Brex Corporate Card for Startups Review: Strong Points Earning and Exclusive Discounts for the Right Type of Business Owner

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: Brex won’t pull your personal credit report when deciding to approve you for this card.

The Brex Corporate Card for Startups offers exclusive benefits and strong bonus categories in its rewards program for venture-backed startup companies who are willing to use Brex as their exclusive corporate card.

While there’s no welcome bonus, you’ll earn bonus points in categories like rideshare, restaurants and travel and get exclusive discounts and special offers worth tens of thousands of dollars.

Here’s our full Brex Corporate Card for Startups review.

Brex Corporate Card for Startups Review

Apply Here: Brex Corporate Card for Startups

You won’t earn any bonus points for signing up for the Brex Corporate Card for Startups. However, Brex has negotiated special offers with providers of key business tools – they claim these partner offers are worth over $50,000. Here are a few highlights:

- $5,000 in Amazon Web Services credit (over one year)

- $500 in Twilio credit (valid for one year)

- $436 Zendesk credit every month for one year

- Up to $150 in Google Ads credit

- Up to 15% off the first six months of a new WeWork office space

- 25% off a Salesforce subscription, up to $375 in savings

How to Earn Points With the Brex Corporate Card for Startups

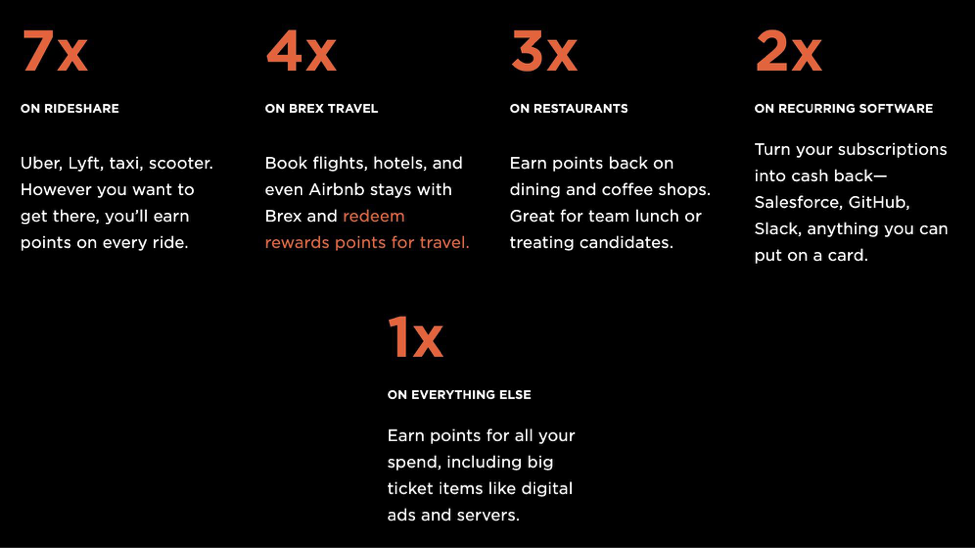

The Brex Corporate Card for Startups has some very enticing bonus categories that make it easy to earn Brex Rewards quickly:

- 7x Brex Rewards points per dollar (7% cash back) on rideshare, including Uber, Lyft, taxis and scooters

- 4x Brex Rewards points per dollar (4% cash back) on travel booked through the Brex Travel portal, including flights, hotels, and Airbnbs.

- 3x Brex Rewards points per dollar (3% cash back) on restaurants

- 2x Brex Rewards points per dollar (2% cash back) on recurring software subscriptions like Salesforce, Slack, Github, and Google’s G Suite.

- 1x Brex Rewards points per dollar (1% cash back) on all other purchases.

However, there’s one big catch – to get these bonus categories, Brex has to be your business’ exclusive corporate credit card. Otherwise, you’ll only earn 1x Brex Rewards points per dollar (1% cash back) in all categories!

