Secret Way to Companion Pass With NOTHING More Than Card Sign-Ups

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.You’ve probably heard the Southwest Companion Pass will soon be harder to earn.

After March 31, 2017, you will no longer be able to earn the Companion Pass with hotel and car rental points transfers. But there’s another easy way to qualify for this amazing travel perk!

It’s possible to earn the Southwest Companion Pass without putting any more than $4,000 in minimum spending on your cards (the amount necessary to earn 2 Southwest credit card sign-up bonuses).

I’ll show you how to earn the Southwest Companion Pass with credit card sign-ups alone!

Earn the Southwest Companion Pass With Credit Card Sign-Up Bonuses & Referrals

Link: Chase Refer-A-Friend

Link: Southwest Companion Pass

2017 has not been kind to the Southwest Companion Pass. Southwest will soon make it more difficult to earn the 110,000 Southwest points required in a calendar year to qualify for the Companion Pass.

Recently, Southwest announced without warning that points transfers from hotel and car rental loyalty programs would no longer count toward the Companion Pass. Then, they changed their minds, allowing hotel and car rental points transfers to count through March 31, 2017.

I’m glad Southwest extended their previous deadline by ~3 months, to give their customers a grace period of the upcoming changes. But the changes are a heavy blow to the strategy lots of of folks had to earning the Southwest Companion Pass.

Fortunately, it’s still possible to get the Companion Pass with nothing more than credit card sign-ups!

How to Get 110,000 Southwest Points With Credit Card Sign-Ups

You don’t have to collect thousands of hotel points to score the best deal in travel. Here’s another way you can easily earn the Southwest Companion Pass. And even help a friend earn it, too!

Step 1. Sign-Up for 2 Chase Southwest Credit Cards

The Chase Southwest Plus, Chase Southwest Premier, and Chase Southwest Premier small business cards are all currently offering a sign-up bonus of 50,000 Southwest points after spending $2,000 in the first 3 months of opening your account. And these sign-up bonuses DO count towards the 110,000 Southwest points you need to qualify for the Companion Pass!

While some folks do have success applying for more than 1 Chase personal credit card in 1 day, I recommend applying for 1 personal credit card and 1 small business credit card (for example, the Chase Southwest Plus and Chase Southwest Premier small business card).

By signing-up for 2 Southwest credit cards, you’ll have 104,000 Companion Pass-qualifying Southwest points (50,000 point personal card sign-up bonus + 50,000 point small business card sign-up bonus + 4,000 points for meeting minimum spending on both cards = 104,000 Southwest points). You’re just 6,000 Southwest points away from qualifying for the Companion Pass!

So how do you earn the remaining Southwest points without spending $6,000?

Step 2. Refer-A-Friend

Link: Chase Refer-A-Friend

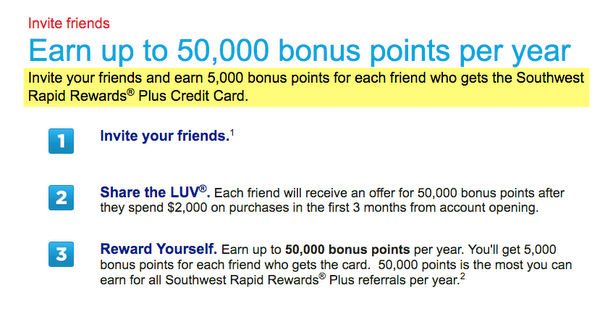

You’ll earn 5,000 Southwest points for every friend you refer to your Southwest credit card. Your friend must apply through your link AND be approved to receive the bonus points. Once they’re approved, your bonus Southwest points will be deposited into your account in 8 weeks or less.

Here is the link to refer a friend to the Chase Southwest Plus. And here is the link to refer a friend to the Chase Southwest Premier.

You can refer up to 25 friends in a 24-hour period. But you’ll only receive bonus Southwest points for up to 10 friends. So the most points you can earn from referring folks to your card is 50,000 Southwest points per calendar year.

And data points show these referral points count towards the Southwest Companion Pass!

So if you’ve signed-up for 2 Southwest credit cards and completed the minimum spending on each, you have 104,000 Southwest points. You can refer 1 friend, receive 5,000 Southwest points, and be just 1,000 Southwest points away from the Southwest Companion Pass. Or refer 2 friends and have more than enough points to qualify!

Note: It may take a while for Chase to generate a referral link for your new Southwest card. You won’t be able to refer friends immediately.Bottom Line

The bad news is points transfers from hotel and car rental loyalty programs will NO LONGER count toward the Southwest Companion Pass after March 31, 2017.

The good news is Southwest points you earn from Chase Southwest credit card sign-up bonuses and Chase Refer-A-Friend bonuses DO count towards the Companion Pass! This means you can earn the Companion Pass simply by meeting the minimum spending on 2 Chase Southwest cards, and then referring 2 friends to a Southwest card.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!