Uncovering the Mystery of the US Bank Travel Portal: A Step-by-Step Guide

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Are you hopelessly over the Chase “5/24” rule? Not sure where to look for your next big bonus?

If so, getting the U.S. Bank Altitude™ Reserve Visa Infinite® Card could be a good deal for you. It currently comes with a 50,000 Altitude point bonus after spending $4,500 on purchases in the first 90 days of card membership.

You can’t transfer the points to travel partners, but you can redeem them for 1.5 cents per point toward airfare, hotels, and rental cars booked through the US Bank travel portal. So the bonus is worth $750 in travel (50,000 Altitude point bonus X 1.5 cents per point)!

To get the most out of your Altitude points you’ll need to first navigate the US Bank travel portal. So here is the help you need – a step-by-step guide!

Million Mile Secret Agent David shared:

I recently applied for this card and I can tell you that it’s not easy to use the travel awards! You have to jump through a lot of hoops and use a rather unfriendly portal.

And there are some strange restrictions. You can’t cancel reservations, so you just lose the points if you cancel! And you cannot pay with a combination of points and cash for plane tickets. Plus, you pay a penalty for canceling a hotel reservation even if the hotel doesn’t impose one.

Could you go into detail on those in this or the next post? I am seriously thinking of just redeeming points for statement credits to avoid future aggravation!

Thanks for the comment, David!

David is right. The US Bank travel portal is a bit different than other bank portals. The biggest downside is that you aren’t able to pay with cash and points. So you’ll need to have enough points to cover the entire booking.

And while there are some potential extra fees and restrictions, I don’t think they are extreme enough to warrant giving up 50% of your points’ potential value by redeeming them for a statement credit at 1 cent per point.

That said, everyone’s situation is different. So let’s take a look at the US Bank Altitude Reserve card and how to book Big Travel with Small Money through the US Bank travel portal.

US Bank Altitude Reserve Visa Infinite Card

Link: US Bank Altitude Reserve Visa Infinite Card

The US Bank Altitude Reserve card comes with a 50,000 Altitude point bonus (worth $750 in travel) after spending $4,500 on qualifying purchases within 90 days of account opening.

And you’ll earn:

- 3 Altitude points per $1 on travel purchases

- 3 Altitude points per $1 on mobile wallet purchases (like Apple Pay or Samsung Pay)

- 1 Altitude point on all other purchases

- $325 in travel credit every cardmember year (you can NOT get it twice before the 2nd annual fee is due)

- Complimentary membership to Priority Pass Select airport lounges, with 4 free entries per year for you and 1 guest (you will NOT get additional memberships for authorized users)

- 12 free Gogo in-flight Wi-Fi passes per calendar year

- Global Entry or TSA PreCheck fee credit of up to $100, available every 4 years

The $400 annual fee is NOT waived the first year. And authorized users are an extra $75 each per year. But the card comes with enough perks to help offset the fee.

You can redeem Altitude points for 1 cent each as a statement credit or even pay the $400 annual fee with 35,000 Altitude points. But you’ll get the most bang for your buck (1.5 cents per point) if you use your Altitude points to book airfare, hotels, or rental cars through US Bank’s travel portal.

You must have an existing relationship with US Bank in order to be approved for this card. But lots of accounts count as an “existing relationship” including auto loans, checking or savings accounts, and credit cards.

US Bank Travel Portal Restrictions

US Bank has slightly stricter rules than other travel portals. For example, if you book airfare through the Chase Travel Portal, you can usually get your points refunded if you cancel within the first 24 hours of booking. And after that 24-hour window, any refunds or cancellations are subject to the airline’s rules.

But flight and hotel bookings through the US Bank travel portal are immediately governed by the hotel or airline policies. So once you book travel with your Altitude points, you can NOT get them back.

If you booked airfare or a hotel that allows changes or refunds, then you might still get something back (travel voucher, etc.). How much you are refunded will depend on the fees charged by the airline or hotel. Also, US Bank could charge an additional $30 fee for flight changes and a $25 fee for hotel changes. But a US Bank phone representative I talked to said you should be able to call and get these fees waived.

All rental car reservations are non-refundable and cannot be changed. So if you’re planning on using your Altitude points for a rental car, make sure your plans are 100% set first.

How to Book Travel With the US Bank Travel Portal

To book through the US Bank travel portal, first log into your US Bank account.

These screenshots are for booking a flight, but you’ll follow very similar steps for reserving hotels or rental cars.

