Thanks to Million Mile Secrets readers for letting me know about their recent Barclaycard applications.

I’ve written about Barclaycard becoming much stricter about approving folks for more than 1 or 2 credit cards per year. And some readers have had existing accounts closed down when they’ve called the Barclaycard reconsideration line to ask for approval.

Why Do Folks Get Denied for a Barclaycard?

Like other banks, Barclaycard will look at your credit score and income before approving you for a card. But they are also quite picky about approving folks who apply for lots of cards!

This (very long) thread on FlyerTalk lists some of the reasons you get denied on Barclaycard applications. Other than having a credit score or income that is too low, the common ones are:

- Too many recent credit applications in general

- Too many recent Barclaycard credit applications

- Already enough credit available on existing Barclaycard credit cards

- Not using their existing Barclaycards enough ( a few purchases a month doesn’t seem to cut it!)

While in the past you could get 4 or 5 Barclaycards (sometimes all at once!), they’ve really tightened up their rules. If you’ve had a lot of recent credit applications, especially with Barclaycard, you might want to wait ~6 months before applying.

That said, I’ve noticed better luck getting approved if I reduce my available credit on outstanding Barclaycard cards or cancel ALL my existing Barclaycard cards and then reapply after a few months.

You should carefully consider your travel goals and spending habits before deciding which card is the best for you. And definitely apply for the card you want the most 1st…because you may not get another for a while!

Barclaycard Airline and Hotel Card Options

1. Barclaycard Arrival Plus® World Elite Mastercard®

Link: Barclaycard Arrival Plus® World Elite Mastercard®

Link: My Review of the Barclaycard Arrival Plus™ World Elite MasterCard®

The Barclaycard Arrival Plus® World Elite Mastercard® is essentially a cash back card. You earn 2 miles per $1 spent, but they can’t be transferred to airlines or hotels. Instead, you redeem them for statement credits towards regular purchases (0.5 cents per mile, not a good value) or travel (1.1 cents per mile).

You get:

- 40,000 miles (worth $400 if used towards travel) when you spend $3,000 in the 1st 3 months

- 5% of your miles back when redeemed for travel

- 2 miles per $1 spent on all purchases

- No foreign currency fees

- $89 annual fee, waived for the 1st year

This is a good card if you do a lot of cheap, coach class domestic travel. It gives you flexibility because you can use statement credits towards any airline, hotel, or cruise without worrying about blackout dates or restrictions.

It’s NOT a good card if you’re looking for First Class or Business Class travel. You’d have to spend ~$250,000 to earn ~$5,500 back for an international Business Class ticket, which is definitely not Big Travel for Small Money!

Note: Barclaycard will only allow you to use travel statement credits if the merchant codes the purchase as travel. Barclaycard defines travel as:

Airlines, Travel Agencies & Tour Operators, Hotels, Motels & Resorts, Cruise Lines, Passenger Railways and Car Rental Agencies as defined by the merchant category code. Purchases made at merchants that do not process transactions under these terms or that use incorrect MasterCard merchant category codes will not qualify.

So expenses like long-term parking while you’re away on vacation don’t count.

If you cancel the card with miles still in your account, you will lose the miles! Read my post about how to keep your miles before canceling this card.

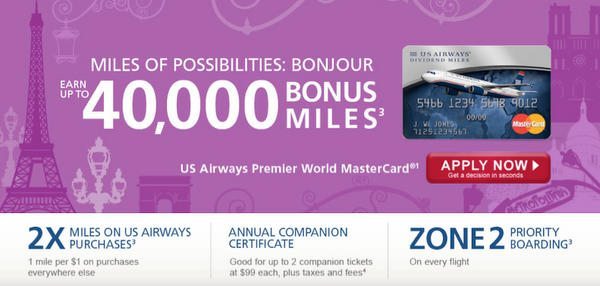

2. Barclaycard US Airways MasterCard

Update: This card is no longer available for new sign-ups.Link: Barclaycard US Airways Card

Link: My review of the Barclaycard US Airways card

The best current offer for the Barclaycard US Airways card is for 40,000 miles after your 1st purchase. This is better than my affiliate link for only 30,000 miles. But I’ll always tell you about a better offer even if it doesn’t pay a commission.

You get:

- 40,000 miles after your 1st purchase

- Up to 10,000 miles (1 mile per $1) on balance transfers within the 1st 90 days (I wouldn’t recommend this as you’ll pay balance transfer fees)

- Earn 2 miles per $1 you spend on US Airways

- Earn 1 mile per $1 you spend on other purchases

- You can book award flights on US Airways for 5,000 fewer miles

- 2 companion certificates each year

- Early boarding, First Class check-in, and 1 free US Airways Club Lounge pass per year

- 3% foreign currency fee

- $89 annual fee, NOT waived for the 1st year

I like that you can book US Airways award tickets for 5,000 fewer miles if you have this card. So the 40,000 mile sign-up bonus can be used for 2 low-level domestic round-trip tickets because each ticket would only cost 20,000 miles. Normally, domestic round-trip tickets are 25,000 miles, so this is a good deal!

