Reader Question: How Not to Mess-Up the Minimum Spending for the Southwest Companion Pass?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

This offer is no longer available. Please check the Hot Deals tab for the latest offers.Million Mile Secrets reader Steve emails with a question:

Hi Daraius,

Just wanted to make sure I apply for the Southwest cards correctly for my wife this fall. I read that the 50,000 sign ups are ready but I forgot, we want to complete the $2,000 minimum spends in January right?

If we meet the limits before then, it won’t count towards our companion pass right?

What is the Southwest Companion Pass

The Southwest Companion Pass is one of the best ways to save money on airline tickets for travel within the US.

Why?

Because it lets a companion travel with you for free whenever you travel on Southwest. It doesn’t matter if your flight is booked with points or paid for with cash – your companion flies free (~$10 in taxes and fees)!

However, the 50,000 point bonus from the Southwest credit cards are currently counting towards the companion pass (though this could change at any time).

And all 4 versions of the Southwest credit cards currently offer 50,000 Southwest points after spending $2,000 within 3 months – up to October 30, 2013. You can redeem 50,000 Southwest points for ~ $710 to $850 in Southwest flights or for ~$500 in gift cards.

2 Southwest credit cards and 10,000 extra points can get you ~$2,840 to $3,400 in Southwest travel and a Southwest Companion pass so that your companion can fly free (pay just the $2.50 security fee) for up to two years!This is The Best Time to Apply

About a month ago, I wrote that the best time to apply for the Southwest cards would be in the middle of October. Which is now!

Why?

Because if you time it right and get all the 110,000 Southwest points to post to your Southwest account in 2014 (and NOT in 2013), you will earn the Southwest Companion Pass until the end of 2015.

That’s close to 2 years of almost free flying for your companion on both paid and award tickets! I earned my second Companion Pass on January 22, 2013 and it is valid up to December 31, 2014!

Don’t Mess Up The Minimum Spending!

Now’s the best time to apply for the Southwest credit cards.

But you’ve got to be careful to ensure that the 50,000 bonus points from each Southwest credit card posts to your account in 2104 and NOT 2013, if you’re trying to earn the Southwest Companion Pass in 2014.

Let’s say you apply for the Southwest card today i.e. on October 20, 2013 and get instantly approved online. You have to complete the $2,000 minimum spending requirement within 3 months to get the 50,000 point sign-up bonus.

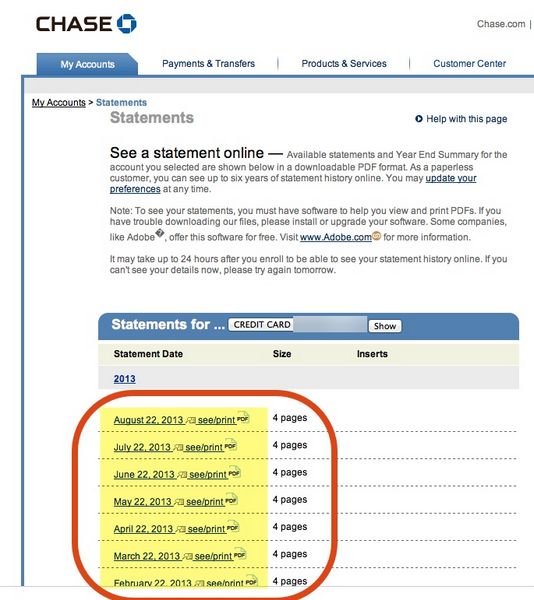

With Chase cards (in my experience), the sign-up bonus usually posts to your account a few days after the statement in which you complete the minimum spending closes or is available for you to see online.

This assumes that you completed the minimum spending 5 to 10 days in before the statement closing date. If you completed the minimum spending, say, 1 day before your statement closes, the points won’t post until a few days after the next statement closes.

You should NOT complete the $2,000 minimum spending immediately, because then the points will post to your account in November 2013 and you’ll have only up to December 31, 2013 to earn the remaining points.

Of course, you should complete the minimum spending as soon as possible, if you already have Southwest companion pass points in 2013 and want to earn the pass in 2013.

Time it Right!

There are two ways to time the minimum spending so that bonus posts to your account in 2014. Which means that your Companion Pass is valid until the end of 2015.

A. Complete Minimum Spending After December Statement Closes

You should complete the minimum spending i.e. exceed $2,000 in charges on your credit card any time AFTER your December 2013 statement closes.

This way, the sign-up bonus will post to your account in January 2014. For example, let’s say that your December statement closes on December 20, 2013.

If you complete or cross $2,000 in charges after December 20, 2013, you’ve completed the requirements for the 50,000 point sign-up bonus. And the bonus will post to your account after the NEXT statement which will be a few days after January 20, 2014.

So you now have the whole of 2014 to earn the remaining points for the Companion Pass!

This is how I timed my minimum spending last year, and the points posted to my account on January 21, 2013.

B. Complete Minimum Spending After January 1, 2014

Some readers have asked me what would happen if Chase posts the sign-up bonus immediately after completing the minimum spending requirements.

I’ve never had a Chase sign-up bonus post immediately after completing the minimum spending requirements (and before my statement closed) like American Express sometimes does with a few of their cards.

But Chase could suddenly change how they post the sign-up bonus (though I don’t expect a change).

So if you want to be absolutely sure that bonus will post in 2014, you can complete the minimum spending after January 1, 2014 but before January 20, 2014. This way the sign-up bonus has to post to your account in 2014.

The drawback of this approach is that you have only ~20 days to complete the minimum spending, which can be difficult for some folks.

And the bonus points may actually post in February 2014 if you complete the minimum spending very close to the statement closing date in January.

Bottom Line

The Southwest Companion Pass is the best deal for travel within the US.

Now’s the best time to apply for any of the Southwest credit cards because all 4 versions offer a 50,000 point sign-up bonus which counts towards the Companion Pass. And if you earn the companion pass in 2014, it is valid until the end of 2015.

If you have no Companion Pass points and are trying to earn all 110,000 points in 2014, make sure that you complete the minimum spending AFTER your December 2013 statement closes so that the points post to your account in 2014!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!