“I’ve Taken Trips That a College Student Wouldn’t Be Able to Afford Otherwise”

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Welcome to the next installment of our interview series where folks share their thoughts about Big Travel with Small Money!Miles & Points Interview: Millennial Side Hustle

Adrian writes Millennial Side Hustle to share to readers his experience in traveling and making money. You can also follow him on Instagram.

How and when did you start collecting miles and points?

I started collecting points in February of 2015, so ~2 years ago. I started collecting them because I wanted the Chase Sapphire Preferred Card due to the fact it was made out of metal. I then started Google searching the best travel credit cards and decided to sign up for the Chase Sapphire Preferred and Chase Freedom. Two years later, I’ve taken various trips that a college student wouldn’t be able to afford otherwise.

Why did you start your blog? What’s special about it?

I started my blog, Millennial Side Hustle, because I wanted to share my experience in traveling and making money. I always read other travel blogs but none seemed to show me how to collect miles and earn extra side money at the same time. I love finding items that I know will sell out as soon as they hit shelves!

Why not go out and buy that item with my credit card and earn points for my trips and also earn some cash by reselling that item on Craigslist or eBay?

What’s the one single thing people can do to get more miles?

The one single thing that people can do to earn more miles is buying items for people and getting paid back, which is basically what I’m doing by reselling hot ticket items to people.

What’s your most memorable travel experience?

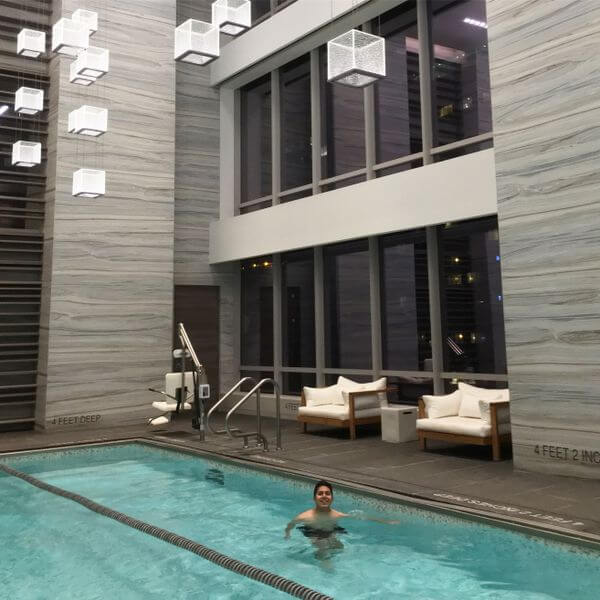

The most memorable travel experience that I’ve had is taking a trip from San Francisco to New York City and staying at Park Hyatt New York, then flying to Cancun for a couple of days and staying at the Hyatt Zilara! It was crazy to think that as a 21 year old I was able to stay in expensive hotels for free and visit 2 different cities on the same trip!

Why did I fly San Francisco to New York to Cancun to San Francisco? Simply because it was cheaper in terms of miles! Something that I would have never been able to book using cash.

What do your family and friends think of your miles & points hobby?

My friends simply make jokes about me wanting to pay for dinner because I want to earn miles, but the joke’s on them when they see my social media posts on these trips! I actually made my best friend sign-up for the same credit cards as me so I can have someone to go on trips with. He was hesitant at first, but after our first redemption he doesn’t seem to mind now!

A lot of people I meet in college don’t like the idea of having a credit card so I don’t bother explaining to them how it works. My family seems to like the idea of it after they’ve seen me take various trips recently.

Is there any tool or trick which you’ve found especially useful in this hobby?

The trick that I’ve found to be helpful is to try to pay for many bills for my parents and by reselling items.

What was the least expected way you’ve earned miles or points?

The least expected way that I’ve earned miles is by paying my school tuition. I asked the cashier if they accepted credit card payments and they said yes! It made paying tuition less painful.

I used my Chase Freedom Unlimited since it was the only card I had that would earn me over 1 point per $1.

What do you now know about collecting miles and points which you wish you knew when you started out?

My first credit card was 3 years ago when I was 18, and it was the Citi Forward card for college students (no longer available). I was earning many points through my spend but I had always redeemed it through Amazon Shop With Points. It was not the best way of redeeming my points, but at the time I did not know it was possible to go on trips with my points.

I wish I knew about the different possibilities of redeeming my points.

What would your readers be surprised to know about you?

I think most of my readers would be surprised to know that I am still in college. I use the money I make from my reselling hobby to pay for books or any other expenses.

Any parting words?

I hope many young readers will find this hobby and learn a lot about managing finances since it is very crucial to not get into debt or pay interest. This hobby has given me the freedom of traveling at such a young age without having to pay out of pocket.

Adrian – Thanks for sharing your thoughts on having Big Travel with Small Money!If you’d like to be considered for our interview series, please send me a note!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!