World of Hyatt credit card review: Great for ongoing hotel perks, like free nights

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you’re looking for free nights at luxury hotels, here is the golden ticket. The World of Hyatt Credit Card is one of the best hotel credit cards, it comes with up to 50,000 bonus Hyatt points after meeting tiered minimum spending requirements. That’s a flabbergasting amount of Hyatt points, and enough for two nights at top-notch hotels like the Park Hyatt Seoul. Or you can stretch the points for 10 nights at less expensive hotels, like the Hyatt Regency Yogyakarta.

Hyatt points go further than most other hotel points, that’s why this is a travel credit card I keep in my wallet. We’ve used Hyatt points to save on fantastic stays at terrific hotels all over the world. Here’s our full World of Hyatt credit card review.

The World of Hyatt Credit Card review

Current bonus

With The World of Hyatt Credit Card, you can earn up to 50,000 Hyatt points after meeting tiered minimum spending requirements.

You’ll earn:

- 25,000 bonus Hyatt points after you spend $3,000 on purchases in the first three months of opening your account

- Another 25,000 bonus Hyatt points after you spend an additional $3,000 ($6,000 total) on purchases within the first six months of opening your account

Not only is this bonus great for booking free nights, you can also use Hyatt points for other redemptions, like suite upgrades on paid stays.

Benefits and perks

The World of Hyatt Credit Card earns 4 bonus points per dollar at Hyatt, 2 points per dollar at restaurants, on airline tickets purchased directly from the airlines, on local transit and commuting, on fitness club and gym memberships and you’ll earn one point per dollar on everything else. This card also has no foreign transaction fees and the following ongoing benefits.

Annual free nights

By far the best benefit of the Hyatt card is the free night at any category 1-4 Hyatt hotel you’ll receive each account anniversary. You’ll also earn an additional free night at a category 1-4 Hyatt hotel or resort after spending $15,000 in an anniversary year. Even if you redeem it at a lower-category Hyatt Place or Hyatt House hotel, you’ll likely get at least $95 in value – and potentially much more.

If you make the most of your free night by using it during peak season or in pricey cities, you can get a stay worth many times more than the card’s $95 annual fee. For instance, standard rooms at the Grand Hyatt Berlin, a category four hotel, can cost more than $350 per night in the summer.

Automatic elite status

You’ll receive automatic Discoverist Hyatt Status with the card. It comes with perks like 10% more bonus points per stay, upgrades to a preferred room based on availability at check-in, late check-out upon request, etc. You’d normally need 10 elite nights or 25,000 base points in a calendar year to achieve this status.

Plus, Hyatt offers extended elite status for anyone with status as of March 31, 2020. Elite status that will expire in 2020 will now be valid through Feb. 28, 2022. They’re even extending the expiration date of any unused Free Night Awards, Suite Upgrade Awards, etc. with an expiration date of between March 1, 2020, and December 31, 2020. These will now expire on December 31, 2021, including existing awards and awards that you may earn throughout this year with a 2020 expiration date.

Elite status credits

As a cardholder, you’ll normally earn two elite night credits for every $5,000 you spend on the card, helping you reach a high level of elite status more easily. But between April 15 and June 30, 2020, you’ll receive three elite night credits, instead. Hyatt has made this change in light of the coronavirus stealing months away from your ability to stay with Hyatt.

If you’re a big spender, you could spend your way to the fancy Globalist Hyatt status without staying a single night at Hyatt. This is the best top-tier hotel elite status and along the way to earning it, you’ll get valuable Milestone Rewards like suite upgrade certificates and free night awards.

Rental car insurance

When you rent a car, pay for the entire rental with your Hyatt card, and decline the rental company’s collision damage waiver (CDW), you’ll get secondary rental insurance coverage for damage due to theft or collision in the U.S. And you’ll get primary coverage if you’re renting outside the U.S.

Trip cancellation/trip interruption insurance

If your trip is cancelled or interrupted for a covered reason (like illness or severe weather), you could be reimbursed up to $5,000 for non-refundable, pre-paid travel expenses when you pay with your World of Hyatt card.

Trip delay reimbursement

The World of Hyatt card can help take the sting out of travel delays. If your flight (or other common carrier) is delayed more than 12 hours or requires an overnight stay, you and your family can be reimbursed up to $500 per ticket for expenses like meals and hotels.

