Confirmed: ~$600 Flight With the FlexPerks Card up to March 7, 2014!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: This offer is no longer available. Check our Hot Deals for the latest offers. I wrote earlier that in addition to the 20,000 point sign-up bonus on the FlexPerks card, you also get extra points for each Olympic medal the US team wins! The link which pays us a commission doesn’t get you these extra points, so use this direct link to the US Bank Flexperks card to get the bonus points.

You have to apply between January 31, 2014 to March 7, 2014 & spend $3,500 within 4 months on the US Bank FlexPerks card to get the bonus points. You also have to make your first purchase by March 31, 2014.

How Many Points Will I Get?

The 2014 Winter Olympics has ended and the US won 28 medals. You get extra points deepening on how many medals the US Olympic team wins.

- Gold medal = 500 points

- Silver medal = 250 points

- Bronze medal = 100 points

The 2014 Winter Olympics are over and the US team won 9 gold, 7 silver, and 12 bronze medals. So that’s 7,450 extra points.

- 9 gold medals x 500 points = 4,500 points for gold medals

- 7 silver medals x 250 points = 1,750 points for silver medals

- 12 bronze medals x 100 points = 1,200 points for bronze medals

This means that you get a total of 30,950 points via the Olympic offer!:

- 20,000 points from the sign-up bonus

- 3,500 points from completing the minimum spending

- 7,450 extra points for the 28 Olympic medals

So, instead, use this link to the US Bank FlexPerks card to get a total of 30,950 points!

How Much Is This Worth?You can use your FlexPerks points on most airlines with no blackout dates or other restrictions. Note that you may not be able to use it for flights on Southwest because you have to book your travel through the FlexPerks portal (which doesn’t show Southwest flights).

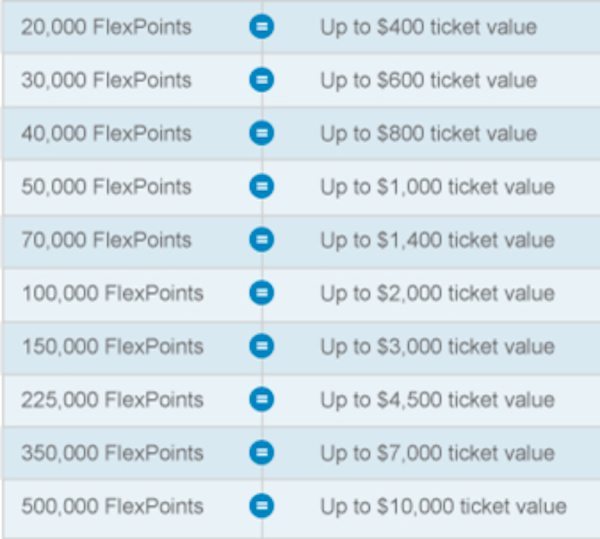

You can use 30,950 points for an airline ticket up to $600.However, you won’t get the maximum value out of your US Bank FlexPerk (based on the chart below) even if you redeem for flights.

For example, if you have 36,000 points you can only use 30,000 points towards a ticket that costs no more than $600. Firstly, it is hard to buy tickets which are exactly even round numbers! When was the last time you bought a ticket for exactly $400 or $600?

Secondly, you will have 6,000 points left over that are not good towards any flights because you have to have at least 20,000 miles to redeem for airfare.

Another bad feature is that you can’t pay cash for the extra cost of the ticket. For example, the chart says that 30,000 FlexPerks will get you a ticket up to $600. But you can’t redeem 30,000 FlexPoints for a $700 ticket and pay the $100 difference!

Note: If you are not approved for the for the US Bank FlexPerks Travel Rewards card, you may get the US Bank FlexPerks Select card which only offers a 10,000 point bonus.

30,000 Flex Points will get you:

- $600 or less worth or air tickets or

- $300 statement credit or

The US Team won 28 medals in the 2014 Winter Olympics. This means that you get 30,950 FlexPerks points when you sign-up for the US Bank FlexPerks Travel Rewards card by March 7, 2014.

These 30,950 FlexPerks points can get you an airline ticket up to $600. However, remember that it is difficult to get the full value out of your FlexPerks points.

If you are new to miles & points, you could be better off with some of the cards in the Hot Deals tab instead. That said, this is probably one of the best times to sign-up for the US Bank FlexPerks card if you planned on applying for it!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!