Readers have been asking what’s the difference between the Chase Ink Bold® & Chase Ink Plus® cards?

Chase Ink Plus & Chase Ink Bold

The Chase Ink Plus® and the Ink Bold both have a $95 annual fee which is waived for the 1st year.

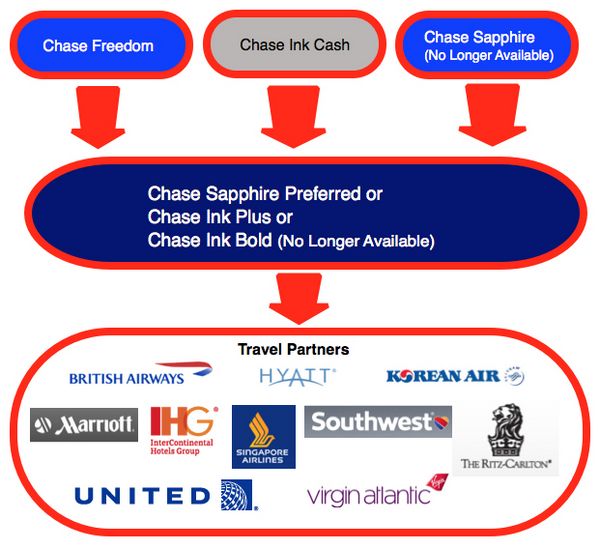

- In return for the $95 annual fee, you can transfer points from your Chase Ink Bold or Chase Ink Plus to airline or hotel partners such as Hyatt, Southwest, United etc.

- You earn 5X Ultimate Rewards points – up to $50,000 or 250,000 points per year – for cable/internet/telecom purchases and for purchases from office supply stores

- You earn 2X points for gas & hotel purchases up to $50,000 or 100,000 points per year

- There are NO foreign transaction fees for purchases in foreign currencies

The main difference between both cards is the Chase Ink Plus is a credit card while the Chase Ink Bold is a charge card.

Chase Ink Bold

A charge card, like the Chase Ink Bold®, has no set spending limit, but you must pay your balance in full each month with a charge card. Of course, you *should* pay your balance in full, and if you don’t pay it in full each month, you’re better off without a miles and point credit card.

Note that no set spending limit doesn’t mean that you get an unlimited credit line. You do have an upper limit above which you won’t be able to charge transactions. But the spending limit increases (or decreases) based on your spending patterns.

The Ink Bold is the better option if you know that you will pay your balance back in full each month, but want the flexibility of having no pre-set spending limit to charge large purchases.

CHASE INK Plus

The Chase Ink Plus® is a credit card which allows you to carry a balance on your card. Which I hope that you never do because you’ll pay a lot more in interest than what the points are worth. You’d be better off not earning miles and points, but paying a lower interest rate with a different card.

That said, the Ink Plus could be a better option if you’d like the flexibility of knowing that at some point you could carry a balance on your card. Perhaps your business is growing and it is easier to finance equipment for a month on your credit card, than applying for a loan from your bank and hoping the loan officer had a good day when he processes your loan application.

I have both the Ink Plus and Ink Bold for my businesses. I got a $20,000 limit on my Ink Bold and a $3,000 limit on the Ink Plus. I prefer using the Ink Bold for larger purchases because I don’t have to worry about hitting the limit with it, and I use my Ink Plus for recurring telecom, internet, and smaller transactions.

Read my review of the Chase Ink Plus and my review of the Chase Ink Bold to learn more about the cards.

Bottom Line

The on the Chase Ink Plus® and the Chase Ink Bold® cards offer the same sign-up bonus and benefits but the Ink Bold is a charge card with no spending limit (up to a point) that you must pay off in full every month.

The Chase Ink Plus is a traditional credit card with a fixed credit line but you can carry a balance (but should not!)