Don’t Stop Short! Get the Most From ALL of Your Cards Perks!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

AMEX has a new line-up of Hilton cards. And there was much rejoicing!

Now that you’ve got your shiny new card, it’s time to start planning to make the most of its benefits! Because there are few things more disappointing to a miles & points enthusiast than realizing you missed out on something free. 🙁

And sometimes it’s not completely clear when (or if!) you can get a perk again. For example, certain credits reset every calendar year, while others are tied to your card anniversary.

Million Mile Secret Agent Jane asked:

I just upgraded my Hilton Honors Ascend Card from American Express to the Hilton Honors Aspire Card from American Express. I think the anniversary date, which is in May, stays the same. Can I use the $250 Hilton resort credit now and get another $250 Hilton resort credit after May since this credit is per cardmember year?

Yes you can, Jane! When a card benefit is listed as “per cardmember year” or “account anniversary year,” you’ll get the benefit again on your anniversary date. But not all perks work this way. Some will be “per calendar year” which is January to December, regardless of when you opened the account.

This is an important distinction, because the benefits on your AMEX Hilton Aspire card do NOT all follow the same rules!

Don’t Miss Out on Your Perks!

Not every benefit that comes with your credit card is automatic. Sometimes there are specific restrictions or you’ll have to make an extra step to take advantage of the perk. This is especially true for “premium” credit cards that typically have higher annual fees.

So here are 3 things to do to make sure you never miss out on a card’s money saving perk again!

1. Do NOT Miss Your Benefit’s Deadline!

Typically, credit card perks do NOT roll over from year to year. So it’s use it or lose it!

Jane’s anniversary date is in May, which is when the $450 annual fee is due on her AMEX Hilton Aspire card (See Rates & Fees). This is also when the $250 Hilton resort credit will reset. So if she doesn’t use all of her Hilton resort credit before her anniversary date, she’ll lose it!

But the $250 airline incidental credit is tied to the calendar year. So she’ll want to use that statement credit before the end of December 2018. And then she’ll be able to get the same credit again in January 2019.

For folks who are visual learners, this is what Jane’s cardmember and calendar years look like.

If you want to know the specifics of your card’s benefits, be sure to read through the card’s terms and conditions. If you threw those away, you should be able to find them online.

Also, occasionally your card benefits will change or be updated and it could affect how you plan to use your benefits. So it’s important to pay attention to any notifications you get from your bank. For example, last year the Chase Sapphire Reserve card’s $300 travel credit changed from being renewed after each calendar year to a cardmember anniversary reset.

2. Know When the Perk Applies & When It Doesn’t

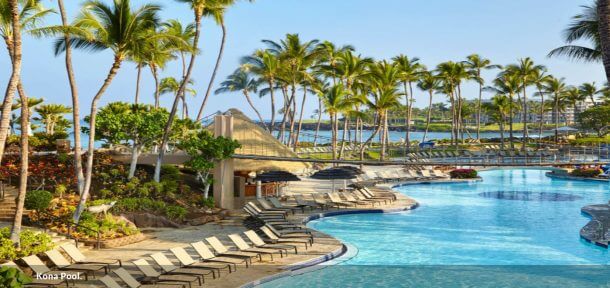

Jane’s $250 Hilton resort credit is only valid for purchases made directly with Hilton resorts. So make sure you check the list before you book a stay.

Room rates and incidentals you charge to your room and pay for with your AMEX Hilton Aspire when you check out will qualify. But if you eat at the resort’s restaurant and charge the meal directly to your AMEX Hilton Aspire card, you will NOT get the credit!

And the AMEX Hilton Aspire’s airline credit is valid for incidental charges like baggage fees or lounge pass purchases with your selected airline. But airfare purchased with your airline won’t be reimbursed.

Lots of credit cards earn bonus miles & points for certain categories of spending. So you can multiply the rewards you earn on your everyday purchases, but you’ll have to remember which bonuses apply to your card. Some folks find it easier to keep track of these perks (and annual fees) by creating a spreadsheet.

3. Take the Extra Step to Get Your Card’s Benefits

One of the other great AMEX Hilton Aspire card perks is the up to $250 airline incidental credit you’ll get per calendar year. The terms for the airline credit state:

To receive statement credits of up to $250 per calendar year toward incidental air travel fees, card member must select one qualifying airline

This works like the The Platinum Card® from American Express & The Business Platinum® Card from American Express airline credits. So be sure to select an airline you want to receive the credit with by calling the number on the back of your card or choosing one online.

And some cards come with memberships like Priority Pass lounge access (including the AMEX Hilton Aspire!) or free Gogo in-flight Wi-Fi passes. But sometimes you’ll have to activate these perks to get the benefit.

Bottom Line

Once you’ve been approved for a credit card and earned the bonus, you’re not done earning Big Travel with Small Money! Because many cards come with valuable perks that can more than offset even large annual fees.

But you’ll want to make sure you don’t miss out on valuable rewards. So it’s important to understand how all of your perks work. Because sometimes you’ll need to activate certain benefits to take advantage of them.

When your card has credits that renew annually, be sure to pay attention to whether it resets per cardmember year or per calendar year. Because there is big difference between them! Your cardmember year starts when you open the card and continues until your anniversary date. But a calendar year is from January to December.

Thanks for the question, Jane!

Take your miles & points knowledge to the next level, subscribe to our newsletter!

For rates and fees of the Hilton Aspire Card, click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!