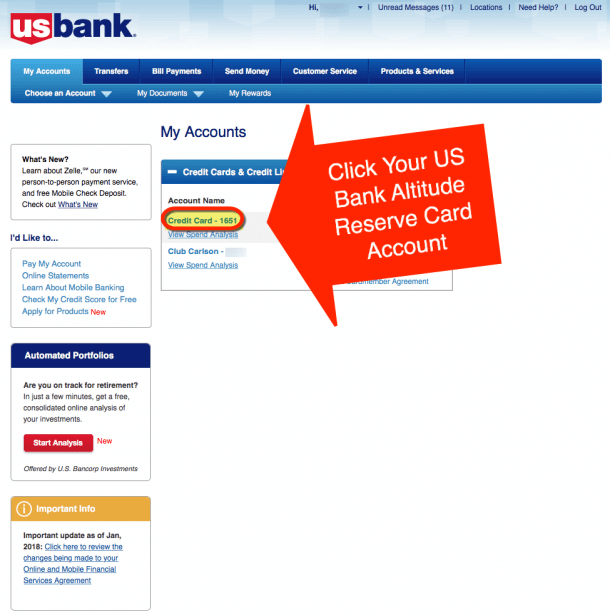

Step 1. Select Your US Bank Altitude Reserve Card Account

Once you’ve logged into your account, click on your US Bank Altitude Reserve card account.

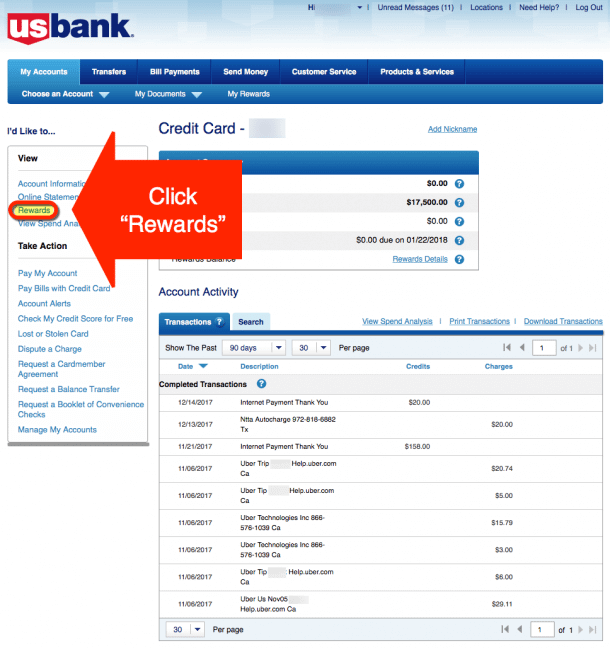

Step 2. Click the “Rewards” Link

Then, on the left side of the screen, click the “Rewards” link.

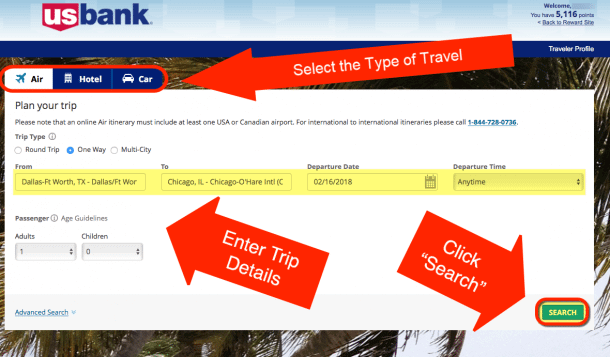

Step 3. Enter Your Trip’s Details

Next, pick the type of travel you want to book (flight, hotel, or rental car).

Now you’ll need to enter your trip details and click the “Search” button to continue.

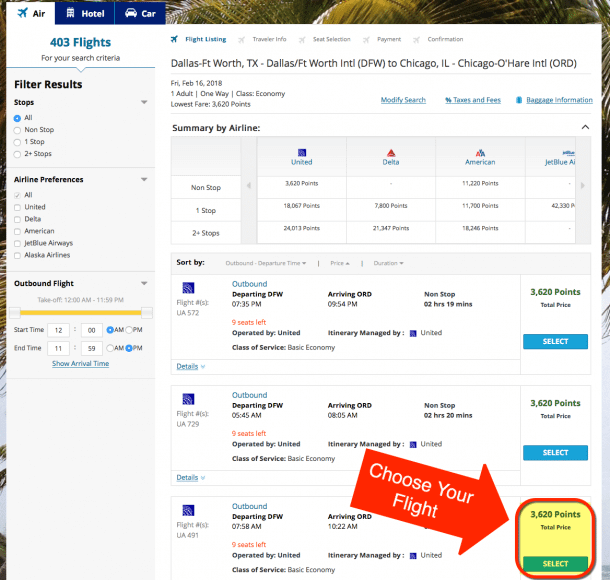

Step 4. Choose Your Flight

Choose the specific flight, hotel, or rental car you want to reserve.

If you need to, you can refine your search with the options on the left side of the screen.

