Should You Use Plastiq to Pay Rent, Loans, Utilities, & More With a Credit Card?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

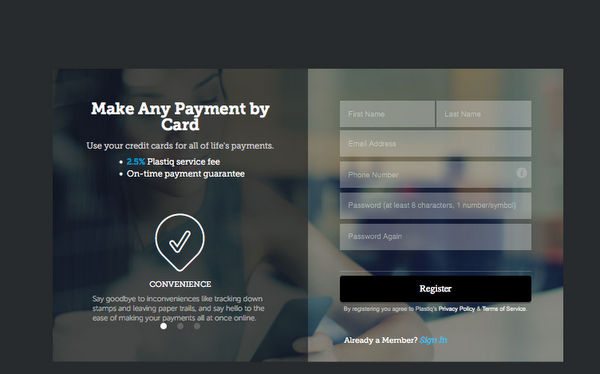

There’s a new way to pay bills that can’t normally be paid with a credit card. Plastiq says you can pay any bill (businesses or individuals) using their service and they’ll charge you a flat 2.5% fee.

But for a limited time, you’ll only pay a 1.99% fee when you use your MasterCard or American Express card!That’s cheaper than other bill payment websites, like Evolve Money or Radpad (which add a ~3% fee).

This could be a good way to meet minimum spending requirements or earn miles and points on big bills like tuition or property taxes. But it’s not for everyone! I’ll explain.

What’s the Deal?

Link: Plastiq

Link: How Plastiq Works

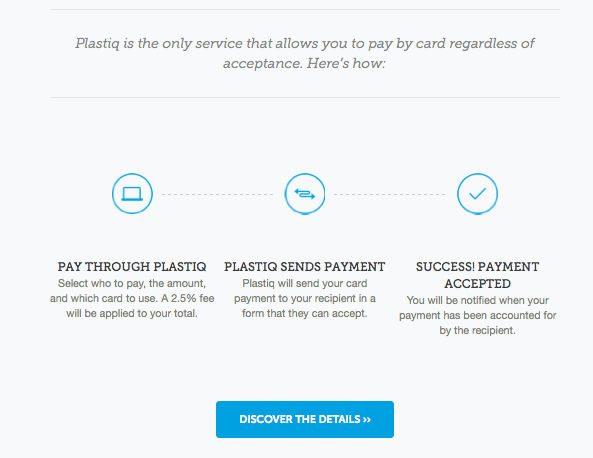

Plastiq is a bill payment service that started in Canada, but recently expanded to the US. They say you can use a credit card to pay any bill or invoice, including:- Rent and utility bills

- Tuition and housing fees

- Home repair and construction

- Income and property taxes

Because Plastiq charges a lower fee (2.5%) than most other bill payment services, this could save you money.

And it’s a better deal now if you use your MasterCard or American Express. You’ll only pay 1.99% for a limited time.

That said, I don’t normally recommend paying a fee to use a credit card for bill payments, because the fee usually negates the value of the miles and points you’ll earn.

But if you need to quickly meet minimum spending requirements, this could be a good deal for you.

How It Works

To use Plastiq, 1st create an account using your name, email address, phone number, and a password. They’ll send you an email to verify your email address, then you can start paying bills.

You can add credit cards to your account and choose which 1 to use to pay certain bills. Currently, Plastiq accepts Visa, MasterCard, and American Express.

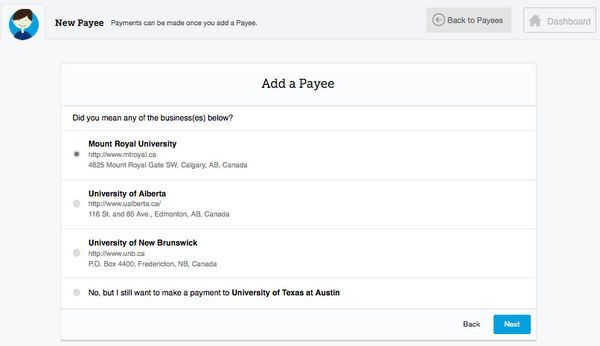

Adding payees is straightforward. Some payees are already registered in their system, but most of these are Canadian businesses and institutions.