I don’t like when cards don’t waive the annual fee for the 1st year. But you’re essentially paying $89 for 2 domestic round-trip tickets, so it’s worth it. Plus you get other perks like priority boarding and a free US Airways Club lounge pass (worth ~$50).

The 2 companion certificates that come with the card can be redeemed for $99 companion tickets within the Continental US and Canada. This means if you buy a paid ticket (it must be at least $250) your companion flies with you for $99 plus taxes and fees. So it could be a good deal if you plan on buying US Airways tickets.

But this card charges a 3% foreign transaction fee, so it’s not good for using outside of the US.

Note: US Airways and American Airlines are merging, so I’m not sure how much longer Barclaycard will offer this card. And US Airways will be leaving the Star Alliance very soon, so you won’t be able to use your miles on Star Alliance airlines like before.

You can read how the merger is affecting US Airways and American Airlines credit card holders and decide if it’s still a good card for you.

3. Barclaycard Hawaiian Airlines MasterCard

Link: Barclaycard Hawaiian Airlines Card

Link: My review of the Barclaycard Hawaiian Airlines card

The Hawaiian Airlines card was recently re-launched by Barclaycard (it used to be issued by Bank of America). It offers:

- 35,000 miles after spending $1,000 in the 1st 3 months

- Free 1st checked bag (for the primary cardholder only, and only if you use your card and buy tickets from Hawaiian Airlines directly)

- 50% discount on 1 companion ticket between Hawaii and North America

- Discounts on award tickets

- No foreign currency fees

- $89 annual fee, NOT waived for the 1st year

You could use 35,000 miles for travel on Hawaiian Airlines or their partner airlines (like American Airlines, Virgin America, JetBlue, etc). Or you can transfer them to Hilton hotel points and use them for hotel stays. But transferring to Hilton isn’t as good as it used to be.

I wouldn’t go out of my way to apply for this card, unless you have a specific need for Hawaiian Airlines miles (a vacation to Hawaii for example).

4. Barclaycard Frontier Airlines MasterCard

Link: Barclaycard Frontier Airlines Card

Link: My review of the Barclaycard Frontier Airlines card

Frontier might not be the 1st airline that comes to mind for domestic travel, but they fly to a lot more places than you might think. This card gets you:

- 40,000 miles after spending $500 in the 1st 3 months

- 10,000 miles (1 mile per $1) on balance transfers in the 1st 3 months (not recommended because of balance transfer fees)

- 2 miles per $1 you spend on Frontier

- 1 mile per $1 you spend on other purchases

- 5,000 mile discount on companion tickets

- 3% foreign currency fee

- $69 annual fee, NOT waived for the 1st year

I like the sign-up bonus on this card because of the low spending requirement to get 40,000 miles. Most airlines charge 25,000 miles for a round-trip domestic ticket, but Frontier only charges 20,000 miles.

And companion tickets get a 5,000 mile discount. So with 40,000 miles you could get 2 domestic round-trip tickets (20,000 and 15,000 miles each) with 5,000 miles left over.

This might be a card to consider if Frontier has good service to your airport. Otherwise, I wouldn’t go out of my way to get it.

5. Barclaycard Lufthansa Miles & More MasterCard

Link: Lufthansa Barclaycard

Link: My review of the Lufthansa Barclaycard

Miles & More is the frequent flyer program for Lufthansa, Swiss, Austrian, and several other European airlines.Last year, I wrote about the increased 50,000 mile sign-up bonus on the Lufthansa Barclaycard. The current offer is only for 20,000 miles, which is not very good. I’d wait for the 50,000 mile offer to come back.

With this card, you get:

- 20,000 miles after your 1st purchase

- 15,000 miles (1 mile per $1) on balance transfers in the 1st 30 days (not recommended because of balance transfer fees)

- 2 miles per $1 you spend on Miles & More airline partners

- 1 mile per $1 you spend on other purchases

- 1 companion ticket per year

- No foreign currency fees

- $79 annual fee, NOT waived for the 1st year (except for Miles & More elite members)

I’ve written that there are lots of ways you can use Lufthansa miles. But be warned that Lufthansa and many of their partners add high fuel surcharges to award tickets.

Either way, I wouldn’t apply for this card right now. It will be a much better deal if the 50,000 mile sign-up offer returns, but I don’t know when that will happen.

