Review: AMEX Starwood Business Credit Card Can Get You Over $1,000 in Hotel Stays

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

A lot of changes have come with the Marriott and Starwood merger. Including revamped cards, like the Starwood Preferred Guest® Business Credit Card from American Express!

The card comes with a welcome offer of 75,000 Marriott points after spending $3,000 on purchases within the first 3 months of account opening. You can potentially turn that into over $1,000 worth of hotel stays!

The Starwood Preferred Guest Business Credit Card is perfect for small business owners who travel often for work and want to earn status faster at Marriott, or for folks looking to boost their Marriott point total and stay at over 6,500 hotels around the world!

I’ll run through the details of this offer and help you decide if it’s a good pick for you!

Starwood Preferred Guest Business Credit Card Review

Apply Here: Starwood Preferred Guest® Business Credit Card from American Express

The Starwood Preferred Guest Business Credit Card currently has a welcome offer of 75,000 Marriott points after spending $3,000 on purchases within the first 3 months of account opening.

The $95 annual fee is waived the first year, so you have ~11 months to test drive the card and see if you like it. Even better, you can get a value of much more than the annual fee because you get a free night award every year after your card account anniversary which you can redeem at hotels worth up to 35,000 points per night.

How you use those points depends on what you are looking for. You can book longer stays at Marriott’s budget-friendly hotels like the Courtyard Orlando Lake Buena Vista, where you can book a 3-night stay for free using your welcome bonus!

Or splurge on an unforgettable stay at incredible resorts, like Marriott’s Maui Ocean Club right on Ka’anapali Beach where my wife and I went for our honeymoon. We were a 5-minute walk from Black Rock where we swam with sea turtles!

How to Earn Points With the Starwood Preferred Guest Business Credit Card

With the Starwood Preferred Guest Business Credit Card, you will earn 2 Marriott points per $1 spent on all purchases. However, the real power of this card comes from the additional categories that earn even more points:

- You earn 6 Marriott points per $1 spent on eligible purchases at participating Starwood and Marriott hotels

- You also earn 4 Marriott points per $1 spent at US restaurants, US gas stations, wireless telephone services purchased directly from US service providers, and on US shipping purchases

In order to reach the minimum spending required to earn the 75,000-point welcome offer from your Starwood Preferred Guest Business Credit Card, you’ll earn at least an additional 6,000 points for your $3,000 in spend, giving you 81,000 Marriott points total!

How to Use Your Marriott Points

Redeeming the Marriott points you earn with the Starwood Preferred Guest Business card is easy! Log into your Marriott account and search the dates and city you are looking for. Make sure you check the “Use rewards points” box to ensure the results come back with the number of points your stay will cost.

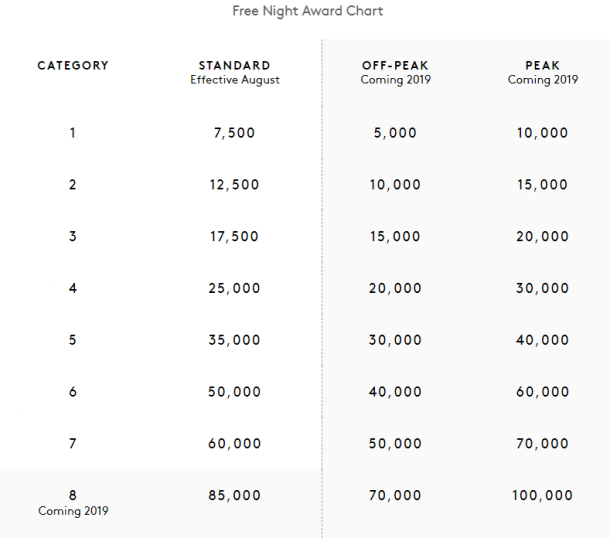

You’ll want to use Marriott’s new award chart to view how much each tier of hotel costs. Or you can search Marriott’s category page for hotel prices directly. With the 75,000-point bonus, you could get 15 Category 1 off-peak nights (off-peak awards coming in 2019)!

