Million Mile Secrets reader Tom commented on the Hotel Credit Card page:

What would be the best credit card out there to gets lots of Hilton or Hyatt points, whether it be a Hilton or Hyatt card, or other, which can transfer to these hotels? I already carry the Citibank cards. Thanks.

Of all the hotel programs, Hilton points are the easiest to acquire via credit card sign-up bonuses (sometimes more than once 😉 )AND amongst the easiest to earn by regular spending via the American Express or Citi co-branded Hilton cards.

For example, you can get ~480,000 Hilton points + 2 free nights + Hilton gold status by applying for 8 credit cards from 3 different banks. These 480,000 points + 2 free nights can be redeemed for 12 nights at a top tier category 7 Hilton hotel using an AXON award (think the Maldives, Hawaii, London, Paris, Tokyo, etc.) or for many more nights at lower-tier Hilton group hotels.

Update: Hilton has devalued their AXON awards. See this post for more details.The lowest category Hilton group hotels start at 5,000 points a night and the highest category cost 95,000 points per night. Waldorf Astoria hotels range between 50,000 points to 95,000 points per night. Here’s a link to the Hilton award chart.

And you may be able to get some of these either more than once in a short period of time or twice at the same time, which means that it is easier to replenish Hilton points via credit card sign up bonuses than other hotel points. Even better – none of these cards are from Chase which usually has the best offers.

However, these are Emily and my personal experience, and your experience could be completely different.

I’ve written about the cards individually, but never listed together all the different ways to rack up Hilton points.

I wouldn’t start off with these cards if you were new to miles and points because you can usually save more money by using credit card sign-up bonuses for airfare, but at some point you’ll need hotel points.

I value 1 Hilton points at ~0.6 cents per point, but I value Hyatt hotel points much higher (~1.5 to 1.8 cents per point). The main reason is because it takes a lot more Hilton points (50,000 points) to earn a top tier hotel room versus only 22,000 points for a top tier Hyatt.

However, the Hilton brand has hotels almost everywhere versus much fewer hotels for Hyatt, and you can earn Hilton points much faster.

This post will cover Hilton, and I’ll cover the different ways to earn Hyatt points tomorrow.

425,000+ Hilton Points + 2 Free Nights

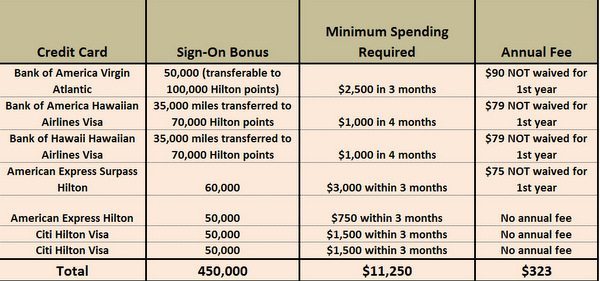

If you apply for cards below i.e. the Virgin Atlantic, 2 Hawaiian Air, AMEX Hilton Surpass, AMEX (non-surpass) Hilton and 2 Citi Hilton cards at the same time, you can get ~425,000 Hilton points + 2 free nights + Gold elite status (free breakfast and internet).

You shouldn’t apply for them all at the same time (unless you know what you’re doing!), and should not apply for credit cards if you have a big loan in the next 2 years.

Even better, the Citi Hilton Reserve, Virgin Atlantic, Hawaiian Air, & regular Citi Hilton, cards are churnable which means that you may be able to get another 240,000 Hilton points every 3 to 4 months.

Let’s see the different ways to rack up Hilton points:

1. 2 Free Nights – Citi Hilton Reserve. This card gets you 2 free nights which can be used at any Hilton on the weekend. That’s ~100,000 points if you redeem at top category Hilton hotels.

Even better the card gets you free Hilton Gold elite status for as long as you have the card. This means free breakfast and free internet which will save you money when you use your points at Hilton hotels. The card (unlike the others below) also has no foreign transaction fee so is great for using outside the US and saving the 3% foreign transaction fee.

Here’s a link to a detailed review on the Citi Hilton HHonors Reserve Card. Emily and I were both able to get 2 Citi Hilton Reserve cards for 4 free nights each! Note that you can NOT get 2 Citi Hilton Reserve cards at the same time any longer.

2. 75,000 Points – Bank of America Virgin Atlantic Credit Card. Isn’t it strange that the card which offers the most Hilton points isn’t a Hilton branded card?

