Living or Working Overseas Series: Part 5 – Charge to Your US Cards, Transfer Foreign Currency to Pay Your Bills

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

This series of posts is written by the Wandering US Expat, who’s lived in Australia and Panama. And applied for cards from there!

Don’t let living abroad stop you from getting miles and points bonuses from credit cards!

It’s no secret that US banks lead the world in promotional point bonuses for new customers. They give away lots of points to get a new customer in the hopes that you’ll remain, and spend, with them for years. Lots of non-US folks wish they could get access to the same deals!

But many US citizens and ex-permanent residents, known as expats, often wonder whether they can still get credit cards if they leave or have already left the US. Perhaps they’ve relocated for a job or have gone for an extended trip abroad. Some expats have left permanently to start a new life.

Are you or someone you know in this category?

Figures are hard to determine because the US does not track expats who are traveling or living abroad. But a recent report estimated the number to be living overseas at about 2 to 7 million. There are millions more who leave, or “visit” outside the US for months at a time all year round.

This series will help folks living outside the US have Big Travel with Small Money!

“Living or Working Overseas” Series Index

- Part 1 – You Can Still Get Lots of Cards!

- Part 2 – How to Setup a Bank Account While Overseas

- Part 3 – Establish, or Re-establish Credit While Overseas

- Part 4 – Mail Forwarding Services for the Overseas Expat

- Part 5 – Charge to Your US Cards, Transfer Foreign Currency to Pay Your Bills

- Part 6 – Car Rental Insurance Reductions – For US and Non-US Licensed Drivers

- Part 7 – Dual Citizens/Residents – Get Extra Points!

How to Pay the Bills

Link: PayPal

Link: CurrencyFair

Link: TransferWise

For those with enough money in their US bank account, or retirement income, it may not be a problem to pay your credit card bills.

But for folks who don’t, there are other options to fund your US bank account with overseas currency.

PayPal

PayPal is well-known as a processor for ebay payments. But it also offers person-to-person transfers. But don’t try sending yourself money if you have 2 PayPal accounts in 2 different countries!PayPal has safeguards in place to prevent people from having multiple accounts in more than 1 country. I wouldn’t recommend trying to get around this because they may close your accounts. The chance of PayPal freezing your money isn’t worth the risk.

However, transferring your money to another person with a PayPal account is relatively easy. Log into your PayPal account and enter the email of the person you want to transfer money to.

Your PayPal account is linked to your bank account, so if you don’t have enough funds for the transfer, then PayPal charges your credit card plus ~3% in fees just like a credit card purchase. So sending $1,000 to your friend in the US could cost you ~$30 in fees.

Your friend would then withdraw the money you’ve sent to their own local US bank account and use it to pay your credit card bill.

Bank-to-Bank Transfer

You could transfer money between banks to pay your credit card bills. This is also known as a wire transfer. You send money from your overseas bank account to a trusted friend’s account in the US.

However, banks charge high fees for this service.

Banks charge anywhere from $15 to $60 to both SEND and RECEIVE a wire transfer. That can add up quickly.

For example, if your bank charges $30 to send a payment and your friend’s bank charges $30 to receive the payment, your out-of-pocket cost could easily reach $60. It’s usually not worth transferring less than $500 when you subtract all the fees for every transfer.

And if your money is in a currency other than US dollars, the bank is likely to add on a processing fee along with an unfavorable exchange rate.

Transferring enough foreign money to send someone $1,000 (to pay a US credit card bill) can cost you an additional 10% or more when you add up fees and the bank’s much lower exchange rates. Your total expense for international currency transfers can get expensive!

Peer-to-Peer Transfers

There are less expensive alternatives to PayPal and bank transfers.

Peer-to-peer transfers are when 1 person sends another money but instead of going through the traditional bank method, a number of smaller companies compete to beat the banks’ rates.

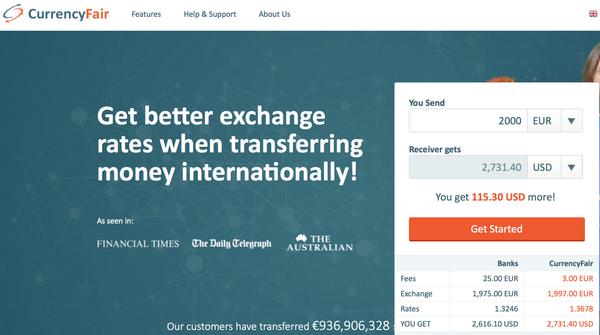

One peer-to-peer transfer service is CurrencyFair.

CurrencyFair began offering peer-to-peer exchange services ~4 years ago. Readers tell me they’ve had a good experience with them.

CurrencyFair will exchange money in many currencies. Some of these include the

- Australian Dollar

- Canadian Dollar

- Euro

- Hong Kong Dollar

- Pound Sterling

- Swedish Krona

- Swiss Franc

- US Dollar

You send money to the US through CurrencyFair via internet bank transfers. You can NOT use a credit card.

CurrencyFair charges ~$4 for a one-time exchange, no matter how small or large the amount. They also give VERY competitive exchange rates.

For example, if the current rate is 100 Australian dollars = $92, a bank will give you $89. But CurrencyFair will give you ~$91.50. That’s nearly market rate!

Transfers take ~2 to ~5 days depending on the banks.

There are other peer-to-peer transfer services such as TransferWise. This company was built by the makers of Skype. I haven’t heard as much about this company, but if you’ve used TransferWise please tell me about your experience in the comments!

Bottom Line

Peer-to-peer transfers can save you money compared to bank transfers and PayPal. This could be the best way to send foreign money from overseas to a US bank account to pay your US credit card bills.And when you’re living in a foreign country you may want to rent a car. So in the next post of this series I’ll give you tips for choosing car rental insurance.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!