Review of the Expedia Voyager Card With $100 Statement Credit

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.When you sign-up for the Citi Expedia+ Voyager card, you’ll earn 20,000 Expedia points after spending $2,000 on purchases in the 1st 3 months of account opening.

And you’ll get a $100 statement credit for an eligible Expedia purchase of $100+ in the 1st 3 months, too.

Let’s take a look at the new offer. I’ll help you decide if it’s right for you!

About the Citi Expedia+ Voyager Card

Link: The Expedia®+ Voyager Credit Card from Citi

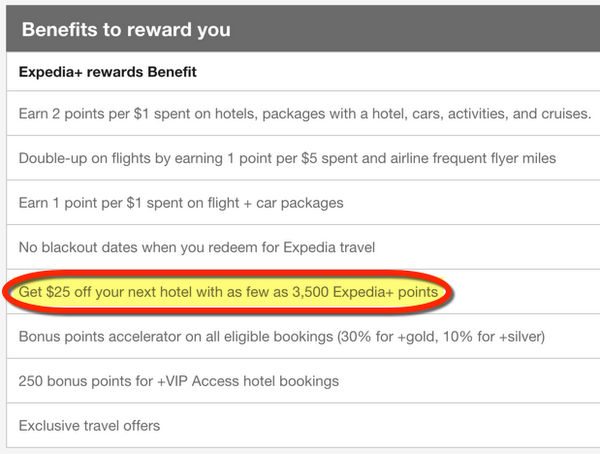

I’ve written about the Citi Expedia+ cards. And showed you how the Expedia+ program works. With the Citi Expedia+ Voyager MasterCard, you’ll earn:

- $100 statement credit after your 1st eligible Expedia purchase of $100+ within 3 months of account opening

- 20,000 Expedia points after you spend $2,000 on purchases in the 1st 3 months of account opening

- $100 annual statement credit for airline incidental fees on qualified airlines, like checked bags and in-flight Wi-Fi, or for Global Entry or TSA PreCheck application fees

- 4 Expedia points per $1 you spend on Expedia purchases

- 2 Expedia points per $1 you spend on dining and entertainment

- 1 Expedia point per $1 you spend on everything else

- Free +gold elite status (upgrades and perks at +VIP Access hotels, points earning bonuses)

- 5,000 point anniversary bonus if you spend over $10,000 in a cardmembership year on purchases

- No foreign transaction fees

- $95 annual fee, NOT waived for the 1st year

If you use the $100 travel credit each year, it more than off-sets the $95 annual fee. So this could be a very good deal for folks who use Expedia often, already have lots of Citi cards with better sign-up bonuses, or don’t want to fuss with airline mile cards.

The Expedia Rewards program has lots of complex rules for earning and redeeming your points. But I figured out how much Expedia points are worth. 20,000 Expedia points is enough for:

- ~$120 worth of flights (20,000 points x ~0.6 cents per point)

- ~$125 worth of Expedia hotel nights @ 3,500 points per $25 coupon (5 coupons)

- ~$250 worth of Expedia +VIP Access hotel nights @ 3,500 points per $50 coupon (5 coupons)

So the value of the sign-up bonus depends on how you want to use your points.

You’ll get the best deal at over 1,400 high-end +VIP Access hotels, where you’ll have enough for a $250+ hotel stay. And because you’ll get Expedia +gold elite status when you sign-up for the Citi Expedia+ Voyager MasterCard, you’ll be eligible for VIP offers and extra perks, like waived fees, bottles of wine, or dining certificates when you check-in.This might appeal to folks who don’t have elite status at chain hotels but want the extra perks! Or if you prefer boutique, independent, or all-inclusive hotels that can’t be booked with points.

20,000 Expedia points is also good for ~$120 toward flights.

But when you consider the $100 Expedia statement credit, the total sign-up bonus is worth:

- ~$220 worth of flights (20,000 points x ~0.6 cents per point plus $100 statement credit)

- ~$225 worth of Expedia hotel nights @ 3,500 points per $25 coupon (5 coupons plus $100 statement credit)

- ~$350 worth of Expedia +VIP Access hotel nights @ 3,500 points per $50 coupon (5 coupons plus $100 statement credit)

Is It Worth It?

I’ll be skipping this offer because there are lots of better deals when you sign-up for a new credit card. And other sign-up bonuses are worth much more than the $350 you can save at the select hotels included in the Expedia +VIP Access program.

I don’t like being restricted to a small selection of hotels. And other cards are worth much more toward flights.

