How to Easily Apply for a Credit Card Through Your Smartphone

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Are you one of the many folks applying for credit cards on your smartphone instead of your computer?

I had never applied for a credit card on my phone before, so I decided to see just how easy (or difficult!) it was. And I was pleasantly surprised! The entire process took just a couple of minutes.

I’ll show you how to apply for a credit card with your smartphone, so you can take advantage of the best deals no matter where you are!

Starwood American Express Mobile Application

Link: Starwood Preferred Guest® Credit Card from American Express

Link: Starwood Preferred Guest® Business Credit Card from American Express

Back when I was a kid, folks would look at you strangely if you tried to use a telephone for things like taking pictures and watching videos.

But times are changing, and nowadays many are filling-out credit card applications with their smartphones. It seemed cumbersome to me to enter all that information on a tiny phone screen, but I was surprised at how easy it actually is!

If you use the same internet browser on your phone as you do with your computer, details like your name, address, and phone number might populate automatically during your application.

Every bank I tried has easy-to-use mobile application pages, though they’re all a bit different. But they’re similar enough that if you’ve navigated one you can get through them all!

In this example, I’ll show you how to fill out a Starwood American Express application with your smartphone!

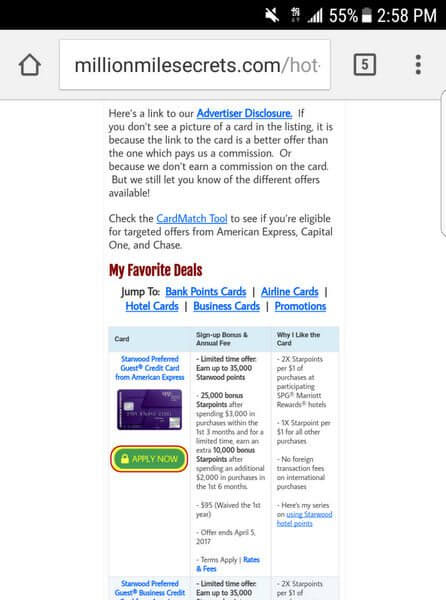

Step 1. Find the Card You Want

Decide which card you want and navigate to the application page. If you’re on our Hot Deals page, just click the big “Apply Now” button in the left column. You don’t have to use our links, but we’re grateful when you do! 🙂

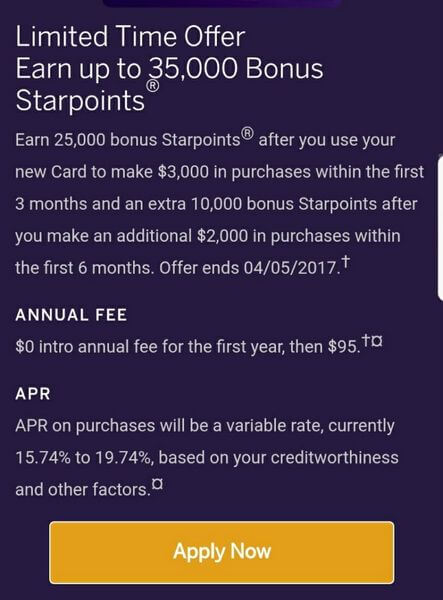

Step 2. Click “Apply Now”

You’ll be taken to the AMEX application page. You’ll see a quick rundown of the card you’re applying for. Scroll down and click the big “Apply Now” button at the bottom of the page.

Step 3. Look Over the Card Details

You can view the rates & fees, benefit terms, and offer terms from this page. Read to make sure you’re applying for the right one! Lots of cards have similar names, but different benefits.

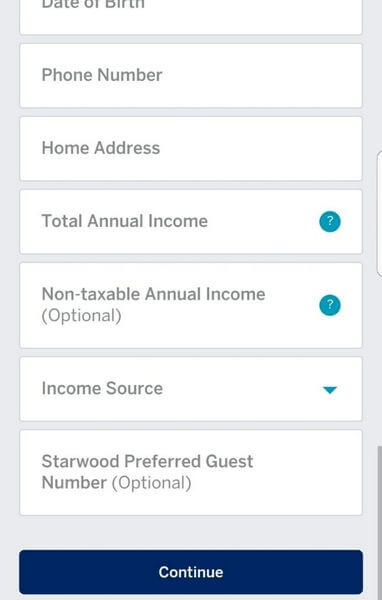

Step 4. Fill Out Personal Information

Now it’s time to give your information to AMEX. You’ll need to give details like your full name, Social Security Number, total annual income, etc. Then tap “Continue” at the bottom of the page.

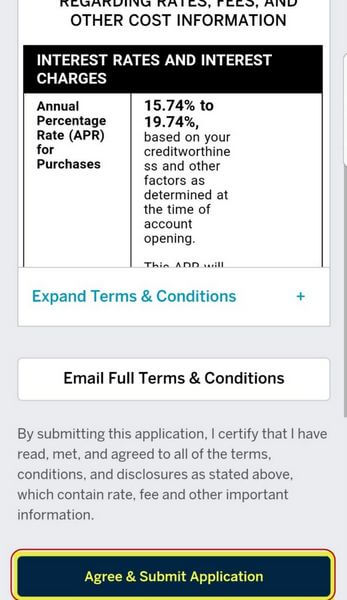

Step 5. Press “Agree & Submit Application”

You’ll have one more chance to look over the fine print before you submit your application. If everything looks good, just tap “Agree & Submit Application“.

And there you have it! You can get approved for a credit card just about anywhere. Just try to do it in a responsible place (don’t apply and drive!). 😉

Note: You will likely NOT be instantly approved for a credit card if you apply internationally. That’s because the bank will see that the application is coming from somewhere other than your home country. You’ll need to call the bank and verify that you aren’t a victim of fraud.Remember, AMEX will only give you the sign-up bonus for each card ONCE per lifetime. However, if you’ve had one card but NOT the other, you’ll be able to get the sign-up bonus on the other card.

Bottom Line

Signing-up for a credit card on your mobile phone is easier than you might think! I was able to complete an application in ~2 minutes. My mobile browser even automatically populated lots of my information, like my name, birth date, address, etc.

What is your preferred method of applying for credit cards?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!