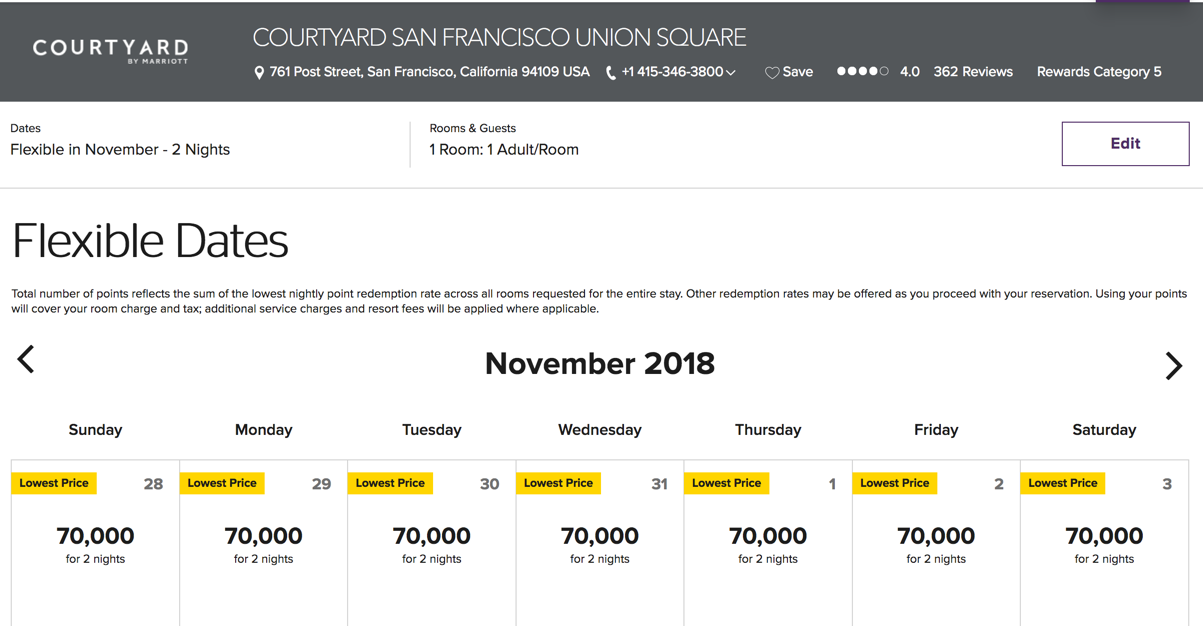

If you are flexible, you can use the Flexible Date Calendar to show you which hotels are available and how many points it’ll cost to stay there. Once Marriott implements its peak pricing in 2019, this will be a very useful feature when trying to plan your stay!

Another interesting development as a result of the Marriott – Starwood merger is the ability to transfer your Marriott points to partner airlines like Delta and British Airways!

You will be able to transfer your points to most airlines at a 3:1 ratio, so 60,000 Marriott points would give you 20,000 airline miles. Additionally, you’ll get a 15,000-point bonus when you transfer 60,000 points, so you’ll really receive 25,000 airline miles for your 60,000 Marriott points.

While you might want to hold onto your Marriott points for hotel stays, the extra flexibility you get from being able to transfer your points is extremely valuable.

Benefits of the Starwood Preferred Guest Business Card

In addition to the great welcome offer and nice bonus spending categories, the Starwood Preferred Guest Business Credit Card comes with a ton of great benefits! I’ll walk you through all the extras you’ll get with your new business card.

Free Night Award

This perk alone easily negates the $95 annual fee on your Starwood Preferred Guest Business card. Beginning your first account anniversary, you’ll receive 1 free night award each year which you can redeem for hotels that cost 35,000 points or less. Hotels in the 35,000-point range include really great locations like the Boscolo Exedra Nice, Autograph Collection, which can cost $300+ per night! We stayed there and were able to book our stay using Marriott points from a welcome offer.

Complimentary Silver Elite Status

You’ll start the year off with complimentary Silver Elite status, which gives you nice perks like a 10% bonus on points earned during stays and priority late checkout. You also have the ability to earn Gold Elite Status after spending $30,000 on your card in a calendar year ($35,000 starting in 2019) which will give you even more benefits!

Free Boingo Wi-Fi

With your Starwood Preferred Guest Business Credit Card you’ll get free, unlimited Wi-Fi on up to 4 devices at more than 1,000,000 hotspots worldwide with the Boingo American Express Preferred Plan.

