The Trick to Avoiding ATM Fees Overseas: Charles Schwab Investor Checking Account

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Have you ever returned from an overseas trip and been unpleasantly surprised when you opened your bank statement?

Most US banks add currency conversion fees of 1% to 3% for using ATMs abroad. And sometimes, there’s an ATM fee of ~$3 to $5 in addition to the foreign exchange fee. These can add up quickly and put a nasty dent in your plans for Big Travel with Small Money!

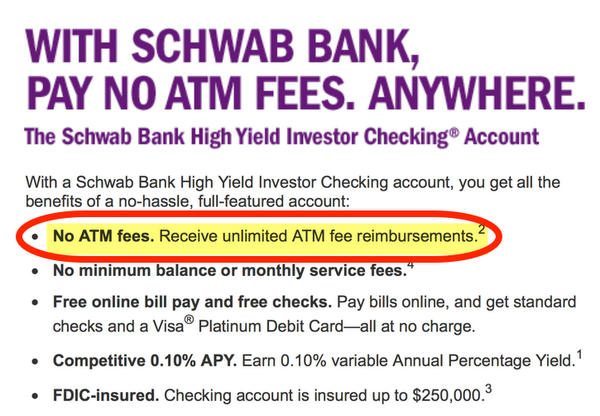

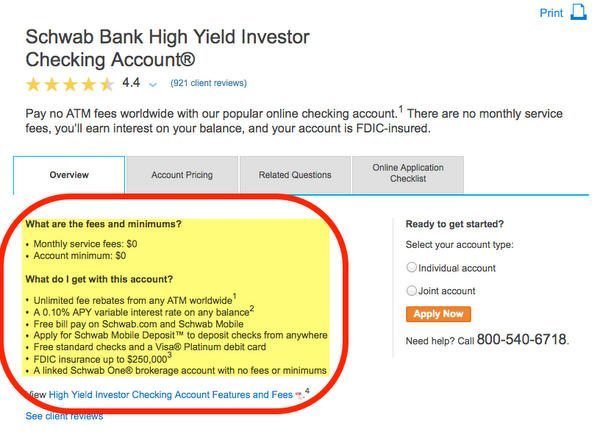

You can avoid these fees by signing-up for a Charles Schwab High Yield Investor Checking account. It does NOT charge currency conversion fees, and you’ll get a rebate for all your US and overseas ATM charges.

Say No to Fees!

Link: Charles Schwab High Yield Investor Checking Account

When Emily and I travel, we use credit cards that don’t charge a foreign transaction fee wherever possible. Our favorite is the Chase Sapphire Preferred, which earns 2X points on travel and dining. And you can soon get it with a chip-and-PIN, which can make it easier to use overseas.

But sometimes you need local currency for places that don’t accept credit cards. I don’t like carrying lots of cash while traveling, and prefer to withdraw money as needed.

The Charles Schwab High Yield Investor Checking Account has the best debit card for use outside the US. When you withdraw cash from an ATM, or use it for transactions, you do NOT get charged ATM fees or foreign transaction fees. And you get a rebate for any fees charged by overseas ATMs.

How Does It Work?

I recently used my Charles Schwab debit card to withdraw cash at ATMs in Mumbai and Hong Kong.

My bank statement shows the withdrawals and 1 reimbursement for all the foreign ATM fees. I saved ~$23 in just a few days of traveling.

How Do You Get an Account?

It’s easy to apply online for a Charles Schwab account. You don’t need to live near a physical branch. You’ll get:

- No monthly service fees

- You don’t need to keep a minimum balance

- Unlimited free ATM withdrawals everywhere

- No currency conversion fees

- Free checks, debit card, mobile deposit, and bill pay

I don’t like paying fees if I don’t have to, so I’m glad I got this account.

You’ll get a linked Charles Schwab brokerage account with no fees or minimums when you apply for the checking account. But you don’t have to use it! However, you may get an inquiry on your credit report for opening the brokerage account.

Reminder: Always Pay in Local Currency!

Visa and Mastercard allow foreign merchants to give US customers the option of paying in US dollars or local currency. For example, if you’re in Europe you’ll often have the option of paying in Euros or US dollars.

You should always choose the local currency, because if you choose US dollars, they’ll add an extra (~3%) foreign exchange fee to the transaction. This is even if you use a card that doesn’t charge foreign exchange fees!

Even though it’s more convenient to see the bill in US dollars (less mental math!), it’s not worth paying an extra 3% or more.

Bottom Line

The Charles Schwab High Yield Investor Checking Account has the best debit card to use when traveling outside the US for purchases and ATM withdrawals. You won’t get charged currency conversion fees, and ATM withdrawals are always free.

When traveling, I prefer to use a credit card that doesn’t charge foreign transaction fees, but sometimes you have no choice but to use cash or debit.

And remember to always pay in local currency, not US dollars, to avoid additional fees when using your credit card!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!