Lost luggage reimbursement

With The World of Hyatt card, you and your family are covered up to $3,000 per person if the carrier damages or loses your luggage.

Baggage delay insurance

Isn’t it the worst when you land at the airport and discover your bags didn’t make the flight? When you book with your World of Hyatt card, if your bags are delayed more than 6 hours you can get reimbursement for essential purchases like toiletries and clothing, up to $100 a day for five days.

Travel accident insurance

Nobody wants to imagine the worst on a trip, but if the unthinkable occurs, the World of Hyatt card offers up to $500,000 in accidental death or dismemberment coverage when you pay for air, bus, train, or cruise transportation with the card.

Purchase protection

Here’s a handy perk when you’re buying a pricey item. With the World of Hyatt card’s purchase protection, if your new purchase is damaged or stolen within 120 days of buying it, you can be reimbursed up to $500 per claim and $50,000 per account.

Extended warranty

With extended warranty, the World of Hyatt card extends the time period of a U.S. manufacturer’s warranty by an additional year on eligible warranties of 3 years or less.

Travel and emergency assistance services

If you’re traveling and need help with relaying an emergency message back home, tracking down lost luggage, or need a medical or legal referral, you can call the Benefits Administrator for help 24 hours a day. Any costs incurred are your responsibility.

Roadside dispatch

As a Visa card you can get roadside dispatch for a flat service fee (~$70) per call for common mishaps like:

- Towing – up to 5 miles included

- Tire Changing – must have good, inflated spare

- Jump Starting – battery boost

- Lockout Service (no key replacement)

- Fuel Delivery – up to 5 gallons (cost of fuel not included)

- Winching (within 100 feet of paved or county maintained road only)

To reach roadside dispatch, call 800-847-2869. This is a helpful alternative if you don’t have your own roadside coverage.

How to redeem Hyatt points

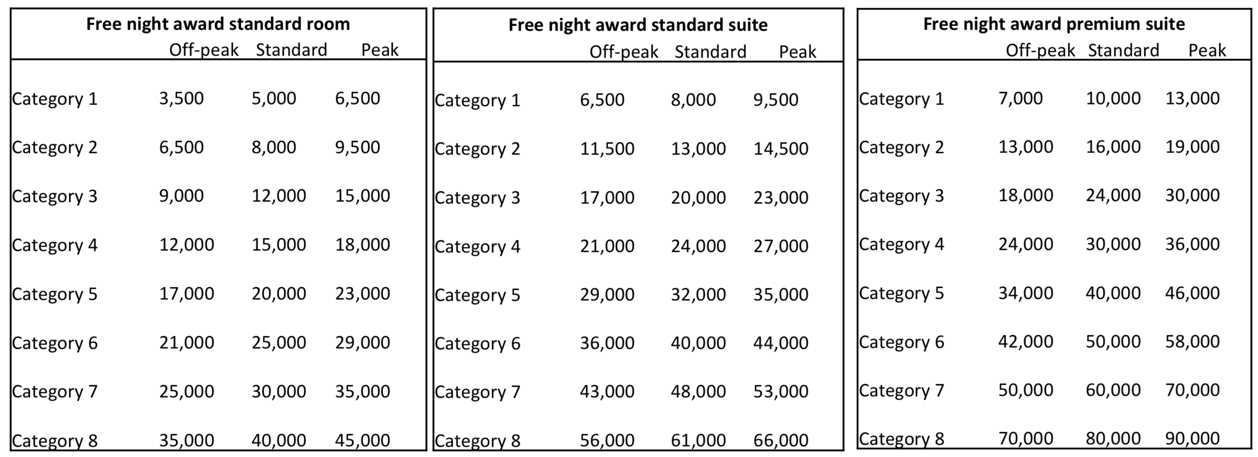

There are lots of terrific ways you can use Hyatt points and you’ll pay 5,000-40,000 Hyatt points for a standard room award night, depending on the category. Also, coming in 2021, Hyatt will introduce peak and off-peak prices. Below is a chart of what you’ll pay for a standard room and for suite awards:

One of the best parts about collecting Hyatt points is the chain has no blackout dates. As long as a standard room is available, you can book using points. Plus, you’ll never pay a resort fee when you book an award night at Hyatt hotels.

