eBay Sellers: Don’t Miss Out on Easy Miles, Points, or Cash Back in 2018!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.| Card Name | Welcome Bonus |

|---|---|

| The Business Platinum® Card from American Express | Up to 75,000 AMEX Membership Rewards points Earn 50,000 Membership Rewards points after you spend $10,000 on purchases and an extra 25,000 points after you spend an additional $10,000 on purchases in the first 3 months from account opening |

| Ink Business Preferred℠ Credit Card | 80,000 Chase Ultimate Rewards points (worth $800 in cash back or $1,000 in travel) after you spend $5,000 on purchases in the first 3 months from account opening |

| Ink Business Cash℠ Credit Card | 30,000 Chase Ultimate Rewards points (worth $300 in cash back) after you spend $3,000 on purchases in the first 3 months from account opening |

| Capital One® Spark® Miles for Business | 50,000 Capital One Spark miles (worth $500 in travel) after you spend $4,500 on purchases in the first 3 months from account opening |

| Capital One® Spark® Cash for Business | $500 cash back after you spend $4,500 on purchases in the first 3 months from account opening |

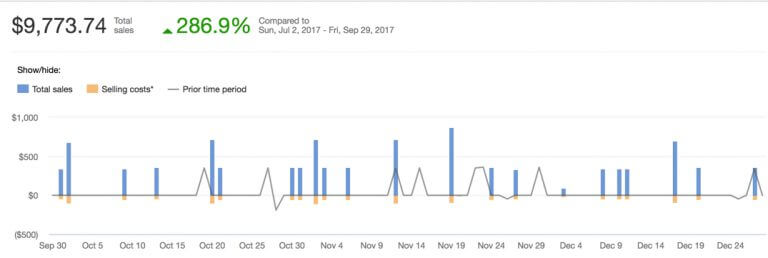

Selling on eBay can be a very rewarding side hustle. Just ask team member Keith who has earned 500,000+ points drop shipping sewing machines. He’ll tell you about some of the best credit cards for eBay sellers!

Keith: Thanks, Daraius! Selling items for a profit on eBay can qualify you for a small business card. This means you can unlock valuable new cardmember welcome bonuses!And you can generate miles, points, or cash back purchasing products or paying expenses related to your business. Plus, some cards includes useful bonus spending categories, like office supply stores. This means you can earn bonus rewards just by using the right card!

Some eBay sellers (including me) use multiple small business cards to take advantage of the perks that each one offers. For example, certain cards offer a way to save money on purchases with select merchants. This means you can use these cards to buy items at a discount and resell them for a profit.

Enhance eBay Profits by Earning Miles & Points With Small Business Cards!

Link: How to Qualify for a Small Business Credit Card (And Why You Should Get One!)

Link: Earn Big Miles & Points With These 7 Quick Small Business Ideas

Qualifying for a small business card with an eBay side hustle is easier than you might think.You have the option to enter your social security number on a business card application instead of an EIN (Employer Identification Number). Here are step-by-step guides to completing business card applications with AMEX and Chase.

Remember, you’re personally responsible for the charges on a business credit card. So banks look at your total income and credit score when evaluating your business credit card application. So it’s possible to get approved for a business card with minimal business income if the rest of your credit profile is strong.

Besides earning valuable rewards, using a business card helps me keep personal and business expenses separate! This makes it easy to track income and expenses!

The best card for your eBay business will depend on your travel goals. My preference is to earn miles & points to save money on award flights and hotels, which helped my wife and I take recent trip to New Zealand and Australia. But I know some folks prefer earning straightforward cash back.

Here are my top 5 cards picks for eBay sellers.

1. AMEX Business Platinum

Link: The Business Platinum® Card from American Express

Link: My Review of the AMEX Business Platinum

The AMEX Business Platinum card earns flexible AMEX Membership Rewards points, which you can transfer directly to 20 AMEX airline or hotel partners.

When you apply for the AMEX Business Platinum card, you’ll earn:

- 50,000 AMEX Membership Rewards points after you spend $10,000 on purchases in the first 3 months of account opening.

- 25,000 AMEX Membership Rewards points after you spend an additional $10,000 on qualifying purchases within the same timeframe

This is a huge minimum spending requirement. But you can likely put a big dent in the requirement by purchasing merchandise for your eBay store or using drop shipping.

With the Business Platinum card, you’ll also get:

- 1.5X AMEX Membership Rewards points on single purchases of $5,000+

- 5X AMEX Membership Rewards points when you book airfare and hotels through the AMEX travel portal

- 35% of your points back for ALL First Class or Business Class flights booked through the AMEX travel portal using Pay With Points

- 35% of your points back for all flights, including coach tickets, booked with your selected airline through the AMEX travel portal using Pay With Points

- Up to $200 in statement credits per calendar year for airline incidentals with your selected airline (luggage fees, in-flight food & drink, etc.)

