How to Use American Express Serve Bill Pay

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Now that you can use gift cards to load American Express Serve accounts at Family Dollar, Million Mile Secrets’ readers have been asking how Serve works and what you can do with it.

Like Bluebird, Serve can be used to pay bills online. You can pay any bill, including mortgages, car loans, student loans, utilities, and credit cards. You can even pay individuals, like your landlord, handyman, or kid’s music teacher!

And since you can load Serve with gift cards bought with a miles and points earning credit card, this means that you’ll get miles and points paying bills that can’t normally be paid with a credit card.

How Does Serve Bill Pay Work?

Link: American Express Serve

Serve allows you to pay a business (like a bank or utility) or an individual person. Many common businesses, like credit card companies, banks, telecom companies, and utilities are already pre-registered. This means that Serve can transfer money to them electronically rather than sending them a paper check.

For businesses that aren’t pre-registered, or for individuals, you can enter the payee’s details (account number, address, and phone number) and Serve will mail them a check.

It takes 2 days for pre-registered business to receive payment, and 4 days for other businesses or individuals. And as long as you pay a bill at least 6 days before it’s due, Serve guarantees that payment will arrive on time. If it doesn’t, they’ll cover any late payment charges, to a maximum of $50 per bill.

How Do You Add a Payee?

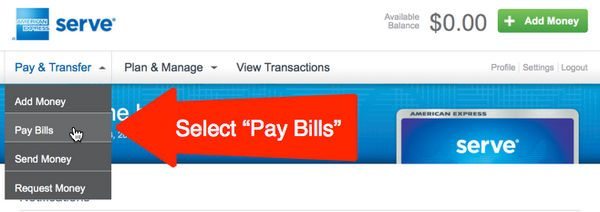

Once you log-in to your Serve account, select “Pay Bills” from the “Pay and Transfer” pull-down menu.

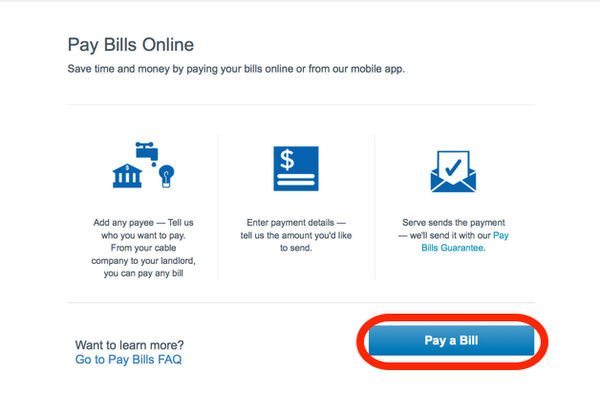

Then, from the Pay Bills page, select “Pay a Bill.“

Pay a Pre-Registered Business

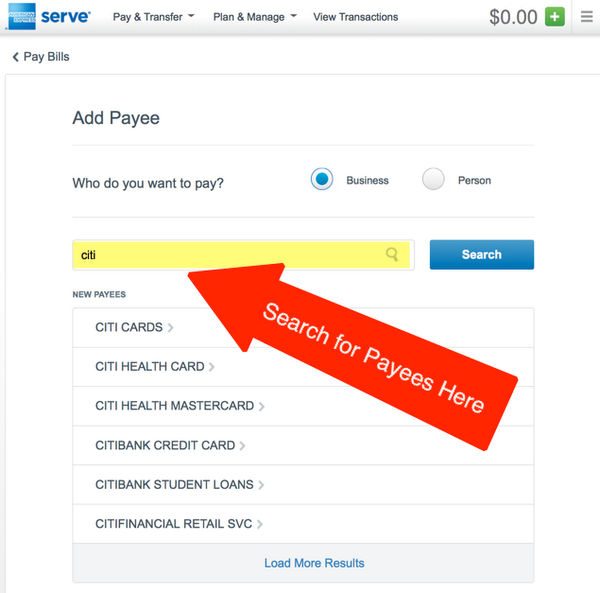

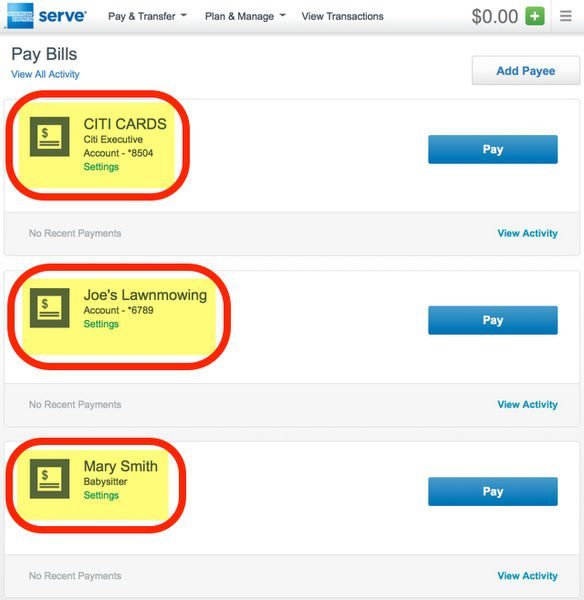

You can add a business or a person. For businesses, you can search to see if your payee is already pre-registered with Serve. I searched for Citi and it returned lots of results.