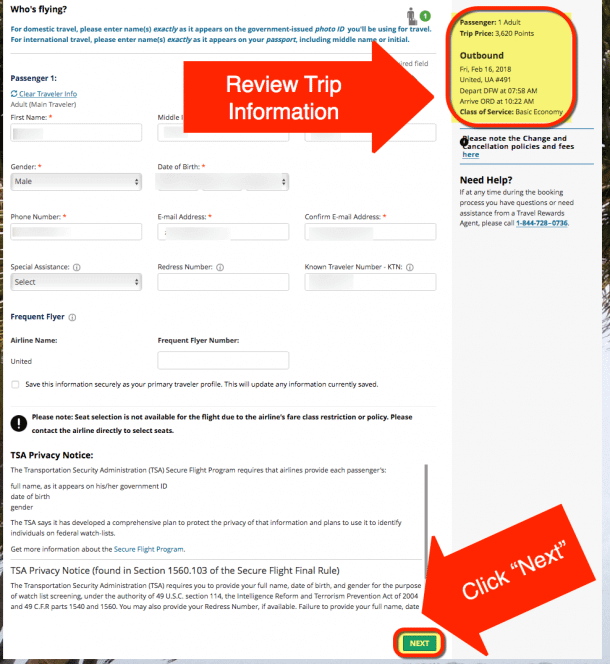

Step 5. Review Your Trip Details

This is your chance to double check that you selected the travel you want to book.

After confirming your trip’s details, enter your personal information and click “Next.”

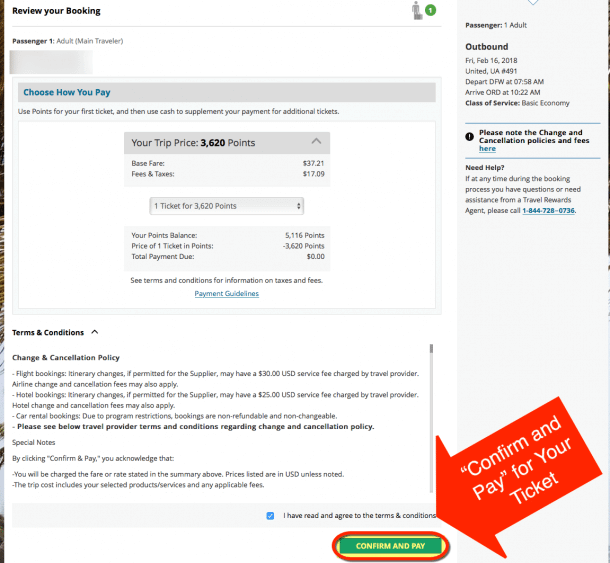

Step 6. Confirm & Pay for Your Travel

To complete your booking, agree to the terms & conditions and click the “Confirm And Pay” button.

And you’re finished!

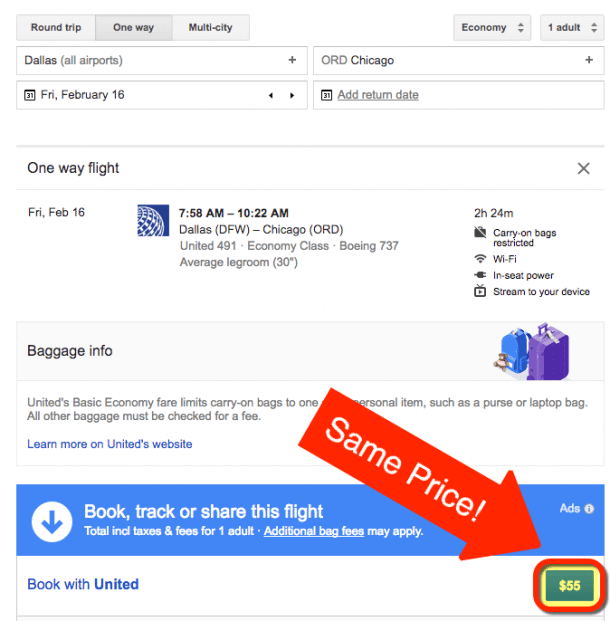

Always Make Sure You’re Getting the Best Deal

When you’re paying for travel through sites like the US Bank travel portal, it’s always a good idea to double check you’re getting the best price. I’ve written about how to find the best price for rental cars. And if you looking for deals on hotels, you’ll usually find them on the hotel’s website.

If you want to find the lowest price for airfare, I recommend using Google Flights, because it’s quick and easy to search for the flights you want. And in this case, Google Flights confirmed I am not paying more for my flight with the US Bank travel portal!

Just remember, when you’re reserving hotels or rental cars through the US Bank travel portal, you will NOT earn points. And your elite status will usually not be recognized. But booking flights with the US Bank travel portal will earn you miles. So make sure to add your loyalty number to the reservation!

Bottom Line

The US Bank Altitude Reserve card is a great card for folks in certain situations. But to get the most value for your Altitude points (1.5 cents each!), you’ll need to book your travel through the US Bank travel portal.

The US Bank travel portal is similar to other portals, but there are more restrictions. For example, you don’t have the option to pay with cash and points. And there could be extra fees charged for changes made to hotel or airfare bookings.

So make sure you read the fine print before making your travel plans!

Do you have the US Bank Altitude Reserve card? If so, what has your experience been like with the US Bank travel portal? Let me know in the comments!

And thanks for the question, David!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!