“The 5 Cards I’m Using the Most Right Now” – Jason

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you want more Big Travel with Small Money, you’ll need to earn the most miles or points per $1 spent. And that usually requires having more than 1 credit card in your wallet.

Every credit card has different bonuses and perks. So it’s important to know your travel goals and to get the best combination of cards for your situation.

I asked Million Mile Secrets team members to share which 5 credit cards they’re using the most. My hope is that you’ll be inspired to take your miles & points hobby to the next level. Here’s team member Jason!

Jason: Thanks, Daraius! I enjoy knowing that the purchases I’m making are working for me and getting me closer to my next adventure. Once I know where I want to travel, it’s much easier to keep the right cards (for me) in my wallet.

“The 5 Cards I’m Using the Most Right Now” Series Index

I’m Planning for the Future With These 5 Cards

I like to know that I’m always getting the best deal, so having credit cards that earn bonus points on the purchases I make the most often is important to me. But it’s not the only thing I take into consideration.

Credit card sign-up bonuses are the easiest way to get Big Travel with Small Money. When I decide which cards to get and keep, I’m always thinking of the next big bonus. I’ve been applying for more small business cards because some of them won’t appear on my personal credit report. So I’ll soon be under the Chase “5/24” rule!

Once that happens, I’ll apply for our favorite card for small businesses, the Chase Ink Business Preferred. If you don’t qualify for a business card, don’t worry. There are still plenty of great options for you, like our favorite card for beginners (Chase Sapphire Preferred) and the card with the easiest to use rewards (Capital One® Venture® Rewards Credit Card).

Or maybe you’ll end up wanting 1 of the 5 cards I use the most!

1. Chase Sapphire Preferred® Card

Link: Chase Sapphire Preferred® Card

Link: Review of the Chase Sapphire Preferred® Card

The Chase Sapphire Preferred earns 2 Chase Ultimate Rewards points per $1 spent on travel or dining purchases. So this is the card I use any time I eat out and for travel purchases from airfare to Uber.

But the bonus categories are small potatoes compared to what I save with the card’s other benefits. I don’t own a car, so when I’m traveling or visiting family and friends, I usually rent one. I always pay with the Chase Sapphire Preferred because it comes with primary rental car insurance, which saves me $100s on every rental!

And in the future, my wife can refer me to the card for an extra bonus.

2. AMEX Platinum Delta Business Card

Link: Platinum Delta SkyMiles® Business Credit Card from American Express

Link: 70,000 Delta Miles for an Easy $700 Flight or a ~$9,751 Business Class Flight

I got this card when the bonus was 70,000 Delta miles after meeting the minimum spending requirement. Because you can only earn the sign-up bonus on an AMEX card once per lifetime, I wanted to get it while the bonus was high. And AMEX small business credit cards do not appear on your personal credit report. So I’ll still be able to earn lucrative bonuses on Chase credit cards in the future.

I’m currently trying to meet the minimum spending for this card, so I’m paying my big business expenses with it. And I’ll earn the bonus once I pay my estimated quarterly taxes.

Afterward, I probably won’t use it as much, because I value flexible points more than Delta miles. But I might keep the card because of it’s first checked bag free benefit. And I usually can save $100s a year with the AMEX offers I get on the card.

3. Chase Freedom® Card

Link: Chase Freedom®

Link: Chase Freedom Card Review

Because I have a Chase Sapphire Preferred card, my Chase Freedom is MUCH more valuable to me. The Chase Freedom normally only earns non-transferable Chase Ultimate Rewards points.

But you can transfer Chase Ultimate Rewards points from one card to another. So I pool all of my points onto my Chase Sapphire Preferred then transfer them to travel partners like United Airlines and Hyatt.

The Chase Freedom card has rotating quarterly bonus categories that earn 5 Chase Ultimate Rewards points per $1 (5% cash back) on up to $1,500 in combined purchases each quarter. When it makes sense for me, I try to earn the maximum bonus each quarter because I’ll be able to earn up to 30,000 Chase Ultimate Rewards points a year ($1,500 quarterly spending X 5X category bonus X 4 times per year)!

The information for the Chase Freedom has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

4. Chase Ink Business Cash Card

Link: Ink Business Cash℠ Credit Card

Link: Best No-Annual-Fee Business Card: AMEX or Chase?

Until I can get the Chase Ink Business Preferred card, I’ll be using the Chase Ink Cash card for most of my business purchases. I can transfer the Chase Ultimate Rewards points I earn from my Chase Ink Cash to my Chase Sapphire Preferred.

The Chase Ink Business Cash earns 5 Chase Ultimate Rewards points per $1 spent (5% cash back) in combined purchases at office supply stores and on cellular phone, landline, internet and cable TV services up to $25,000 each account anniversary. So I typically put my phone and internet bills on this card.

It has no annual fee, so I keep it year after year.

5. AMEX EveryDay® Preferred Card

Link: AMEX EveryDay® Preferred Credit Card

Link: My Review of the AMEX EveryDay Preferred

The AMEX EveryDay Preferred card earns 3 AMEX Membership Rewards points per $1 on up to $6,000 per year on purchases at US supermarkets. So I use it for most of my grocery shopping.

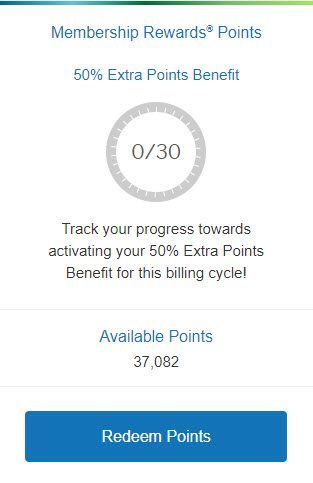

And you get a 50% bonus on points earned during any billing cycle that you make 30 or more purchases. I usually put small purchases (under $5) on the card so I can get the bonus with as little spending as possible!

I like collecting AMEX Membership Rewards points because they transfer to Delta at a 1:1 ratio. So they are perfect for topping off my Delta account if I need more miles for an award.

Bottom Line

Jason uses these 5 cards the most right now:

- AMEX EveryDay® Preferred Credit Card

- Chase Freedom®

- Chase Sapphire Preferred® Card

- Ink Business Cash℠ Credit Card

- Platinum Delta SkyMiles® Business Credit Card from American Express

He uses his AMEX EveryDay Preferred card to earn 3X AMEX Membership Rewards points per $1 on US supermarket purchases (up to $6,000 per year). And he earns 7,500 Chase Ultimate Rewards points quarterly with his Chase Freedom card, which he then transfers to the Chase Sapphire Preferred so he can convert the points to United Airlines miles or Hyatt points.

Jason likes to set himself up to earn future bonuses. So he got the AMEX Platinum Delta Business card. Because AMEX business cards don’t appear on your personal credit report, he can stay under the Chase “5/24” rule. And later, he’ll still be eligible for the big bonus on the Chase Ink Business Preferred card!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!