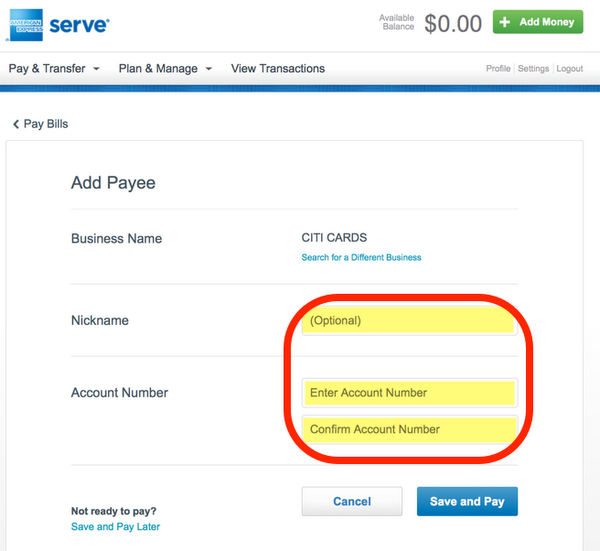

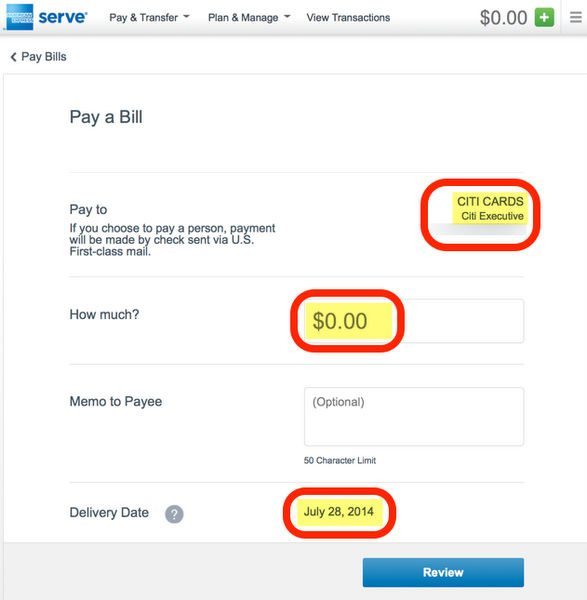

Once you’ve found the business you want to pay, you’ll be prompted to add a nickname for the bill and your account number. Then you can save and pay the bill.

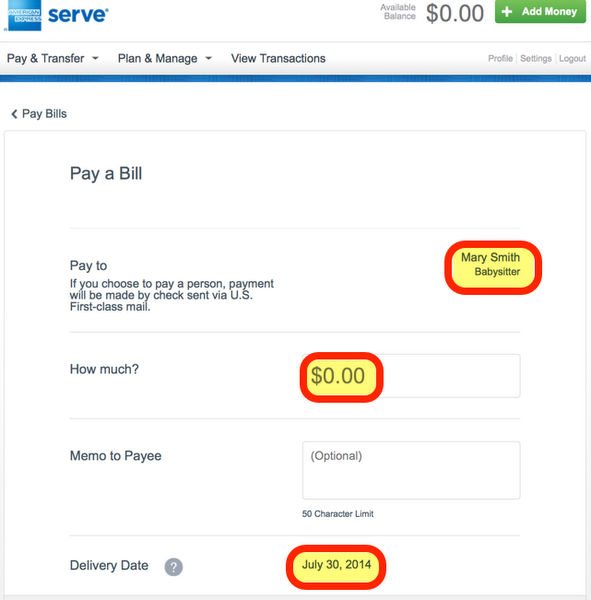

After adding the payee, you’ll have the option to pay a bill right away or come back later and pay. You’ll just need to enter the amount and a memo if you wish. Serve will also advise you of the delivery date at the bottom of the screen.