How to Use Brex Rewards

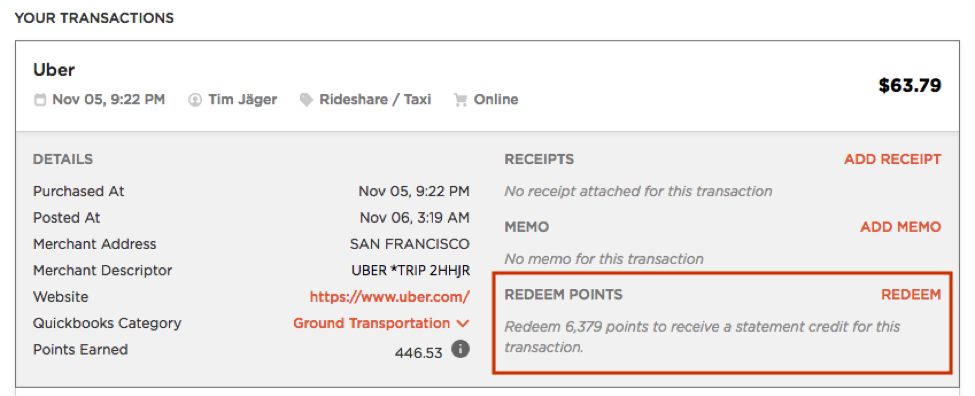

Each Brex Rewards point is worth 1 cent and can be redeemed for statement credits (that’s cash back in your pocket) or travel through the Brex Travel portal.

Redeeming points for statement credits is easy — all you have to do is select a transaction on your online account, then click “Redeem” under the “Redeem Points” section.

And you earn your rewards as soon as a transaction posts to your account — typically within two days of making a purchase — unlike most credit cards where you earn points after your monthly statement closes.

If you choose to redeem Brex Rewards for travel, you just have to book your trip through Brex Travel and select Brex Rewards as your payment method.

Brex Travel

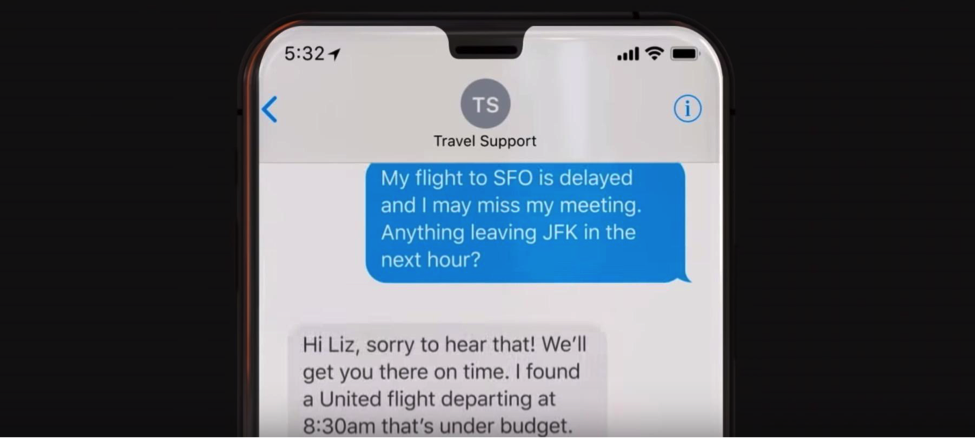

Booking travel with your Brex card or Brex Rewards gives you access to TravelBank, a premier travel booking portal designed for startups and small businesses. Unlike most credit card travel portals, Brex Travel offers a streamlined experience that makes it easy to book travel quickly while keeping your trips under budget.

You’ll get access to exclusive corporate discounts normally available to large companies, and an incentive program that rewards employees for saving you money by selecting less expensive travel options. You can also create profiles for each employee so all their details including frequent flyer numbers, seat preferences, and TSA PreCheck numbers are applied automatically for each trip. And best of all, you get free 24/7/365 support from real expert travel agents.

Brex Airline Transfer Partners

You can transfer Brex miles to:

- Singapore Airlines

- Cathay Pacific

- Avianca

- Flying Blue (the loyalty program of Air France and KLM)

- Aeromexico

- Qantas

You can transfer Brex points to these airlines at a 1:1 ratio if Brex is your business’ exclusive corporate credit card. If not, the transfer ratio will be 1.5:1 (1.5 Brex points = 1 airline mile).

Several of these airlines are remarkably useful. For example, you can use 16,000 Qantas miles to book roundtrip short-haul flights 600 miles or less on American Airlines. Or, you can reach Hawaii for as little as 24,000 Singapore Airlines miles roundtrip when you book on Alaska Airlines from the West Coast!

