Ready to Convert Your Bluebird Account to a Serve Account? Here’s How to Do It!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Now that you can load gift cards to an American Express Serve account at Family Dollar, are you thinking about converting your Bluebird account to a Serve account?

American Express does NOT allow folks to have both a Bluebird and Serve account open at the same time. So doing the conversion is a bit of a process.

But I’ll show you how to do it!

How to Switch From Bluebird to Serve

Link: American Express Bluebird

Link: American Express Serve

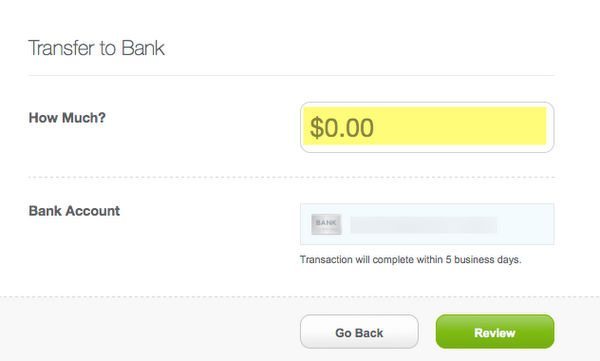

Step 1 – Zero Out Your Account Balance on Bluebird

The very 1st thing you must do is make sure the balance on your Bluebird account is ZERO. You can do this by paying a bill or transferring any remaining funds to your bank account or to a friend.

Step 2 – Call Bluebird and Cancel Your Account

Once your account balance is zero, give Bluebird a call at the number on the back of your card (877-486-5990). Explain you’d like to cancel your Bluebird account because you’d like to sign-up for a Serve account instead. This should only take a few minutes.

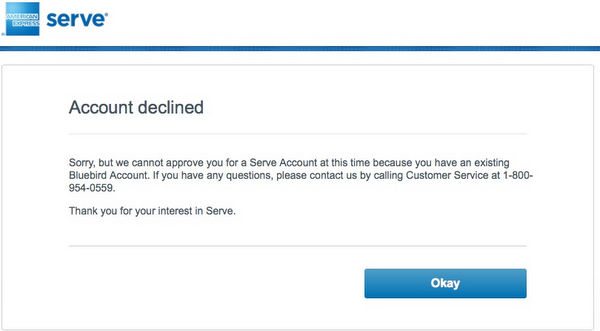

If you don’t cancel your account 1st, you’ll get this message when you try to sign-up for a Serve account.

This should be fairly straightforward, as long as you have no pending transactions on the account.

Step 3 – Sign-Up for a Serve Account

After you’ve closed your Bluebird account, you have 2 options:

a) Sign-Up for a Serve Account Online

If you sign-up for a Serve account online, be sure to use the same information (address, phone number, etc.) you used on your Bluebird account. You will likely get a message saying “Your account is being reviewed.” You can wait, if you want, but it can take a long time (weeks!) for them to get back to you.

Instead, call them after you’ve registered at 800-555-4318 and ask them to speed up the process. They might ask some verification questions, and some folks report being on hold for a long time, but you should be able to get approval using this method.

Note: It takes 7-10 days for your new card to be delivered once you’re approved.b) Buy a Temporary Serve Card

You can purchase a temporary Serve card at 1 of the following stores:

- CVS

- Duane Reade

- Family Dollar

- Fred’s Super Dollar

- Office Depot

- Sheetz

- Walgreens

- Walmart

Once you have the temporary card, register it online. You might get the same “Your account is being reviewed” message. Again, you can wait for their response, or call 800-555-4318 to expedite things.

When you’re approved, they’ll say you can load and spend on your temporary card, but you can NOT do bill pay or load online with a credit card until you receive your permanent card in the mail (which takes 7-10 days).

Step 4 – Use Your New Serve Account!

Once you have your permanent Serve card, you can access all the features of your account. You’ll be able to load the account (with gift cards purchased with a miles and points earning credit card if you wish), pay bills, transfer funds, and make ATM withdrawals (for free from MoneyPass ATMs).

Remember, gift cards purchased with a credit card that earns miles and points can help you meet the minimum spending requirements for credit card sign-up bonuses. And you’ll earn miles and points that help you get even more Big Travel with Small Money!

One Last Thought…

If you and your partner each have a Bluebird account, it might be a good idea to keep 1 Bluebird account open and convert the other to Serve. That’s because we never know what opportunities for earning miles and points might arise in the future.

Although many folks think Bluebird is much less useful now, other ways to use it to earn miles and points might come around later. It could be a pain to change all of your accounts back in the future.

And I do NOT know how American Express will view folks who constantly switch back and forth between Bluebird and Serve.

So keep this in mind before you go switching all of your family accounts to Serve! 😉

Bottom Line

Switching from Bluebird to Serve can be a bit of a process, and you’ll have to be patient. If you cancelled your Bluebird today, it would take (best case) at least 7-10 days before you’d be able to access all the features of your new Serve account.

But it could be worth it if you’re someone who liked loading Bluebird with gift cards you bought with a miles-and-points-earning credit card. Since Bluebird loading has become much more restrictive, this could be a good option for many folks.

If you’ve converted your Bluebird account to a Serve account and have had a different experience, I would love to hear about it in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!