For example, you’ll earn 50,000 Chase Ultimate Rewards points when you sign-up for the Chase Sapphire Preferred card and spend $4,000 on purchases within the 1st 3 months of opening your account.

This is the best sign-up bonus I’ve seen for this card. And Chase Ultimate Rewards points are flexible, which makes them more valuable. And it’s also my favorite points program overall!

Chase Ultimate Rewards points are worth 1.25 cents each when you book flights through the Chase Travel Portal. So you’ll get at least $625 worth of travel with the 50,000 points you’ll earn with the Chase Sapphire Preferred. And, you won’t have to worry about blackout dates or finding award seats!

You can also transfer the points at a 1:1 ratio to travel partners like British Airways, Hyatt, or United Airlines for award flights or hotel stays. And get potentially thousands of dollars worth of flights or hotels.

Or, you can sign-up for the Barclaycard Arrival Plus World Elite Mastercard to book flights or hotels on Expedia. You’d earn 2.1 cents per $1 you spend (2 miles per $1 + 5% rebate when redeemed for travel). And you’ll earn 40,000 Barclaycard Arrival miles which are worth ~$420 in flights or hotel nights. And again, you won’t have to worry about choosing certain hotels.

And if you want to earn airline miles, there are lots of cards to choose from, too.

For example, you can earn 50,000 American Airlines miles after making $3,000 in purchases within the 1st 3 months of opening a new Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard®. That’s enough for 2 round-trip coach award flights to anywhere in the continental US. The information for the Citi AAdvantage Platinum Select card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

It has the same annual fee as the Citi Expedia+ Voyager card, and you can bet the flights will be worth more than $220 (which is how much the total sign-up bonus on the Citi Expedia+ Voyager card is worth). Here are more ways to use your American Airlines miles.

And there are cards with a similar sign-up bonus which have no annual fee and a lower minimum spending requirement. For example, the TD Cash Visa currently has a $200 sign-up bonus after you spend $1,500 on purchases in the 1st 90 days of opening your account.

Plus, it earns 2% cash back on dining (1% on everything else) and you can use the cash however you want – for flights, hotels, or spending money!

OK, We Get It! So Who Should Get This Card?

As you can see, you’ll usually do better by selecting another card because their sign-up bonuses are worth much more. In some cases, hundred of dollars more!

But you should consider the Citi Expedia+ Voyager card if:

- You spend a lot of money on Expedia

- You already have all the other Citi credit cards you need

- It’s easy for you to earn Expedia points because you book a lot of hotels for other people

- You like overly complex rewards programs 😉

Some folks might like this card for the double-dip opportunities with paid airline tickets (because you’ll earn airline miles and 4X Expedia points). Or if you tend to book independent or boutique hotels that don’t have award programs.

Keep in mind you must wait ~8 days between Citi personal card applications, and can NOT get more than 2 personal cards each 65 days.

And if you’ve already received this sign-up bonus, you must wait ~18 months after you’ve last had the card to earn the bonus again. If you signed-up with a lower offer, call Citi and ask if they will match you to the current offer.

Remember, personal Citi credit cards are eligible for Citi Price Rewind, which is a great way to save money on big-ticket items!

Bottom Line

Now you can earn 20,000 Expedia points and a $100 statement credit on a $100+ Expedia purchase when you sign-up for the Citi Expedia+ Voyager and spend $2,000 on purchases in the 1st 3 months of account opening. The Expedia points combined with the $100 statement credit you’ll earn are worth:

- $350 at Expedia +VIP Access hotels

- $225 toward other hotels on Expedia

- $220 toward flights booked through Expedia

Expedia points aren’t usually worth as much as other airline and hotel points. And flexible points programs like Chase Ultimate Rewards points give you access to both flights and hotels, plus rental cars, cruises, and more when you book through the Chase Ultimate Rewards travel portal.

The sign-up bonus on the Citi Expedia+ Voyager isn’t a lot when you look at other credit card offers. For example, the sign-up bonus on the Chase Sapphire Preferred card is worth at least $625 in the Chase Travel Portal.

And the sign-up bonus on the Barclaycard Arrival Plus card is worth at least $420 toward travel. And there are no blackout dates or hotel restrictions to worry about!

The Citi Expedia+ Voyager card is best for folks who spend a lot of money on Expedia, or have run out of Citi cards to apply for. Otherwise, I recommend selecting another card to earn a better sign-up bonus!

Do you collect Expedia points? Does this new offer appeal to you?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!