Brex Corporate Card for Startups Benefits

The Brex Corporate Card for Startups has a few key benefits that companies will likely find important.

No Fees or Interest

The Brex Corporate Card for Startups doesn’t have an annual fee. You pay no interest on your purchases because this is a charge card so you can’t carry a balance — Brex only makes money from the fees charged to merchants when you use your card. Payments are automatically deducted from your bank account every 30 days, so there are no late fees.

The first five cards on your account are free; additional users cost $5 per month.

High Credit Limits

Brex advertises credit limits 10-20x higher than most competing cards. Credit limits for the Brex Corporate Card for Startups are based on the amount of cash raised from venture capital, the amount of equity in your company and your business’ spending patterns.

No Impact on Your Personal Finances or Credit Report

The Brex Corporate Card for Startups is based on the creditworthiness of your business, not your personal finances. Most business credit cards hold you personally liable if the company fails to pay the bills, but Brex doesn’t require this. That also means the card has no impact on your personal credit score.

Build Business Credit

Brex reports to two major business credit agencies — Experian and Dun & Bradstreet — which helps you establish a credit history for your business, making it easier to get loans and financing in the future.

Bonuses for Referring Other Business Owners

If you refer another business owner to Brex and their application is successful, you’ll receive a $250 Amazon gift card after they spend $1,000 with their Brex card.

Does the Brex Corporate Card for Startups Charge Foreign Transaction Fees?

No.

Who Is Eligible for the Brex Corporate Card for Startups?

As its name suggests, this card is designed for startups. You must be a US based company incorporated as a legal entity like a Limited Liability Company (LLC), partnership, or corporation — unlike most business credit cards, sole proprietors are NOT eligible. You also must have at least $50,000 in your bank account at all times.

According to Brex’s FAQ, companies that are typically approved for a Brex Corporate Card for Startups are backed by venture capital firms and have at least $100,000 in their bank account when they apply.

Customer Support for the Brex Corporate Card for Startups

Brex offers 24/7 support via email, live chat and phone — and their phone number goes directly to a real person, with short hold times and no pressing buttons or struggling with a voice recognition system.

Cards Similar to the Brex Corporate Card for Startups

Established ecommerce businesses could consider the Brex Corporate Card for Ecommerce. Like the Brex Corporate Card for Startups, there’s no personal credit check to qualify and you won’t pay any fees, but you will require a substantial bank balance and revenue. One big bonus – you’ll have 60 days to pay your balance (as opposed to 30).

There’s no rewards program, but you’ll have access to similar discounts, credits and special offers. Here’s our full review of the Brex Corporate Card for Ecommerce for more details.

For owners who don’t have the revenue or structure to qualify for a Brex card but want a card that can help their business grow, The Blue Business®️ Plus Credit Card from American Express is a terrific pick, and you’re eligible as a sole proprietor. It has no annual fee (See rates and fees) and earns 2 Amex Membership Rewards points per dollar on the first $50,000 in purchases per year (then 1 point per dollar).

Plus, you’ll have the ability to spend above your credit limit if you have a large upcoming purchase. Here’s our review of the Amex Blue Business Plus to learn more.

Bottom Line

The Brex Corporate Card for Startups isn’t for your typical small business: it’s designed for venture-backed startups looking to maximize rewards on everyday business purchases, and willing to have their team use Brex as their exclusive corporate credit card.

If this describes you, you should definitely consider the Brex Corporate Card for Startups, especially if any of the exclusive sign-up offers are services you want to use for your company. Keep in mind Brex wants to see a business account balance of at least $100,000 when you apply, and you must keep a balance of at least $50,000 at all times. In return, you’ll receive a credit limit typically 10-20x higher than other business credit cards.

And if your business isn’t quite at the level Brex is targeting with this card, check out some of our favorite best business credit cards, like the Ink Business Preferred Credit Card or The Blue Business Plus Credit Card from American Express.

You can apply for the Brex Corporate Card for Startups here.

For more tips and tricks to make the most of your credit card spending, subscribe to the Million Mile Secrets newsletter.

For rates and fees of the Blue Business Plus card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!