Here are three ways you can redeem points from The World of Hyatt Credit Card sign-up bonus.

1. All-inclusive stay at the Hyatt Ziva Los Cabos

Folks looking for an all-inclusive getaway can use 40,000 Hyatt points to book two standard award nights at the Hyatt Ziva Los Cabos.

A similar 2-night stay could cost $1,000+ if you paid cash, so using points is a great way to save money. And it gets excellent reviews on TripAdvisor.

As an all-inclusive hotel, you get:

- Unlimited drinks (alcoholic and non-alcoholic) and snacks at lounges and bars

- Meals at all seven hotel restaurants

- Live bands and theatre performances

- Wi-Fi internet access

To book a room with points at this resort, you must call Hyatt at 866-567-7830.

The standard room cost is for two adults. You can bring up to two additional guests for 10,000 Hyatt points per person per night and you do not have to pay for children under three years old.

2. Weekend in Austin

If you’re looking to explore fun nightlife and terrific restaurants, you can redeem 40,000 Hyatt points to stay two nights at The Driskill in Austin.

This hotel is only a ~10 minute walk to historic attractions like the Texas State Capitol Building and Congress Avenue and it’s located on 6th street putting you right in the heart of the downtown entertainment district.

And the location of the hotel is great if you want to explore other parts of Austin, including the Austin Historic District.

3. Vacation in New York

If you’re planning ahead for a trip to New York City, you can redeem points at the Hyatt Place Flushing-LaGuardia Airport. This Hyatt hotel is only a category three making it eligible to use your free award night or help your points stretch even further while only being a quick subway ride into Manhattan.

With only 48,000 points you can book four free nights at the Hyatt Place Flushing-LaGuardia Airport. Don’t forget, all guests enjoy free breakfast at Hyatt Place hotels when they book directly with Hyatt.

This hotel is only a ~15 minute Uber ride to LaGuardia or ~30 minutes to JFK. And it’s only a ~30 minute subway ride to Times Square. My wife and I enjoyed being close enough to visit my Aunt in Manhattan, but also far enough away from the hustle and bustle so we could recover at night.

Is the annual fee worth it?

This card has a $95 annual fee. But the free night at a category 1-4 Hyatt each cardmember anniversary can easily offset the annual fee. It’s a great reason to keep the card open year after year.

In addition:

- Hyatt has no blackout dates. As long as a standard room is available, you can book using points.

- Hyatt does not charge resort fees when you book award stays

- The World of Hyatt Credit Card gets you automatic Discoverist elite status

Who is the Hyatt credit card for?

The Hyatt card is a great choice if you want to pamper yourself with luxury hotel stays. Hyatt is a smaller hotel chain with fewer locations than the big boys like Marriott, Hilton and IHG. But what it lacks in quantity it makes up for in qualify and Hyatt has been expanding its offerings through a partnership with Small Luxury Hotels of the World (SLH). You can now redeem and earn Hyatt points at 1,000+ locations (including 300+ SLH partners) with more to come. MMS staffer Jason stayed at the Villa Orsula Dubrovnik (an SLH property) for only 40,000 Hyatt points for a free night which would have otherwise cost $800+ and because of the Hyatt partnership, he got free breakfast for two.

This card is also a great option if you want the flexibility of booking longer stays with points. Currently, a category 1 Hyatt hotel costs 5,000 points per night, but coming in 2021 (when peak and off-peak prices are being introduced) that price will drop to 3,500 points during off-peak dates. So this card’s bonus could get you 10 free nights at a bevy of Hyatt House hotels, which offer free breakfast and in-room kitchenettes (at many locations).

To have a good chance of being approved for this card you’ll want a credit score of 700+ and you’ll need to be under the Chase 5/24 limit. The 5/24 rule will restrict you from being approved for any Chase credit card if you’ve opened five or more cards from any bank in the past 24 months (most business credit cards will not add to your 5/24 count).

