Million Mile Secrets reader, The Reaper Grim (thanks!!), emailed me to let me know that the Chase 100,000 mile British Airways credit card is back!

Chase offered 100,000 miles for the British Airways credit card in November 2009 (when Emily and I both got the card), and in May this year. And Online Travel Review has hinted that the 100,000 offer would be back soon.

“Quit babbling.” you say. “Where’s the link?”Well, the current offer is not as straightforward as the previous offers where you got the 1st 50,000 miles after the 1st purchase and the 2nd 50,000 mile after spending $2,500 within 3 months.

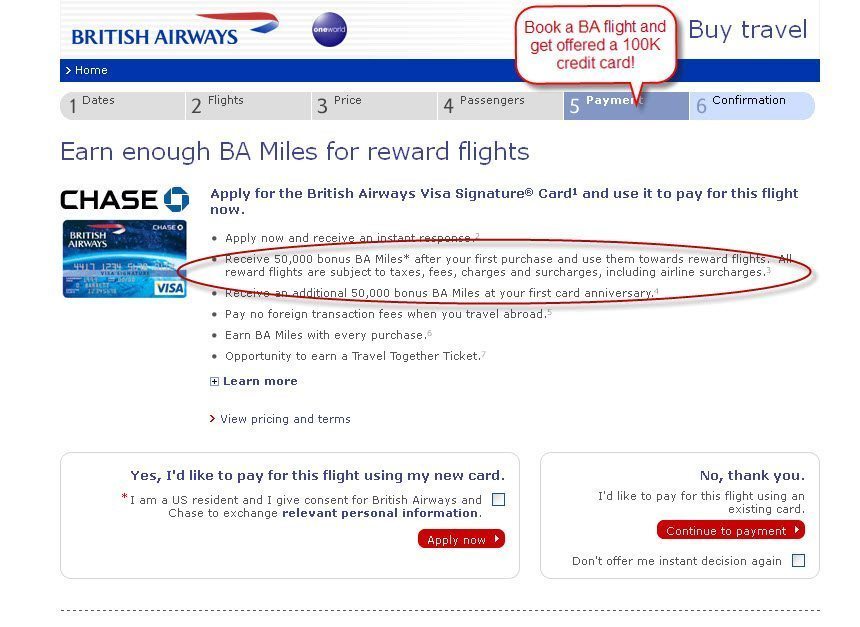

The current offer appears only when you try to book a ticket on British Airways and get to the payment screen. The terms of the offer are also different – you have to book a BA flight and then you get an option to apply for the card and use it to pay for the flight. You get a 50,000 mile bonus after your 1st purchase and another 50,000 after your 1st anniversary.

After you select flights and enter in your information, you get to a screen which says (bolding mine):

“Apply for the British Airways Visa Signature® Card1 and use it to pay for this flight now.”Apply now and receive an instant response.2

Receive 50,000 bonus BA Miles* after your first purchase and use them towards reward flights. All reward flights are subject to taxes, fees, charges and surcharges, including airline surcharges.3

Receive an additional 50,000 bonus BA Miles at your first card anniversary.4“

In its current version, the 100,000 mile British Airways credit card is not terribly attractive, because you have to:

1) Book a ticket on British Airways and apply for the British Airways credit card to use towards that ticket.

2) You get the 2nd 50,000 miles only after 1 year of holding the card.

But this is good news because it suggests that Chase is experimenting with different versions of the British Airways 100,000 mile offer and is surely measuring the results of each iteration of the 100,000 offer.

Most corporations slash their budgets during the last few months of the year in a misguided effort to meet the financial goals set by Wall Street’s finest (research analysts). So I wouldn’t expect a lot of big offers until the new year when marketing managers have a new budget and permission to go on new card member acquisition binges.

On the other hand, the British Airways award chart is changing in November, and there could be another lucrative credit card offer to get more US members to sign-up.

Bottom Line:I wouldn’t suggest applying for the current version of the 100,000 British Airway credit card offer, but to wait for a version which doesn’t require booking a British Airways ticket and a 1 year wait to get the 2nd 50,000 miles.

The US credit card market is saturated and the main way to grow is to steal market share from other banks. I suspect we haven’t seen the last of the 100,000 mile (or more) mega credit card offers!

(Hat Tip to The Reaper Grim!)Or like me on Facebook or follow me on Twitter.