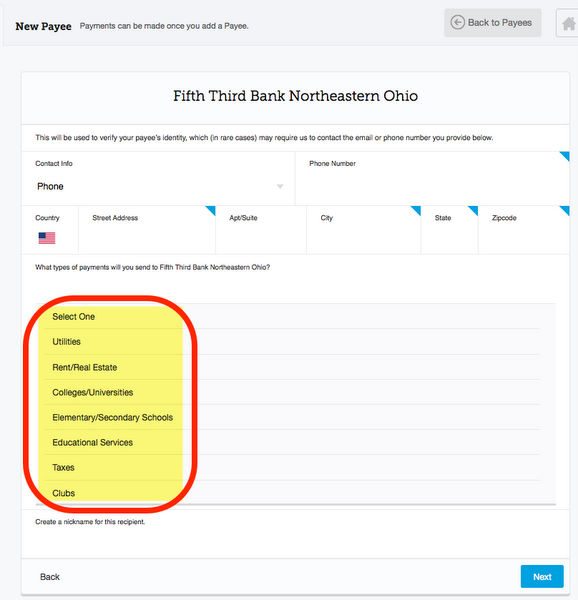

To add your own payee, enter their name, address, telephone number, and the type of payment you’ll be sending them (for example, tuition, rent, or utilities).

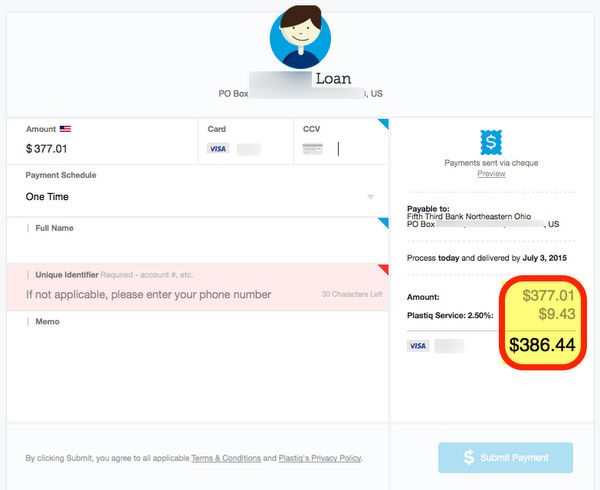

Once you’re ready to make a payment, select your payee and enter your account information, payment amount, and credit card validation code.

Plastiq will automatically add the fee to the payment amount.

That said, folks on FlyerTalk report delays in mailing paper checks.

Is It Worth It?

It’s usually NOT worth paying a fee to earn miles and points, because the fee usually cancels out the value of what you’ll earn.

Plastiq is NOT meant to be a person-to-person money transfer service. But you can pay individuals for goods and services (like your handyman or babysitter). Just be sure to indicate on the payment page what type of bill you’re paying.Commenters on Doctor of Credit and View From the Wing have mixed information regarding whether gift cards are accepted.

Plastiq payments (with the exception of a couple of Canadian banks) should post as a purchase. So there shouldn’t be a cash advance fee. And you’ll earn miles and points for the payment.

That said, I haven’t (yet) experimented with Plastiq, so I don’t have personal experience. I’ll report back when I do!

Note: If you’re paying income taxes, there are cheaper ways to pay by credit card. Some payment processors charge fees as low as 1.87%, and the charge definitely codes as a purchase (and earns miles, points, and cash back).This could be a good deal for folks who are struggling to meet a minimum spending requirement.

Bottom Line

Plastiq is a new online service that allows you to pay bills (businesses or individuals providing you with goods and services) with a credit card for a flat 2.5% fee.And for a limited time, payments made with MasterCard or American Express cards will only be charged 1.99%!

Their fee is lower than many other bill payment websites. And most banks treat Plastiq payments as a purchase, so you won’t be charged a cash advance fee and will earn miles and points.

It’s usually NOT a good idea to pay a fee to use a credit card anyway, because the fee usually cancels out the value of the miles & points you’ll earn. That said, 1.99% is a very good rate.

But if you’re in a hurry to meet a big minimum spending requirement, this could be worth it for you!

Have you tried Plastiq? I’d love to hear about your experiences.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!