fees

Many American Express cards do not charge foreign transaction fees, including:

- Premier Rewards Gold Card from American Express

- The Business Gold Rewards Card from American Express OPEN

- The Platinum Card® from American Express

All Delta American Express cards, including:

- Gold Delta SkyMiles® Credit Card from American Express

- Platinum Delta SkyMiles® Credit Card from American Express

- Delta Reserve Credit Card from American Express and, as of last year

Both Starwood Preferred Guest cards, including:

- Starwood Preferred Guest® Credit Card from American Express

- Starwood Preferred Guest® Business Credit Card from American Express

All Discover cards, including:

The information for the Discover it Miles card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuerAll Capital One cards, including:

Many Chase cards, including:

- Chase Sapphire Preferred® Card

- Ink Plus® Business Credit Card

- Southwest Rapid Rewards® Premier Credit Card

- Southwest Rapid Rewards® Premier Business Credit Card

- Marriott Rewards® Premier Credit Card

- Marriott Rewards Premier Business Card

- Chase Hyatt

And

Bottom Line

When traveling abroad, it’s important to choose a card with no foreign transaction fees.

But don’t forget that currency conversions will differ by card. So consider the card with the best conversion rate. But for small transactions, I’d likely choose the card with the best bonus points, even if I had to pay a few cents more.

Although imperfect, the free Mercez app does a great job of that.

Do you consider the credit card conversion rates when you travel overseas?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!