Insider tips

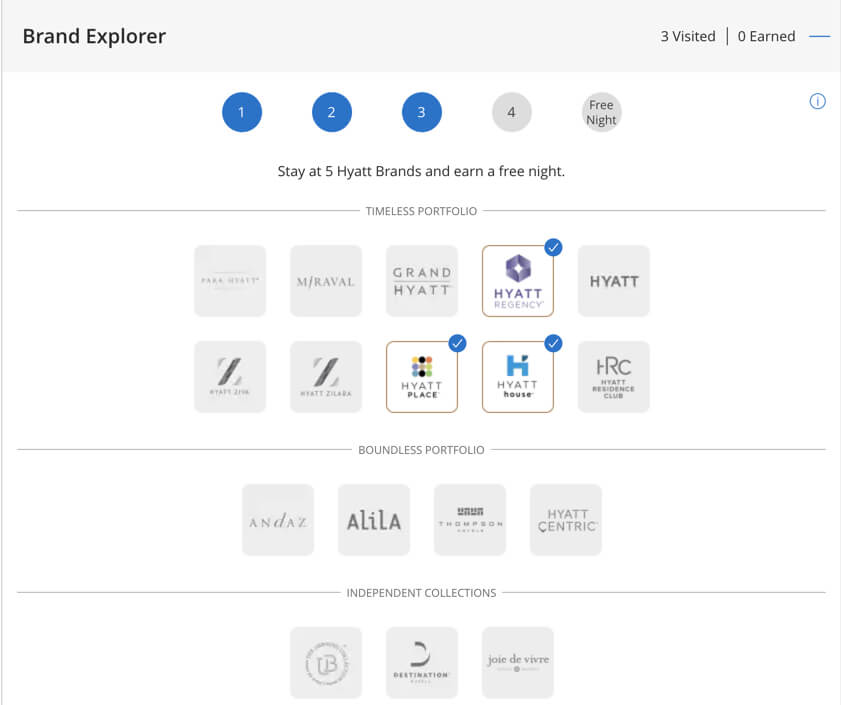

Beyond the Hyatt card’s opportunities to earn free nights you can also take advantage of Hyatt’s ongoing Brand Explorer promotion. The way it works is, you’ll earn a category 1-4 free night for every five Hyatt brands you stay with. Currently there are 17 Hyatt brands with more in the works, so you can earn up to three additional free nights this way.

This promotion is ongoing, so the stays aren’t reset every year. Any paid stay (including Points + Cash rates) made after Mar. 1st 2017 counts and any award stay made after Jan. 1st 2018 (including free night awards) also counts.

Pairing the World of Hyatt Credit Card with other credit cards

You can earn Chase Ultimate Rewards points to use for free Hyatt stays with lots of great rewards credit cards, because Hyatt is a Chase Ultimate Rewards transfer partner. I’ll share three options. Just keep in mind these cards are also impacted by Chase’s stricter application rules. So if you’ve opened 5+ cards from any bank (except Chase business cards and certain other business cards) in the past 24 months, you won’t be approved.

Ink Business Preferred Credit Card

You can earn 100,000 Chase Ultimate Rewards points with the Chase Ink Business Preferred after you spend $15,000 on purchases in the first three months from account opening. This is the highest sign-up bonus currently available on any card earning Chase Ultimate Rewards points.

This card has a $95 annual fee, which is not waived the first year.

Chase Sapphire Preferred® Card

When you open the Chase Sapphire Preferred, you’ll earn 80,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. This card’s annual fee is $95.

Chase Sapphire Reserve®

You’ll earn 50,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. This card has a $550 annual fee, which is not waived the first year. But cardholders get amazing perks like up to $300 in statement credits each account anniversary year, which offsets travel purchases for hotels, airfare, car rentals and much more.

The Chase Sapphire Reserve gets the most use among the cards in my wallet. I love earning bonus points for travel & dining purchases.

Bottom line

The World of Hyatt Credit Card comes with up to 50,000 Hyatt points after meeting tiered minimum spending requirements. It’s an outstanding card for folks who like luxury hotel stays in beautiful destinations. Hyatt doesn’t have many hotels, so if you like road-tripping or staying in small towns, you probably won’t get much use from Hyatt points.

But if you dream of staying in 5-star glam, you can’t get much better than this card. For example, using 50,000 Hyatt points can save you ~$1,200+ on a 2-night stay at the Park Hyatt Mallorca.

Remember, you can transfer Chase Ultimate Rewards points directly to Hyatt. One of the best parts about using Hyatt points is that there are no blackout dates. If you find a standard room available for sale, you can book it using points and you never pay a resort fee when you book an award night at Hyatt hotels.

You can apply for The World of Hyatt Credit Card here.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!