The Credit Card Trick That’s as Easy as Picking up the Phone

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Lots of miles and points enthusiasts use and keep cards with annual fees, because the benefits and rewards they earn far outweigh the yearly expense. But some folks might be on the fence about keeping a card after the first year because they don’t want to pay the annual fee.

I recently called Citi about my Citi Premier Card, which just had the $95 annual fee come due. I also have the Citi Prestige which has a hefty annual fee. So I didn’t feel it made sense to pay 2 annual fees when the bonus categories on the cards are so similar.

But I was pleasantly surprised when I asked if there were any retention bonuses before canceling the card. The Citi representative quickly offered me an easy solution that offset the annual fee and more. And all I had to do was ask!

Always Ask for a Retention Offer Before You Cancel (or Decide to Pay Another Annual Fee)

We always recommend you give a card a try for at least ~10 months, to see how you like it before you decide to keep it or not. Many cards even waive the annual fee for the first year to encourage folks to test it out!

If you do decide to cancel (or if you’re unsure what you want to do), it’s always a good idea to give the bank a call and see if they’ll give you an incentive to keep the card. Sometimes you’ll get bonus points for spending a certain amount. Or a rebate toward the annual fee.Occasionally, you’ll get nothing. But there’s no harm in trying. (And you can still keep the card if you decide to!)

When I first started in our hobby, I was sheepish about asking banks for retention offers or to waive annual fees after the first year of trying out a card. Maybe it was a fear of rejection or sounding stupid…I’m really not sure.

But then I realized I should take the advice I always give to my kids…

If you don’t ask, you don’t get. And the worst they can say is no.

This time around, it didn’t take any verbal gymnastics to get a good retention offer. It was SO easy!

How to Discount Your Credit Card Annual Fee

I called the number on the back of my Citi Premier card and explained that my annual fee had posted, and I wasn’t sure it was worth keeping the card. I asked if there was anything they could do to offset the annual fee.

The agent thanked me for my loyalty and recognized that I do use the card (she commented on my substantial Citi ThankYou point balance!). I mentioned I also have the Citi Prestige, which has many of the same bonus spending categories.

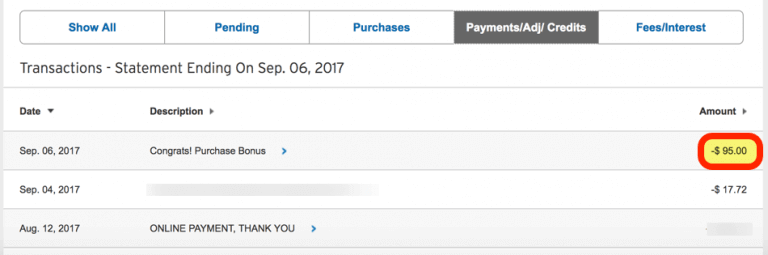

She immediately offered a retention bonus. If I spent $95 (total!) over the next 3 billing cycles, they’d give me a $95 statement credit (equal to the annual fee). I usually spend a few hundred dollars on the card each month anyway, so this was a no-brainer.

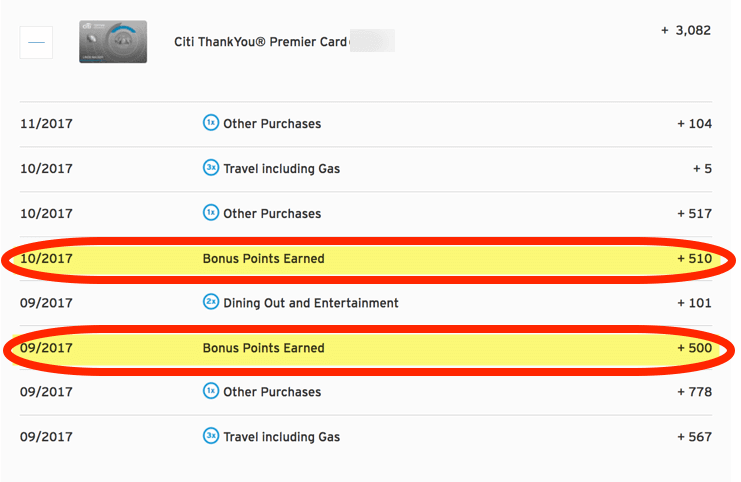

In addition, she said for each of the next 16 billing cycles, if I spent $500+ on purchases, I’d earn an extra 500 Citi ThankYou points. That’s not mind-blowing, but it’s enough to make me consider using the card more often.

If I hadn’t spent the ~5 minutes to call and ask, I’d have received nothing. And I would have been out of pocket $95 if I had decided to keep the card anyway.

Of course, this doesn’t always work. In my experience, if it’s a card you don’t use much, it’s less likely you’ll get a retention offer. But it’s always worth asking!

Bottom Line

I had an easy experience getting a retention bonus which more than covers the annual fee on my Citi Premier card. And all I did was ask!

If your card’s annual fee is coming due, it’s always worth calling the bank to see if they’ll give you an incentive to keep the card. This could be a statement credit, bonus points, or a waived annual fee.

It’s an easy call to make – don’t be shy! Just let the bank know you’re on the fence about keeping the card and ask if there’s anything they can do. And if you have any other cards from the same bank with duplicate benefits, that’s worth mentioning, too.

Have you had luck getting retention bonuses from the banks?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!