Chase Ink Plus

During my visit to New York, the Director of the Ink Business cards suggested that there was a new publicly available Ink card coming out which would be identical to the existing Chase Ink Bold (update: no longer offered). The only difference would be that the new Ink Plus would be a credit card (where you can pay only a portion of your balance each month) unlike the Ink Bold which is a charge card where you had to pay your balance off each month.

Well, the Chase Ink Plus is now available to all (previously it was available only via targeted offers). But you shouldn’t be applying for cards if you can’t pay off the balance in full.

I believe that this is considered a separate product, so it should be possible to get the sign-up bonus on the new Ink Plus in addition to the Ink Bold. But I don’t have any personal experience…yet.

And if you’re a Big Spender who maxes out the 5X category bonus at Office Supply stores on the Ink Bold, you could apply for this card which has a $50,000 cap for 5X purchases at Office Supply stores.

You get 50,000 points after spending $5,000 within 3 months. As I wrote earlier, the trend towards higher spending to get the full sign-up bonus is here to stay.

Chase Ink Plus Review

Emily and I love Chase Ultimate Rewards points because they give us a lot of ways to have Big Travel with Small Money.

Not only can we transfer Ultimate Rewards points to airline partners, but we can also transfer them to hotel partners. The choice of airline and hotel partners is also much better than the transfer options of American Express’ Membership Reward Points.

Emily can also transfer Ultimate Reward points directly to my account or to my airline and hotel accounts for free.

Chase usually lets you get 1 business and 1 personal card on the same day, but you’ll have to call the reconsideration line to get approved for the 2nd card.

Business Credit CardThe Chase Ink Plus, unlike the Chase Ink Bold is a business credit card which means that you can pay off only a portion of your credit card bill each month. Of course, you should NOT be doing this because the interest charges are very high and negate the value of any miles and points earned.

As I’ve written before, many folks may qualify for this card even if they don’t currently have a business, but are thinking of starting one. Or if you’ve dabbled with a business (sold something on ebay, had a garage sale, sold crafts etc.), but now want to concentrate a bit more on it.

Or you could want a business card to keep your reimbursable business expenses at work separate from your personal expenses.

You usually have to enter your social security number on the application form and the credit inquiry will appear on your personal credit report, but the credit line will not appear on your personal credit report.

This means that the average age of your credit history should not decrease because the business credit line doesn’t sit on your personal credit report.

However, it may take a little longer for the effect of the credit inquiry to be made up, because your personal credit report will not show increased available credit so your credit utilization ratio will not change. But I like the longer term effect of having a higher average age of my personal credit history.

When applying for a business credit card as a sole proprietor, I enter my social security number as the Tax ID in the application form and enter my name as the business name.

Chase Ink Plus Review

1. 50,000 point Sign-up BonusYou get 50,000 Ultimate Rewards points as a sign up bonus after spending $5,000 within 3 months of being approved for the Chase Ink Plus.

Spending $5,000 within 3 months is a lot for us, especially since we’ll probably be applying for other cards and will have to complete the minimum spending on those as well.

However, I’ll be using some of the ways outlined in the 40+ ways to complete minimum spending requirements including paying my rent via Williampaid.

How to use 50,000 Ultimate Reward pointsThe Chase Ink Plus earns Chase Ultimate Rewards points which are very valuable. For example, the 50,000 bonus points can be redeemed for:

- Gift cards – $500 value

- Travel through the Ultimate Rewards Portal – $625 value

- Transfer to hotel and airline partners – $625 – $2,000+ value

You can transfer Ultimate Rewards points earned via the Chase Ink Plus (& also the Chase Sapphire Preferred, Chase Ink Bold, and JP Morgan card), in a 1:1 transfer ratio, to:

- United

- British Airlines

- Southwest Airlines

- Korean Air

- Hyatt

- Marriott

- IHG

- Ritz-Carlton

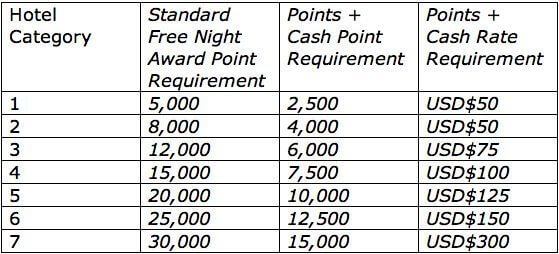

My preferred way to redeem 50,000 Chase Ultimate Rewards points is to transfer them to Hyatt and redeem for 2 nights in a top category 6 Hyatt hotels such as the Park Hyatt in Paris, Tokyo, or the Maldives where I could get to experience a hotel room which I would otherwise never be able to afford ($ 500 or more per night).

Another potential use is to transfer to United which, together with the bonus from either the targeted United 65,000 miles card or the Chase Sapphire Preferred, will get you ~100,000 miles or enough for a business class trip to Europe. Or may be all 3 eventually for ~150,000 United miles.

Or you can transfer 4,500 points to British Airways and redeem them for short distance tickets on American Airlines which would usually require 25,000 American Airline miles.

And transferring to Southwest Airlines is another great option for domestic travel!

In general, you may be able to squeeze out more value by transferring to a hotel or airline partner than redeeming through the Ultimate Rewards portal.

However, I wouldn’t redeem for Priority Club points since I can get them for 0.7 cents per point using the cash and points trick. If I were to redeem 50,000 Ultimate Rewards points for 50,000 Priority Club points I would get only a $350 value (50,000 X 0.7 cents).

But your needs will be different so do what’s best for you.

2. Double points on gas & hotels & 5 X points on office supplies, cable & satellite TV, wireless and land line expenses. You earn double points on gas & hotel purchases up to the 1st $50,000 in purchases.And you earn 5X points on office supplies (from office supply stores), cable and satellite TV services and wireless and land line expenses up to the 1st $50,000 in purchases.

This is the best category bonus I’ve seen for office supplies, cable, wireless and land line expenses!

I’m not usually a big fan of category bonuses because they are slow to add up. But even spending $200 a month on office supplies and telecom expenses on the Chase Ink Plus would earn you 12,000 ($200 X 12 months X 5 points) Ultimate Reward points a year, versus the 2,400 points ($200 X 12 months X 1 point) you’d earn on a card which earned only 1 point per $1 spent.

But do the math before applying for the card because not everyone will spend significantly in these categories. I know that I don’t spend significantly in those categories.

3. No Foreign Transaction Fee. The Chase Ink Plus like the Chase Ink Bold does not have a foreign transaction fee which saves ~3% when you use the card outside the US.This could be a good deal if you don’t travel often, but still like lounge access, but don’t want to pay for a full year of lounge membership or get the American Express Platinum card which does come with lounge access.

Here’s a post on how to sign-up for the free Lounge Club benefit.

DrawbacksOr you could get the Chase Ink Plus for one year with the fee waived and then get the Chase Ink Bold the next year with the fee waived so you won’t be paying a fee for 2 years.

2. $5,000 minimum spending. $5,000 within 3 months is high, so I’ll be relying on the 40+ ways to complete minimum spending requirements. Bottom Line: The 50,000 sign up bonus is an easy way to get more Ultimate Reward points.The double points on hotels and gas, and 5 X points on cable, internet, telecom & office supply stores could be useful to folks who spend heavily in those categories.

Or like me on Facebook or follow me on Twitter.