6. Barclaycard Wyndham Rewards Visa

Link: Barclaycard Wyndham Card

Wyndham Rewards is the loyalty program for budget hotels like Wyndham, Ramada, Super 8, Howard Johnson, Travelodge and Microtel. This card gives you:- 30,000 points after your 1st purchase

- 5 points per $1 you spend on Wyndham hotels

- 2 points per $1 you spend on other purchases

- 5,500 points each year on your card anniversary

- 3% foreign currency fee

- $69 annual fee, NOT waived for the 1st year

You can redeem Wyndham points for free nights, starting at 5,500 points per night at a low level hotel and going as high as 50,000 points for their top category. So if you stay in budget hotels a lot, this could be a good card to consider. Remember that it charges foreign currency fees, so it’s not a good card for traveling outside the US.

You can get more from your Wyndham points by transferring the points to airlines including Southwest, American, Alaska, US Airways and United. And if you transfer to Southwest, the points count toward the Companion Pass, which lets a companion fly with you for ~free on Southwest.

But the transfer ratio to Southwest isn’t very good. You need 6,000 Wyndham points to get 1,200 Southwest points. So the sign-up bonus of 30,000 points converts to only 6,000 Southwest points.

You could buy 6,000 Southwest points from Southwest for $165. So you’d be better off getting the Barclaycard Arrival Plus™ World Elite MasterCard®, because the $400 travel credit sign-up bonus is worth more than that!

I’d only transfer from Wyndham to Southwest if I really needed a few extra points for the Companion Pass.

I wouldn’t get this card just to stay at Wyndham hotels, because I like other chains much better. But if you stay in their hotels often, or need some extra points for the Southwest Companion Pass, this might be a card to think about.

7. Barclaycard Best Western Rewards MasterCard

Link: Barclaycard Best Western Card

The Barclaycard Best Western card earns Best Western Rewards points. The sign-up bonus is for 16,000 points, which sounds like a lot – but 1 night at the lowest category Best Western hotel costs 8,000 points (and there are very few of these hotels!). So at best the sign-up bonus will get you 2 free nights.

This card offers:

- 16,000 points after your 1st purchase

- 15 points per $1 you spend at Best Western

- 1 point per $1 on other purchases

- Gold Elite status (and Diamond Elite after you spend $10,000 in 1 year)

- NO annual fee

Points can also be transferred to several airlines, including American, Alaska, Delta, Southwest and US Airways.

The sign-up bonus isn’t good at all. And Gold Elite status only gets you a 10% point bonus on stays (no room upgrades or extra perks).

While it’s a fee-free card, and could help increase your credit score if you keep it for a long time, there are many Barclaycard offers that are better. So I definitely wouldn’t apply for the card unless you know you’ll frequently be staying at Best Western hotels. Even then, you could get more travel with the Barclaycard Arrival Plus® World Elite Mastercard®.

8. Barclaycard Choice Privileges Visa

Link: Barclaycard Choice Card

The Choice Privileges Rewards Program includes Quality Inn, Comfort Inn, Clarion, Econolodge and other budget hotels. The 32,000 point sign-up bonus could be used for 4 nights at a low-level hotel (8,000 points per night), and there are lots to choose from. However, you have to actually stay at a Choice hotel to get the full bonus.

With this card, you get:

- 8,000 points after your 1st purchase

- 24,000 points after your 1st Choice hotels stay (paid with your card)

- 15 points per $1 you spend at Choice hotels

- 2 points per $1 you spend on other purchases

- Gold Elite status

- 3% foreign currency fee

- NO annual fee

But many folks don’t know you can also redeem Choice points for stays at Ascend Collection and Preferred Hotels. Both are groups of luxury independent hotels and resorts. So you could use the sign-up bonus towards 1 night at a resort like Las Brisas Ixtapa in Mexico or Gran Melia Golf Resort in Puerto Rico.

Points can also be transferred to airlines, including Southwest. Converting Choice points to Southwest is 1 of the easiest (and cheapest) ways to get extra points towards the Companion Pass!

This card has no annual fee, so it’s a good card to keep for a long time and possibly improve your credit score.

This is a good card for folks who stay in budget hotels (AND you’ve got all the better Barclaycard cards), or if you’re looking to stay at some of the independent luxury hotels Choice has partnered with (that you wouldn’t be able to stay at with points otherwise!).

But keep in mind you could always use Barclaycard Arrival Plus® World Elite Mastercard® miles toward stays at independent hotels, too. I’d rather get the ~$400 from the Barclaycard Arrival Plus™ World Elite MasterCard® than the Choice hotel card!

Bottom Line

Barclaycard has become much more strict about issuing credit cards. Now, most folks can get only 1 or 2 cards a year from Barclaycard.

There are many Barclaycard travel cards to choose from. Before deciding to apply, you should think about your travel goals and your spending habits. Then pick 1 or 2 that best suit your needs and 1st apply for the 1 you like the best.

If I had to pick, I’d apply for the Barclaycard Arrival Plus® World Elite Mastercard® and Barclaycard US Airways cards. But your goals might be different, so do what makes sense for you!