You earn 20,000 miles after your 1st purchase and an additional 25,000 miles after spending $2,500 within 90 days. You also get 5,000 miles by adding 2 authorized users to your account for a total of 50,000 Flying Club miles. Here’s my earlier review of the card.

You can convert 50,000 Flying Club miles to 75,000 Hilton Points by calling Virgin Atlantic (800-365-9500) and asking them to transfer the miles to your Hilton account.

Emily and I are on our second Virgin Atlantic card and we didn’t cancel the previous version before applying for a new one. We had to call Bank of America’s reconsideration line, but were both quickly approved for the card. We waited ~5 months since we last applied before getting another Virgin Atlantic card.

Some readers have written that they were able to get another card after 3 months and some reported being approved for 2 cards at the same time after calling the reconsideration line. But of course, your experience could be different.

You earn 1.5 Virgin Atlantic miles or 1.5 Hilton points per $1 spent and 3 Virgin Atlantic miles per $1 spent on Virgin Atlantic.

3. 70,000 points – Bank of America Hawaiian Air Credit Card. The Bank Of America Hawaiian airlines credit card gets you 20,000 Hawaiian Miles after the first purchase and an extra 15,000 miles after spending $1,000 within 4 months. Here’s my earlier review of the card.

These 35,000 Hawaiian Air miles can be converted to 70,000 Hilton points by calling Hawaiian Air (877-426-4537).

Note that you may instead receive the Platinum Visa card which offers only 10,000 HawaiianMiles after the first purchase if you do not qualify for the Signature card.

4. 70,000 points – Bank of Hawaii Hawaiian Air Credit Card. Same deal as the Bank of America Hawaiian Air card in #2, except that this card is issued by FIA card services, a division of Bank of America, and you may be able to get more than 1 card every few months like with the other Bank of America credit cards.

Note that you may instead receive the Platinum Visa card which offers only 10,000 HawaiianMiles after the first purchase if you do not qualify for the Signature card.

5. 100,000 points – American Express Hilton Surpass Credit Card. If you have Hilton points, you should strongly consider getting either the AMEX Hilton Surpass card or the AMEX Hilton regular card (#5). Why? Note that you can’t have both the AMEX Hilton cards open at the same time.

Because you get access to AXON awards which give you a significant discount on award redemptions. For example, instead of paying 200,000 points for a 4 night Hilton stay in a Category 7 hotel, you’ll pay only 145,000 points or 27.5% less.

You also get free Gold status for the 1st year (free internet, breakfast, and a shot at upgrades) and then Silver status which gets you access to the discounted VIP awards. If you’re a big spender you can earn Gold status by spending $20,000 a year (free if you have the Citi Reserve card) or top tier Diamond status for $40,000 a year.

You earn 9 Hilton points per $1 spent at Hilton hotels, 6 points per $1 at supermarkets, drugstores, gas stations, phone/internet/cable & 3 points per $1 for everything else which makes it pretty easy to rack up Hilton points via regular spending as well (but of course the big pay off for most folks is to focus on the credit card sign-up bonuses).

6. 40,000 to 50,000 points – American Express (Regular) Hilton Credit Card. This card has NO annual fee which makes it a great card to build a long term history with American Express. You get free Hilton silver status which makes you eligible for discounted VIP awards.

7. 40,000 to 50,000 points – Citi Hilton Visa. The regular affiliate link is for 40,000 points, but there is a link to a 50,000 point version which also works based on reader feedback. You get free Hilton Silver elite status which makes you eligible for discounted VIP awards

Another reason to get this card is because it doesn’t have an annual fee and is a nice card to plan to keep for a long time and build a long-term relationship with Citi.

Hawaiian Air Debit Cards

Bank of America used to offers a Hawaiian Air debit card for a $30 annual fee which earns 1 mile per $2 spent. But I can’t find a link to it anymore.

Bank of Hawaii offers Hawaiian Air debit cards, but doesn’t have any branches in the mainland US. You can transfer Hawaiian Air miles to Hilton points at a 1:2 ratio so the net effect is that you’re earning 1 Hilton point per $1 spent.

Other options

There are other ways to get Hilton points, such as transferring American Airlines miles to Hilton, but I don’t recommend that because the transfer ratio (1.67 Hilton point for every 1 American Airlines mile) is not worth it to me.

Bottom Line: It is fairly easy to rack up lots of Hilton points for Big Travel with Small Money. If you do collect Hilton points, you should consider an American Express Hilton card, because it will get you access to discounted VIP or AXON awards which means paying less points for Hilton awards.