Million Mile Secrets Readers Prefer the AMEX Hilton Surpass – Here’s Why!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.The limited-time highest-ever AMEX Hilton card offers are disappearing on May 31, 2017.

So if you’ve been trying to decide whether to apply for the Hilton Honors™ Card from American Express or the Hilton Honors™ Surpass® Card from American Express, I thought I’d let you know what other Million Mile Secrets readers are doing!

Both are good cards. But the AMEX Hilton Surpass has a $75 annual fee. However, readers still prefer it over the no annual fee AMEX Hilton Honors card!

I’ll tell you why! And remind you what to expect with each of these cards.

American Express Hilton Surpass Compared to American Express Hilton Card

Link: Hilton Honors™ Surpass® Card from American Express

Link: Hilton Honors™ Card from American Express

Link: AMEX Hilton Cards Offering Highest Sign-Up Bonuses Ever

Million Mile Secrets readers have been applying for the increased offers on the AMEX Hilton cards because the sign-up bonuses are the highest ever!

The AMEX Hilton Honors card currently has a sign-up bonus of 80,000 Hilton points after you spend $2,000 on purchases in the first 3 months of opening your account. It also comes with:

- 7 Hilton points per $1 spent at Hilton hotels

- 5 Hilton points per $1 spent at US gas stations, US restaurants, and US supermarkets

- 3 Hilton points per $1 spent on all other purchases

- Free Hilton Silver elite status (late check-out, 2 free bottles of water, and 15% points bonus on Hilton points earned)

- Free Hilton Gold elite status (free breakfast and better upgrades) after spending $20,000 in a calendar year

- NO annual fee

- Terms & limitations apply

And the AMEX Hilton Honors Surpass card comes with 100,000 Hilton points after you spend $3,000 on purchases in the first 3 months of opening your account. You’ll also get:

- Free Hilton Gold Elite status (free breakfast at certain hotels, upgrades when available)

- Free Hilton Diamond Elite status when you spend more than $40,000 in a calendar year (better upgrades)

- Free weekend night at nearly any Hilton hotel on your first cardmember anniversary

- 12 points for every $1 you spend at Hilton hotels

- 6 points per $1 you spend at US restaurants, US supermarkets, and US gas stations

- 3 points per $1 you spend on everything else

- $75 annual fee

- Terms and limitations apply

Most of our readers have been opening the AMEX Hilton Honors Surpass with a $75 annual fee instead of the no annual fee version. Here’s why!

1. Higher Sign-Up Bonus

The Hilton Honors Surpass comes with 100,000 Hilton points after spending $3,000 on purchases within the first 3 months. That’s 20,000 points higher than the sign-up bonus of the no annual fee AMEX Hilton Honors. And lots of folks think the 20,000 point difference is worth the $75 annual fee!

Hilton points are generally worth ~0.5 cents each when redeeming them for hotel stays. So 20,000 bonus Hilton points per night is equivalent to ~$100. Though it’s possible to get MUCH more value (or much less!) from Hilton points.

For example, the Hilton Okinawa Chatan Resort costs $117 per night, or 36,000 Hilton points for a free night. That means you’ll get a value of 0.325 cents per point ($117 cost of room / 36,000 Hilton points).

But the Hampton Inn by Hilton Merida in Mexico sells rooms for $67. And you can redeem 5,000 Hilton points for a free night, giving you a value of 1.34 cents per point ($67 cost of room / 5,000 Hilton points).

So if you were to stay at the Hampton Inn by Hilton Merida, the 20,000 extra points you’ll get with the Hilton Honors Surpass are worth $268 (20,000 Hilton points = 5 free nights worth $67 each). That’s MUCH more than the annual fee!

2. Free Anniversary Night

The Hilton Honors Surpass comes with a free weekend night at nearly any Hilton hotel after your first cardmember anniversary. And that’s a big deal!

That’s because Hilton hotels can cost up to 95,000 points per night, depending on where you stay. So if you use your free night for a stay at a super luxurious hotel, like the Waldorf Astoria Jerusalem, that’s like getting an extra 95,000 bonus points!

Even if you do NOT use your free night at a luxury hotel, this is still a worthwhile perk! If you think you’ll be staying at a hotel at least once next year, you’ll likely get a value greater than the card’s $75 annual fee from this free night.

3. Better Earning and Perks

The AMEX Hilton Honors Surpass has a better earning rate than any other Hilton co-branded card (including the Citi Hilton HHonors Reserve and Citi Hilton HHonors Visa Signature). You’ll earn:

- 12 Hilton points per $1 spent at Hilton hotels (5 points higher than the AMEX Hilton Honors)

- 6 Hilton points per $1 at US restaurants, US supermarkets, & US gas stations (1 point higher than the AMEX Hilton Honors)

This makes the AMEX Hilton Honors Surpass the best card by far if you have lots of paid Hilton stays!

The AMEX Hilton Surpass also comes with Hilton Gold status, which gets you free breakfast (a big money saver, depending on where you stay) and room upgrades when available. The AMEX Hilton Honors only comes with Hilton Silver Status, which only gets you late check-out, 2 bottles of water, and bonus points on paid stays.

Do What You’re Comfortable With

I understand why folks might not want to open a card with an annual fee. However, if a card has certain benefits that you’ll use often, paying an annual fee can save you more in the long run! Always consider whether you’ll make good use of a card’s extra benefits.

And if you don’t like the idea of having a card with an annual fee, don’t apply for the AMEX Hilton Honors Surpass! The no annual fee AMEX Hilton Honors is still a good card. The best card just depends on your situation.

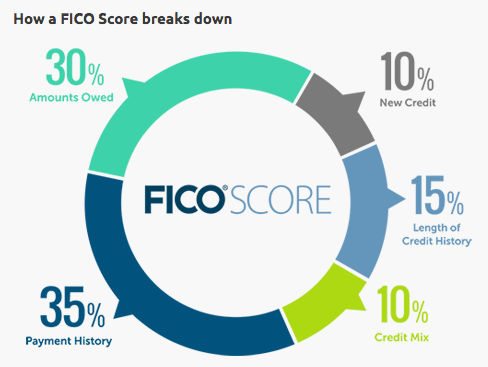

If you aren’t sure you’ll use the nice perks of the AMEX Hilton Honors Surpass, go for the no annual fee version. I always recommend folks apply for cards with no annual fee and keep them long-term. That’s because they can increase the average age of your credit accounts, and eventually improve your credit score!

And remember, these cards are considered different products. So you can get both if you want!

Note: As a general rule, you should NOT apply for more than 3 AMEX cards within a 3 month period. It’s possible to be approved for 2 AMEX cards in 1 day, as long as you mix your applications with 1 credit card (like the Hilton Honors Surpass) and 1 charge card (like The Platinum Card® from American Express).Just keep in mind that AMEX restricts folks to receiving the sign-up bonus on their cards once per lifetime. So if you’ve opened these cards before, you will NOT get the sign-up bonus this time.

Bottom Line

Need help deciding which increased AMEX Hilton offer to apply for before they disappear on May 31, 2017?

Fellow readers prefer the AMEX Hilton Honors Surpass with a $75 fee over the no annual fee AMEX Hilton Honors. That’s because the sign-up bonus is higher. And the benefits that come with the AMEX Hilton Honors Surpass, like 12 points per $1 at Hilton, Gold Elite status, and a free weekend night after your first cardmember anniversary, easily outweigh the $75 annual fee for most folks.

Which AMEX card do you think is the better deal?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!