Pay a Non-Registered Business

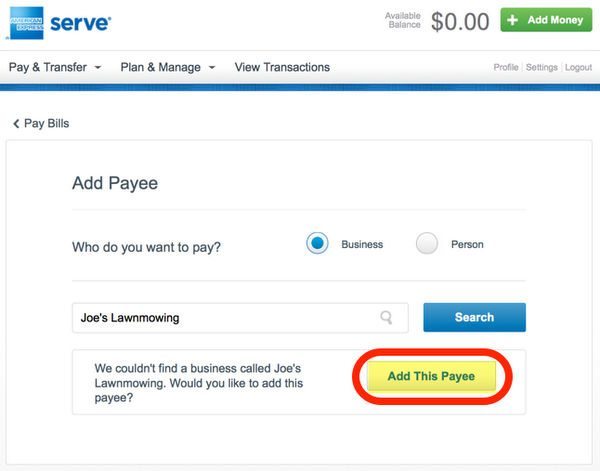

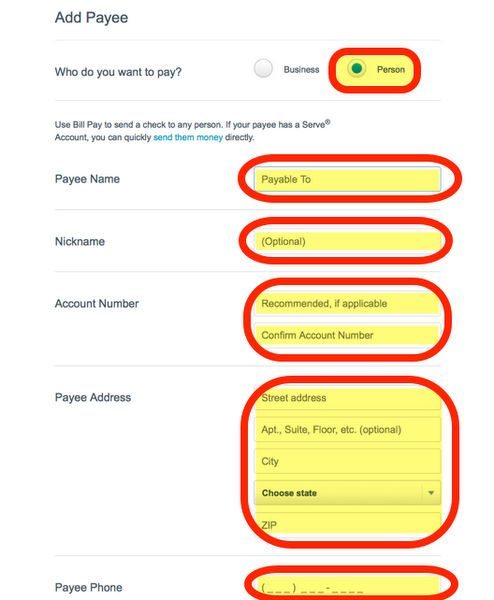

If the business you’re paying isn’t pre-registered with Serve, or if you’re paying an individual, you’ll have to enter the payee’s address details and your account number if required. For example, I searched for “Joe’s Lawnmowing” and it’s not a registered payee.

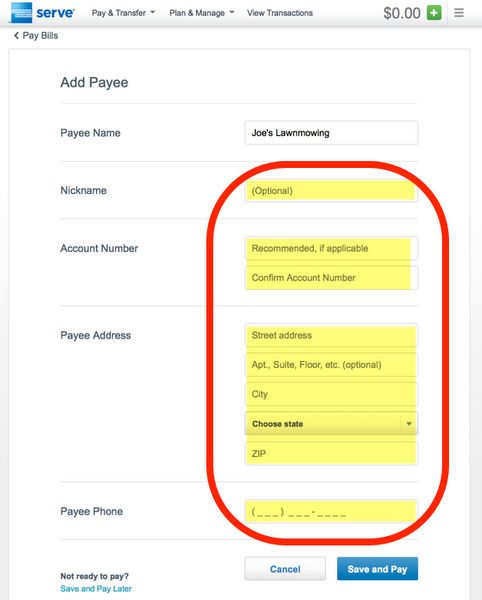

Fill in the payee’s nickname (optional), address, account number, and telephone number. Then, when you pay this business, Serve will send them a paper check.

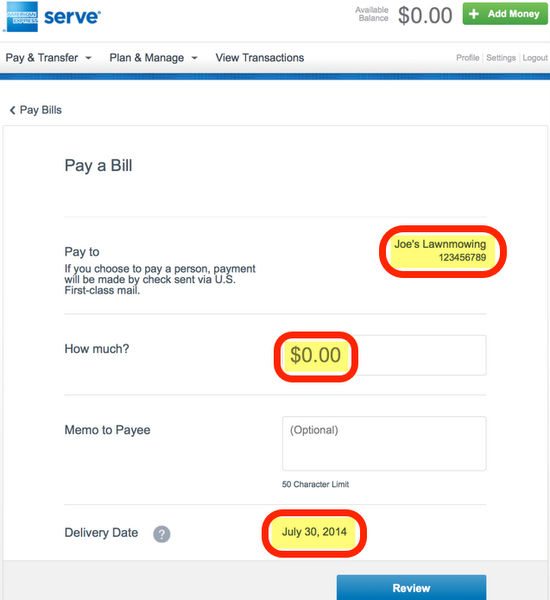

Then, when you’re ready to pay a bill, you can enter the amount and a memo just like with a pre-registered business. But it takes 2 days longer to pay because they’ll send a paper check.

Pay a Person

Much like paying a non-registered business, you can pay a person by entering their name, address, and phone number. Serve will also send them a paper check when you pay them.

When you pay a bill, you’ll be able to enter the amount and a memo. As with non-registered businesses, because they’re sending a paper check, Serve takes an extra 2 days to pay the bill.

Once you’ve added a payee into the system, you don’t have to re-enter their details again. The next time you log in and select “Pay Bills,” a list of payees you’ve already set up will appear.

Bottom Line

You can pay any bill to a business or person using American Express Serve‘s bill pay feature.

Many payees are already pre-registered in their system, and Serve will pay these businesses electronically so payments take 2 days. For non-registered businesses or individuals, payments take 4 days because Serve mails a paper check.

In either case, as long as you pay a bill at least 6 days before it’s due, Serve guarantees it will be paid on time (and will cover up to $50 in late fees if it’s not!).

What do you think of paying bills with Serve?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!