Reader Nina Earns Over Half a MILLION Miles & Points Every Year With Her Small Business! And She’s Sharing Her Strategy!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Welcome to the next installment of our Small Business Card Reader Success Series, where Million Mile Secrets readers share how they opened a small business credit card to get Big Travel with Small Money!

Small Business Card Interview: Ascertainment Marketing, Inc

Nina shares her success as a small business owner to help others learn how to earn and use miles & points to make their travel dreams a reality!

Please introduce yourself and tell us a bit about your small business.

Hi, my name is Nina and I live in Knoxville, Tennessee. I’ve owned a media buying agency since 1996, and negotiate and purchase advertising buys for clients.

I work out of my home and have raised 2 girls as a single mom with this business. One of my daughters now works in Boston and and the other just started college this year!

Why did you decide on the card(s) you chose?

The first business card I ever applied for, The Business Gold Rewards Card from American Express OPEN, I have had for over 20 years. About 5 or 6 years ago, they added a bonus of 3X AMEX Membership Rewards points per $1 you spend in 1 of 5 categories (you get to choose), on up to $100,000 in spending. And one of those categories is advertising! How lucky am I?

That means that starting every January, when I spend $100,000 on advertising, I wind up with 300,000 AMEX Membership Rewards points. I actually got my husband to sign-up for the card too, so we could earn 600,000 AMEX Membership Rewards points each year!

That’s not my only business card. I also have the Chase Ink Business Plus (no longer available) and Chase Ink Business Preferred, both the AMEX Delta Gold and Platinum Delta small business cards, The Business Platinum® Card from American Express, Starwood Preferred Guest® Business Credit Card from American Express, and the Chase Southwest business card.

I use my Chase Ink Business Plus (no longer available) card for all my internet and cable charges. And use the Chase Ink Business Preferred for my cell phone bill because of the insurance. Otherwise, my AMEX Business Gold card is my go-to card, unless I’ve hit the $100,000 maximum spending to earn 3X AMEX Membership Rewards points on advertising purchases.

At that point, I charge any advertising charges over $5,000 to the AMEX Business Platinum card, to get 1.5X AMEX Membership Rewards points.

For any other spending, I alternate cards based on my travel goals. Sometimes, I’ll use my Chase Sapphire Preferred Card (a personal card) for advertising expenses that are under $5,000. Because I like earning and using Chase Ultimate Rewards points.

Describe the application. ex. Did you apply as a sole proprietor with your social security number or some other way?

My business is corporation and I have an EIN (Employer Identification Number), so I apply for cards with that.

One of my daughters recently signed-up for the Chase Ink Business Preferred card using her social security number. And was approved with her income of ~$600 per month. So I wouldn’t worry too much about using your social security number, no matter how small your business might be.

I apply for a new business card every few months and have never ever been turned down. When I recently applied for the AMEX Delta Platinum small business card, American Express did say that I had hit my limit with credit cards and had to close one. So I chose to close my Starwood Preferred Guest Credit Card from American Express.

Approximately how much annual small business income did you list on your application? (Or if you’re not comfortable sharing that, which factors do you think lead to your applications being approved?)

My income changes from year to year, but I have never been denied a card. So I would say the approvals would have been based on any income from $50,000 to $150,000 per year.

Again, I don’t think income is the decisive factor. I have a credit score in the low 800s, always pay my credit cards in full, and have a total credit line of over $250,000 between the cards I have.

And remember, my daughter was approved for the Chase Ink Business Preferred with an annual income of just $7,200!

What would you tell someone who’s never applied for a small business card?

Don’t hesitate! In many ways, a business card is easier to apply for than a personal one. And yes, while on occasion the minimum spending requirements are higher, the bonus usually is too!

Obviously, I would make sure that you qualify for a business card in the first place, and then go for it! For example, my daughter sells jewelry and has parties where she makes her money.

Also, look for special offers or higher bonuses on categories you spend a lot on. Does your business ship packages often? Do you have high internet and cell phone bills? Do you spend money on digital advertising? If so, there are certain cards that can help you accumulate a large number of rewards!

Now the fun part! How do you plan to use your miles or points to get Big Travel with Small Money? 🙂

Let me make it clear, I only travel for fun! Fortunately, I don’t have to travel for business (although I often wanted to when my kids were driving me crazy!).

I made my first trip completely on miles & points ~7 years ago, after a breast cancer diagnosis. With my doctors’ blessing, a month after surgery I headed to Italy with some girlfriends.

I had enough miles & points for all of us. And my girlfriends paid me the point value, which was considerably lower than the ticket. Then I had cash for the trip! It was a win-win for all of us. 🙂

That particular trip got me completely hooked on miles & points. I don’t think I have paid for a flight since!

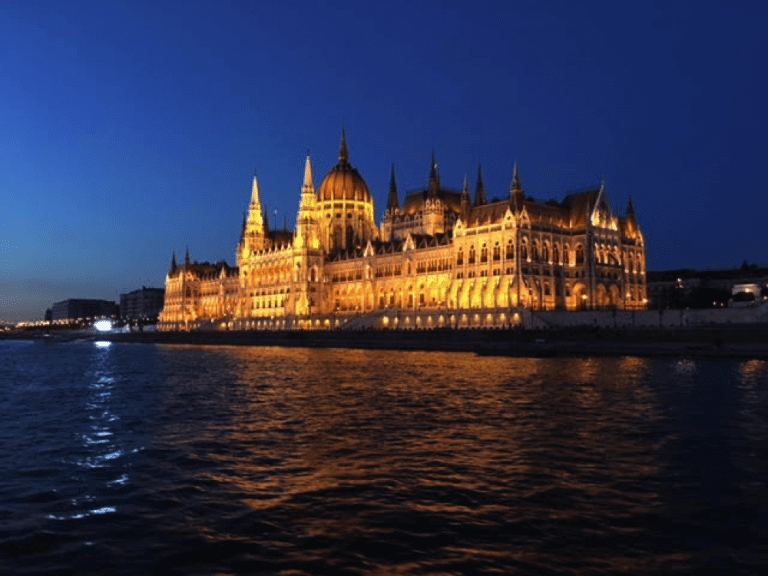

Two years ago I married a wonderful man who also loves to travel, and since then, we have been to Spain, Portugal, Ireland, Cancun, Hungary, Croatia, Cuba, Thailand, Vietnam, and Tokyo…all on miles & points! Not to mention, traveling around the US for concerts, music festivals and good beer!

Our most recent trip to Asia would have cost us ~$12,000 had we paid cash. But with miles & points, we only spent ~$500 in fees.

Everything (and I mean everything!) I have learned about this hobby was from Daraius and Million Mile Secrets. And I owe them a huge debt of gratitude for my free travels.

Want to Share Your Story?

If you’d like to share your small business card success, please send me a note! Emily and I would love to hear about how it went for you!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!