- Ability to book hotel stays through AMEX Fine Hotels & Resorts

- Statement credit for Global Entry or TSA PreCheck

- Terms & limitations apply

This card has a $450 annual fee, which is NOT waived. But it’s not difficult to offset the fee by taking advantage of a few perks, like statement credits for airline incidentals or Global Entry.

2. Chase Ink Business Preferred

Link: Ink Business Preferred℠ Credit Card

Link: My Review of the Ink Business Preferred Card

With the Ink Business Preferred, you earn flexible Chase Ultimate Rewards points, which you can transfer to terrific airline and hotel partners like Hyatt and Singapore Airlines.

When you sign-up for the card, you’ll earn 80,000 Chase Ultimate Rewards points after you spend $5,000 on purchases in the first 3 months from account opening. You also get:

- 3X Chase Ultimate Rewards points for every $1 you spend on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites, and search engines (up to a maximum of $150,000 in combined purchases per account anniversary year)

- 1X Chase Ultimate Rewards points on all other purchases

- Up to $600 in cell phone insurance when you pay your cell phone bill with the card

So you’ll earn a 3X bonus on shipping, which is a common eBay seller expense. And you can pay your internet and phone bill to earn bonus points and get coverage for your cell phone.

The card has a $95 annual fee, which is NOT waived the first year. But the sign-up bonus is worth at least $800 in cash back or $1,000 in travel.

Keep in mind, the Ink Business Preferred card is impacted by Chase’s tighter application rules. So if you’ve opened 5+ cards from any bank (NOT counting Chase business cards and these other business cards) in the past 24 months, it’s unlikely you’ll be approved for this offer.

3. Chase Ink Cash

Link: Ink Business Cash℠ Credit Card

Link: My Review of the Chase Ink Cash Card

The Chase Ink Business Cash card is a great no-annual-fee card option for folks selling on eBay.

You can earn 30,000 Chase Ultimate Rewards points ($300 cash back) after spending $3,000 on purchases in the first 3 months from account opening.

With this card, you also get:

- 5X Chase Ultimate Rewards points (5% cash back) on the first $25,000 spent in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services each account anniversary year

- 2x Chase Ultimate Rewards points (2% cash back) on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year

- 1% cash back on all other purchases

So shopping at office supply stores (like Staples or Office Depot) for your eBay business can earn you 5% cash back!

You can redeem points linked to your Ink Business Cash Credit Card account for cash back or toward a trip through the Chase travel portal. Or you can combine points to one of the below cards to transfer points to hotel and airline partners:

- Chase Sapphire Preferred Card

- Chase Sapphire Reserve

- Ink Business Preferred Credit Card

- Chase Ink Plus (no longer available)

- Chase Ink Bold (no longer available)

Like the Ink Business Preferred, it’s tougher to get approved for the Ink Cash because of Chase’s stricter application rules.

4. Capital One Spark Miles for Business

Link: Capital One® Spark® Miles for Business

Link: My Review of the Capital One Spark Miles Card

Capital One has a straightforward rewards program, which means their miles are easy to redeem! Just pay for travel expenses (like airfare, hotel stays, parking, and much more) with your credit card. Then, log-in to your account and “erase” the charge by redeeming your miles.

When you sign-up for the Capital One Spark Miles card, you’ll earn 50,000 Spark miles (worth $500 in travel) after spending $4,500 on purchases within the first 3 months. And you’ll earn 2X Spark miles per $1 you spend on all purchases.

Million Mile Secrets reader Susan says UPS shipping purchases code as travel. This means eBay sellers can redeem Spark miles to offset these charges!

This card has a $95 annual fee, which is waived the first year. Just keep in mind, if you’re new to miles & points, you might consider waiting to get this card after applying for valuable Chase cards.

5. Capital One Spark Cash for Business

Link: Capital One® Spark® Cash for Business

Link: My Review of the Capital One Spark Cash Card

The Capital One Spark Cash card is terrific for eBay sellers who prefer to earn straightforward cash back.

When you sign-up for the Capital One Spark Cash card, you’ll earn a $500 cash sign-up bonus after spending $4,500 on purchases within the first 3 months of account opening. You’ll also earn unlimited 2% cash back on all purchases! This is essentially like saving 2% off each purchase.

And the card’s $95 annual fee is waived the first year!

Keep in mind, Capital One pulls your credit score from the 3 main credit bureaus when they process your application. This can have a bigger temporary effect on your credit score than applying for credit cards issued by other banks.

Bottom Line

Whether you’re a full-time eBay seller or just do it as a side hustle, you can earn valuable miles, points, or cash back by using the right rewards credit card.

These are the top 5 business cards team member Keith recommends to eBay sellers:

- AMEX Business Platinum

- Chase Ink Business Preferred

- Chase Ink Cash

- Capital One Spark Miles for Business

- Capital One® Spark® Cash for Business

Remember, selling on eBay is an easy side activity that can make you eligible for a small business card. You can apply using just your social security number, so there’s no need to have an EIN (Employer Identification Number).

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!