Free Employee Cards

This is a great perk for small business owners who delegate spending to their employees. You’ll earn the same points on your employee cards as you would on your own, with no additional fee!

Extended Warranty

When you make eligible purchases using your Starwood Preferred Guest Business card, the original manufacturer’s warranty can be extended up to 2 additional years on eligible warranties of 5 years or less. That will allow you to skip paying for an additional warranty on expensive purchases!

Purchase Protection

Accidents happen. When you make eligible purchases using your Starwood Preferred Guest Business card, those purchases are protected from accidental damage or theft for up to 120 days. That’s great for people like my mom who dropped her brand-new Pixel XL 2 phone 2 weeks after buying it!

Is the Starwood Preferred Guest Business Card Worth the Annual Fee?

In my opinion, YES! For folks who plan on staying at a Marriott or Starwood hotel even just one night per year, the free night award more than makes up for the annual fee! Depending on where you stay, you can even come out a couple hundred dollars ahead! And remember, the $95 annual fee on the Starwood Preferred Guest Business card is waived the first year.

Does the Starwood Preferred Guest Business Card Have a Foreign Transaction Fee?

No.

Who Is Eligible for the Starwood Preferred Guest Business Card?

This is where the Marriott / Starwood merger gets a little tricky. One thing to remember is that you’re only eligible for the welcome bonus on an AMEX card once, per card, per lifetime. So if you’ve received the welcome bonus on the Starwood Preferred Guest Business card before, you won’t be eligible for the 75,000 point bonus.

Additionally, you’re restricted from earning the intro bonus if:

- You have or had a Chase Marriott Business card in the past 30 days

- You received an intro bonus or upgrade bonus for a Chase Marriott Rewards Premier Plus Credit Card or a Chase Marriott Rewards Premier card in the past 24 months

- You were approved for a Chase Marriott Rewards Premier Plus card or a Chase Marriott Rewards Premier card in the past 90 days

Here’s a post outlining the restrictions for all of the Chase and AMEX Marriott/Starwood cards.

If you are a small business owner and you meet the above criteria, take a look at our AMEX small business card application guide. We’ll walk you through the application process!

Remember, you don’t need an EIN (Employer Identification Number) or have to be a large corporation to apply for a business credit card. You can apply with your social security number as a sole proprietor and be approved as long as you operate a small business. There are many activities you probably already do that will qualify you as a small business!

Customer Support for the Starwood Preferred Guest Business Card

AMEX is well-known for its great customer support services and fraud protection. I have personally had fraudulent charges quickly removed from my AMEX card in the past, and a new card sent to my home in just a few days.

AMEX has this fraud protection built into their cards. They also offer Roadside Assistance Hotline and a Global Assist Hotline for a fee which help you in case you find yourself requiring assistance while traveling.

Credit Cards Similar to the Starwood Preferred Guest Business Card

If you are not eligible for the welcome bonus because you’ve had the Starwood Preferred Guest Business card in the past, an alternative is the Starwood Preferred Guest® Credit Card from American Express which also offers 75,000 Marriott points after you spend $3,000 on purchases in the first 3 months of account opening.

This card earns 6 Marriott points per $1 spent at Marriott and Starwood hotels and then 2 Marriott points per $1 spent on other purchases. You lose the 4 point tier that the business card offers, but you do still get the 1 free night award every year after your account anniversary date. The $95 annual fee is also waived the first year.

Bottom Line

The Starwood Preferred Guest® Business Credit Card from American Express currently comes with a welcome bonus of 75,000 Marriott points after spending $3,000 on purchases within the first 3 months of account opening.

The Starwood Preferred Guest Business Credit Card is perfect for small business owners who travel often for work or for folks looking to boost their Marriott point total. Remember, you can potentially turn 75,000 Marriott points into over $1,000 worth of hotel stays!

The $95 annual fee is waived the first year so you have ~11 months to try out the card and see if you like it. Even better, the annual fee is essentially negated because you get 1 free night award every year after your card account anniversary, which you can redeem at hotels worth up to 35,000 points. That’s like getting a 35,000 point bonus every year you hold the card!

Just pay attention to the restrictions when applying for Chase and AMEX Marriott/Starwood cards.

Let me know your favorite ways to redeem Marriott points, especially with the new award chart!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!