Chase Southwest Premier Business Card review

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

We’re big fans of Southwest here at Million Mile Secrets. With its allowance of two free checked bags, no change or cancellation fees, friendly customer service and an increasing list of destinations in the U.S. (including Hawaii) and abroad, there is a lot to like.

In addition, the Southwest® Rapid Rewards® Premier Business Credit Card is one of the best Southwest credit cards out there and serves as a fast track to earning the Southwest Companion Pass, which we crown the best deal in travel.

Here’s our Southwest Premier Business card review to help you determine if it’s the right card for you.

Southwest Premier Business card review

Current bonus

The Southwest Premier Business Credit Card comes with a 60,000 Southwest point sign-up bonus after you spend $3,000 on purchases in the first three months of account opening. You can redeem that bonus for multiple round-trip flights and even more if you have the Companion Pass.

Southwest points are, on average, worth ~1.5 cents per point, so the 60,000-point sign-up bonus is worth ~$900 in travel. If you have the Southwest Companion Pass, the sign-up bonus could be worth nearly double that. If you are interested in earning the Companion Pass, the Southwest Premier Business card is a terrific way to boost your points balance, because both the sign-up bonus and the points you earn from spending count toward the 125,000 points required to get the Companion Pass.

Benefits and perks

This isn’t a great rewards credit card for everyday spending. Here are the Southwest points you can earn with the card:

- 3X points on Southwest Airlines purchase

- 2X points with Southwest and Rapid Rewards hotel and car rental partner purchases

- 1X Southwest points on all other purchases

You’ll also receive 6,000 bonus points each account anniversary year (i.e. every time you pay the annual fee). The Southwest Premier Business card comes with a host of benefits, including

- Primary rental car insurance

- Lost-luggage reimbursement and baggage-delay insurance

- Extended warranty and purchase protection

For more details on all the protections offered by the card, check our guide to the Southwest Premier Business card’s benefits and perks.

How to redeem points

Southwest points are worth on average 1.5 cents each, but because there is no Southwest award chart, the actual cost for an award ticket will depend on your destination, how far in advance you book, the time of day and other factors that impact the price.

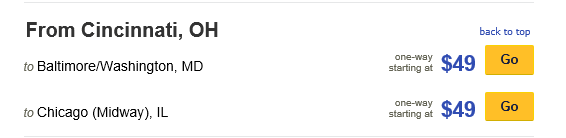

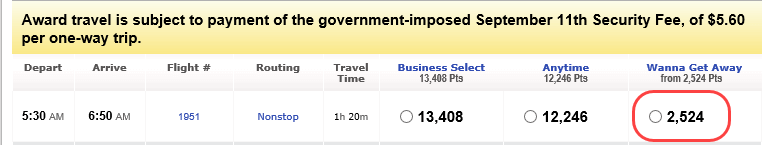

If you are flexible with your travel plans, you can find some incredible values. For example, Southwest frequently has sales with fares starting as low as $49 one-way or less. In that case, you would have to spend just 2,524 Southwest points plus ~$6 in taxes for the flight, making these sales one of the best ways to use Southwest points.

With the 60,000-Southwest-point welcome offer, you could take 23 of these flights with this deal. That’s an incredible value from one travel credit card bonus and there’s no rush to use your points because Southwest points don’t expire.

Is the Southwest Premier Business card worth it?

If you use this card to earn a Companion Pass, it’s one of the top travel credit card deals currently available. When you earn the Companion Pass, you can bring a friend or family member along on paid and award tickets for just the cost of taxes and fees. To qualify for the Companion Pass, you’ll need to earn 125,000 qualifying Southwest points in a calendar year. Points earned from the Southwest Rapid Rewards Premier Business Credit Card’s 60,000-point sign-up bonus count toward that total. After earning 125,000 Southwest points, the Companion Pass is valid for the remainder of the calendar year and the entire following year.

Chase will only allow you to have one Southwest personal credit card. So the easiest way to earn this bonus is by:

- Opening one personal card and one business card and earning their bonuses

- Opening both Southwest business cards and earning their bonuses

Using points with the Companion Pass effectively doubles the value of the points, since your companion’s ticket will be almost free (you’ll just pay taxes and fees). For example, on the flight deal I found earlier, a one-way ticket for both you and your companion would cost a total of 2,524 points plus ~$11 in fees. However, if you have Southwest status your companion won’t share your status perks.

Even if your travel plans don’t line up with a Southwest fare sale, the price of an award flight is tied to the cost of a paid ticket, so when fares go down, award prices do too. If you find a deal, you could squeeze several round-trips out of the bonus.

Who is the Southwest Premier Business card for?

If you want to stock up on Southwest points, this airline credit card has you covered. It is a small business credit card, but almost any income you earn outside your regular job can qualify you as a business owner. You could also be eligible if you’re working as an independent contractor (Uber, Lyft, delivery services) or freelancer, which makes you a sole proprietor. And, if you’re a sole proprietor, you don’t need an Employee Identification Number (EIN) to apply for the card. A sole proprietor can just use their name (as the business name) and Social Security number (as the tax ID) in the application. If you’re just starting your business or side hustle it’s even possible to qualify for the card as a brand new business owner with almost no business income.

For more tips on applying, read our step-by-step guide to completing a Chase business card application. Also, if you have already setup a Southwest account you’ll want to add your Rapid Rewards number to your application, otherwise a duplicate account may be created under your name.

The Southwest Premier Business Credit Card falls under Chase’s strict approval rules. If you’ve opened five or more credit cards within the past 24 months from any bank (except Chase business cards and certain other business credit cards), you will not be approved for the card. Also, you cannot open a new Southwest Premier Business Card if you currently have the card or have earned a sign-up bonus from the card in the past 24 months.

The card comes with an annual fee of $99. Small-business owners who want a credit card with no annual fee or a business cash-back credit card should consider other travel credit cards first, like the Ink Business Cash® Credit Card.

Insider tip

Chase business cards won’t appear on your personal credit report, that means you can be approved for the Southwest Premier Business card without adding to your Chase 5/24 count.

Pairing the Southwest Premier Business with other cards

Chase has four other Southwest cards with slightly different perks, benefits and earning rates. You can only hold one personal Southwest card at a time, but if you’re interested, you have the following three personal options and one other business-card option with the following sign-up bonuses:

- Southwest Rapid Rewards® Plus Credit Card- Earn 40,000 bonus points after spending $1,000 on purchases in the first three months your account is open.

- Southwest Rapid Rewards® Premier Credit Card – Earn 40,000 bonus points after spending $1,000 on purchases in the first three months your account is open.

- Southwest Rapid Rewards® Priority Credit Card – Earn 40,000 bonus points after spending $1,000 on purchases in the first three months your account is open.

- Southwest® Rapid Rewards® Performance Business Credit Card – Earn 80,000 points after you spend $5,000 on purchases in the first three months of account opening

Bottom line

With the Southwest Rapid Rewards Premier Business Credit Card, you’ll earn 60,000 Southwest points after meeting minimum spending requirements. This is a small-business card, but you don’t have to be a big corporation to qualify.

The 60,000-Southwest-point sign-up bonus is enough for ~$900 in airfare on Southwest (effectively doubled if you have the Companion Pass). The points you earn count toward the 125,000 Southwest points needed to qualify for the Companion Pass, which is our favorite deal in travel.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!